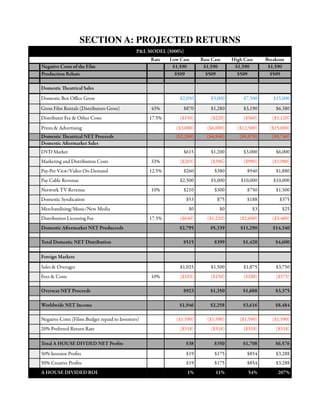

This document is a prospectus for a proposed motion picture project titled "A House Divided". It seeks $1 million in financing to fund a production budget of $1,575,000. It outlines the production team's experience and describes the film as a drama/thriller directed by Brent Huff. It defines the target market as dramas appealing to adults ages 18-45 and cites comparable successful low-budget films. The prospectus details distribution strategies, financial projections, and an investment structure offering a 20% preferred return and profit sharing agreement anticipated to provide a 100%+ return of investment within 7 years.