Small Business Lending Index November 2015

•

1 like•516 views

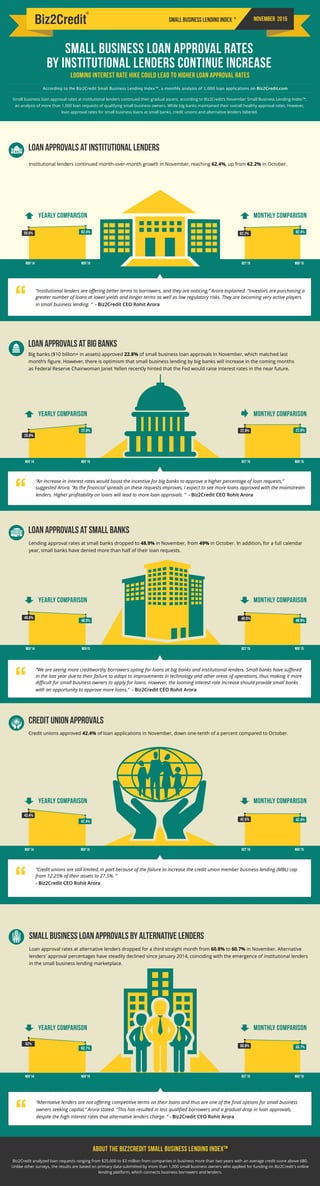

Small business loan approval rates continued to increase slightly at institutional lenders in November according to an analysis of over 1,000 loan applications. Approval rates rose to 62.4% at institutional lenders but fell to 48.9% at small banks and 60.7% for alternative lenders. There is optimism that an expected interest rate hike by the Federal Reserve could lead to higher approval rates by big banks as their profits on loans increase.

Report

Share

Report

Share

Download to read offline

Recommended

Small Business Lending Index October 2015

Big banks increased 22.8% of small business loan requests in October 2015, up from 22.5% in September.

Small Business Lending Index August 2015

Big banks decreased 22.3% of small business loan requests in August 2015, down from 22.4% in July, marking the tenth consecutive month, small banks have denied more than half of their loan requests.

Small Business Lending Index February 2019

Biz2Credit: https://www.biz2credit.com/

Related Resource: https://www.biz2credit.com/small-business-lending-index/february-2019

According to the month of February 2019, Small business loan approval rates at big banks improved to 27.2% in February 2019, which is up from January's figure of 27%.

For further queries, contact us at 800-200-5678

Follow us at:

Twitter: https://twitter.com/biz2credit

Facebook: https://www.facebook.com/biz2credit

Linkedin: https://www.linkedin.com/company/biz2credit-inc/

Pinterest: http://www.pinterest.com/biz2credit/

Google+: https://plus.google.com/u/0/+Biz2credit/

Biz2Credit Small Business Lending Index - July 2015

For the ninth consecutive month, big banks registered an increase in the loan approval rates with an approval of 22.4% for small business loan requests in July 2015, up from 22.19% in June.

Small Business Lending Index January 2019

Biz2Credit: https://www.biz2credit.com/

Related Resource: https://www.biz2credit.com/small-business-lending-index/october-2018

According to the month of January 2019, Big banks approved 27% of the funding requests they received in January, the same percentage as in the month of December.

For further queries, contact us at 800-200-5678

Follow us at:

Twitter: https://twitter.com/biz2credit

Facebook: https://www.facebook.com/biz2credit

Linkedin: https://www.linkedin.com/company/biz2credit-llc

Pinterest: http://www.pinterest.com/biz2credit/

Google+: https://plus.google.com/u/0/+Biz2credit/

Small business lending index september 2015

Big banks increased 22.5% of small business loan requests in September 2015, up from 22.3% in July. In the past six months, big banks up and down by a few tenths of a percentage points.

Funding Options business finance review

Slides from Conrad Ford's speech at the Real Business Funding event on March 15th 2013 at the British Library

Revolutionizing lending in today's digital world

Imagine a world where the lending journey is streamlined and aligned with today's innovative technologies. A world where income and asset verification happen real-time. No need to return to your customers and request even more paperwork to support their ability to pay. This presentation dives into how lenders can now bring financial data aggregation into the mainstream. With a simple interface, lenders can verify income and assets in minutes vs. days, leading to reduced processing times, improved revenue streams and higher customer satisfaction.

Recommended

Small Business Lending Index October 2015

Big banks increased 22.8% of small business loan requests in October 2015, up from 22.5% in September.

Small Business Lending Index August 2015

Big banks decreased 22.3% of small business loan requests in August 2015, down from 22.4% in July, marking the tenth consecutive month, small banks have denied more than half of their loan requests.

Small Business Lending Index February 2019

Biz2Credit: https://www.biz2credit.com/

Related Resource: https://www.biz2credit.com/small-business-lending-index/february-2019

According to the month of February 2019, Small business loan approval rates at big banks improved to 27.2% in February 2019, which is up from January's figure of 27%.

For further queries, contact us at 800-200-5678

Follow us at:

Twitter: https://twitter.com/biz2credit

Facebook: https://www.facebook.com/biz2credit

Linkedin: https://www.linkedin.com/company/biz2credit-inc/

Pinterest: http://www.pinterest.com/biz2credit/

Google+: https://plus.google.com/u/0/+Biz2credit/

Biz2Credit Small Business Lending Index - July 2015

For the ninth consecutive month, big banks registered an increase in the loan approval rates with an approval of 22.4% for small business loan requests in July 2015, up from 22.19% in June.

Small Business Lending Index January 2019

Biz2Credit: https://www.biz2credit.com/

Related Resource: https://www.biz2credit.com/small-business-lending-index/october-2018

According to the month of January 2019, Big banks approved 27% of the funding requests they received in January, the same percentage as in the month of December.

For further queries, contact us at 800-200-5678

Follow us at:

Twitter: https://twitter.com/biz2credit

Facebook: https://www.facebook.com/biz2credit

Linkedin: https://www.linkedin.com/company/biz2credit-llc

Pinterest: http://www.pinterest.com/biz2credit/

Google+: https://plus.google.com/u/0/+Biz2credit/

Small business lending index september 2015

Big banks increased 22.5% of small business loan requests in September 2015, up from 22.3% in July. In the past six months, big banks up and down by a few tenths of a percentage points.

Funding Options business finance review

Slides from Conrad Ford's speech at the Real Business Funding event on March 15th 2013 at the British Library

Revolutionizing lending in today's digital world

Imagine a world where the lending journey is streamlined and aligned with today's innovative technologies. A world where income and asset verification happen real-time. No need to return to your customers and request even more paperwork to support their ability to pay. This presentation dives into how lenders can now bring financial data aggregation into the mainstream. With a simple interface, lenders can verify income and assets in minutes vs. days, leading to reduced processing times, improved revenue streams and higher customer satisfaction.

How lenders can capitalize on the growth in personal loans

Personal loan originations have returned to pre-recession levels with sustained year-over-year growth around 20% for multiple years. Meanwhile, delinquency rates remain at historic lows and demand has been met by increased liquidity amid a low-rate environment. If you’ve been riding the wave, take note: there are signs indicating growth is leveling off. How can lenders become more efficient in finding personal loan prospects going forward to sustain growth? And if you are a lender looking to enter the personal loan space, what steps should you take to assess the marketplace and seek out the right opportunities? Learn more in this slideshare presentation.

Leveraging data, tech and analytics to improve collections

Companies readily invest in acquisitions, but many do not invest in trying to improve their collections processes. Viewing collections as an omni-channel opportunity can have a significant impact on overall profitability and is an excellent opportunity to improve long-term customer loyalty. With the right data and technology, personalized collections are now a reality. This presentation addresses:

• The latest delinquency numbers

• New, sophisticated tools to digitize your efforts and enhance the customer experience

• Using data-driven decisioning to offer the right debt resolution options

• The benefits of a personalized, consistent experience across all channels

Top Regulatory Insights for Fintechs & Financial Institutions

We're breaking down the top regulatory insights you need to understand to prepare your compliance strategy for 2019 and beyond. Covering the latest information on upcoming regulations, including:

- Impact of CECL and how to prepare

- Priorities for the CFPB and House Financial Services Committee

- Must-know details of the Consumer Privacy Act of 2018

Judo Capital Case Study

BankSight works with Judo Capital to deliver an end-to-end digital process that enables Judo lenders to orchestrate a collaborative leads and referrals process across any channel with both small businesses and brokers.

How Big Data Can Lead to Bigger ROI

From underwriting to marketing and managing risk, and every business function in between, big data is valuable and integral to your commercial success. Experian’s latest technology innovation levels the playing field and fills the gaps in your data across all facets of your organization

How Alternative Credit Data Provides Lift in Your Portfolio

What is alternative data and how does it differ from traditional credit data?

How can alternative data be used to maximize your portfolio?

Learn how to leverage this new data set to maximize profits in your business. We’ll cover the latest findings in lender and consumer perspectives on alternative credit data and ways to use alternative credit data across the customer lifecycle giving you a deeper view of the consumer.

Hedge Fund Looks to Capitalize on Peer-to-Peer

Direct Lending - Brendan Ross - LA Business Journal 1.5.15

How do consumers feel about alternative credit data?

Consumers rely on credit for purchases big and small. While some have robust credit files, others are still invisible and seeking ways to grow their credit presence so they can have access to loans, credit cards and beyond. What types of information and data will they share to grow their credit files? In an exclusive Experian survey, we asked consumers how they perceive alternative credit data sources. Here are the findings.

5 Reasons to Report Credit Data

Every lender must make the decision on whether or not to report credit data. Furnishing data to the credit bureaus is still voluntary, but there are a number of reasons to embrace this action as a lender. Here are five reasons to consider if you are on the fence about becoming a data furnisher.

Credit Marketing Strategies to Capture Today's Digital Consumer

Consumers look at their smartphones an average 150 times per day. They are active on multiple social media platforms. Many consistently make online purchases. We live in a digital world, but is your credit-based marketing keeping up with the times? This slideshare reveals the latest trends and insights regarding consumer engagement with credit offers. Are consumers responding to direct mail, email or something else in the financial services space? Learn about insights specific to credit offers and how consumers are responding via various digital channels. Discover the latest channels financial marketers can leverage when delivering firm offers of credit.

Understand best practices to capture eyes on your financial offers and maximize your marketing spend.

Why is it_so_hard_to_get_a_business_loan_by_plousio

The major U.S. banks are not interested in lending to small business due to the raising cost in compliance and underwriting, and the small businesses are the ones suffering the consequences.

Let's look at the reasons and impacts behind the small business loan challenges.

Trends in Alternative Financial Services

The term “alternative data” is tossed about in the industry, but what types of alternative data can truly be used when lenders want to make a credit decision? How can it be leveraged to help you grow your credit portfolio wisely? What insights can you glean to expand your consumer universe?

Uncover some of the latest trends attached to the non-prime universe and learn the latest around alternative credit data. This deck additionally explores how some of the newest attributes can benefit lenders of all sizes.

Credit outlook for Millennials and Gen Z

You might be quick to lump Millennials and Gen Z together. After all, both groups are young, tech-savvy and changing the way we shop, consume and save. But like all the generations before them, they are unique. Generation Z (also known as Centennials) is now 28% of the U.S. population, with 5% over the age of 18. Millennials, now the largest generation in the workforce, makes up about 19% of the U.S. population and are deep into making big money decisions as they launch families and careers. This presentation highlights how both groups are behaving in the credit space, illuminates if they embracing certain credit products and touches on how their credit scores are trending.

And most importantly, what do these discoveries and insights mean for lenders?

Louisiana Small Business Loans – Get Approved For Small Business Financing

Are you looking for a loan for your commercial vehicle? If yes, then you should consider applying for commercial vehicle financing. The process of obtaining business loans for vehicles is quite simple. However, there are certain factors that you need to keep in mind while applying for a commercial vehicle loan.

If you are planning to buy a new commercial vehicle, then you should apply for commercial vehicle financing before buying the vehicle. It is because the finance company will give you a better rate of interest if you apply for a commercial vehicle loan before purchasing the vehicle.

Bryan Zhang / Insights from the latest Peer-to-Peer Lending Research

Bryan Zhang: Insights from the Latest P2P Lending Research

Keynote address by Bryan Zhang, of University of Cambridge, at LendIt Europe 2014. The title of this presentation is Insights from the Latest P2P Lending Research.

The Fintech Paradox : Accessing the USD 480 billion of untapped SME and SCF r...

The Fintech Paradox : Accessing the USD 480 billion of untapped SME and SCF revenue banking pools.

The attached thought piece from The Growth Paradigm PARTNERSHIP (GPP) discusses the unfulfilled promise and great potential from the land of Fintechs.

We talk about how Fintechs, both those with business models that look at collaborating with banks and the others that look at disrupting banks by taking their place, are struggling to increase their relevancy and scalability in the global world of trade, supply chain finance and SME lending.

GPP advocates that in order to get a share of the USD 480 billion untapped SME revenue pools , organisations have to get the 4C’s right, which revolve around Credit, Compliance, Capital and Client (acquisition, ease of accessibility and transacting ).

Wharton FinTech - P2P Lending Discussion

Wharton FinTech Club hosted a seminar on P2P (peer-to-peer) lending in October '14. Take a look at our key insights and analyses on this fast-growing industry!

Commercial banking outlook: Views from bankers, disruptors and innovators

Commercial banking outlook: Views from bankers, disruptors and innovators. A five forces analysis on the banking industry and the top challenges facing commercial banking executives.

Top 20 Social Networking Sites To Drive Huge Traffic to Your Website

Top 20 Social Networking Sites To Drive Huge Traffic to Your WebsiteTeam Mango Media Private Limited

Social networking websites is a online websites where users can create, add, edit and share bookmarks of images, video, blog posts,web documents and webpages. To Submitting our product related content to these social bookmarking sites helps us to increase brand awareness and drive huge traffic to our website.13.55 Regelefterlevnaden inom yrkestrafiken, Mikael Kyller

Presentation dag 2 Tylösandsseminariet 2016

More Related Content

What's hot

How lenders can capitalize on the growth in personal loans

Personal loan originations have returned to pre-recession levels with sustained year-over-year growth around 20% for multiple years. Meanwhile, delinquency rates remain at historic lows and demand has been met by increased liquidity amid a low-rate environment. If you’ve been riding the wave, take note: there are signs indicating growth is leveling off. How can lenders become more efficient in finding personal loan prospects going forward to sustain growth? And if you are a lender looking to enter the personal loan space, what steps should you take to assess the marketplace and seek out the right opportunities? Learn more in this slideshare presentation.

Leveraging data, tech and analytics to improve collections

Companies readily invest in acquisitions, but many do not invest in trying to improve their collections processes. Viewing collections as an omni-channel opportunity can have a significant impact on overall profitability and is an excellent opportunity to improve long-term customer loyalty. With the right data and technology, personalized collections are now a reality. This presentation addresses:

• The latest delinquency numbers

• New, sophisticated tools to digitize your efforts and enhance the customer experience

• Using data-driven decisioning to offer the right debt resolution options

• The benefits of a personalized, consistent experience across all channels

Top Regulatory Insights for Fintechs & Financial Institutions

We're breaking down the top regulatory insights you need to understand to prepare your compliance strategy for 2019 and beyond. Covering the latest information on upcoming regulations, including:

- Impact of CECL and how to prepare

- Priorities for the CFPB and House Financial Services Committee

- Must-know details of the Consumer Privacy Act of 2018

Judo Capital Case Study

BankSight works with Judo Capital to deliver an end-to-end digital process that enables Judo lenders to orchestrate a collaborative leads and referrals process across any channel with both small businesses and brokers.

How Big Data Can Lead to Bigger ROI

From underwriting to marketing and managing risk, and every business function in between, big data is valuable and integral to your commercial success. Experian’s latest technology innovation levels the playing field and fills the gaps in your data across all facets of your organization

How Alternative Credit Data Provides Lift in Your Portfolio

What is alternative data and how does it differ from traditional credit data?

How can alternative data be used to maximize your portfolio?

Learn how to leverage this new data set to maximize profits in your business. We’ll cover the latest findings in lender and consumer perspectives on alternative credit data and ways to use alternative credit data across the customer lifecycle giving you a deeper view of the consumer.

Hedge Fund Looks to Capitalize on Peer-to-Peer

Direct Lending - Brendan Ross - LA Business Journal 1.5.15

How do consumers feel about alternative credit data?

Consumers rely on credit for purchases big and small. While some have robust credit files, others are still invisible and seeking ways to grow their credit presence so they can have access to loans, credit cards and beyond. What types of information and data will they share to grow their credit files? In an exclusive Experian survey, we asked consumers how they perceive alternative credit data sources. Here are the findings.

5 Reasons to Report Credit Data

Every lender must make the decision on whether or not to report credit data. Furnishing data to the credit bureaus is still voluntary, but there are a number of reasons to embrace this action as a lender. Here are five reasons to consider if you are on the fence about becoming a data furnisher.

Credit Marketing Strategies to Capture Today's Digital Consumer

Consumers look at their smartphones an average 150 times per day. They are active on multiple social media platforms. Many consistently make online purchases. We live in a digital world, but is your credit-based marketing keeping up with the times? This slideshare reveals the latest trends and insights regarding consumer engagement with credit offers. Are consumers responding to direct mail, email or something else in the financial services space? Learn about insights specific to credit offers and how consumers are responding via various digital channels. Discover the latest channels financial marketers can leverage when delivering firm offers of credit.

Understand best practices to capture eyes on your financial offers and maximize your marketing spend.

Why is it_so_hard_to_get_a_business_loan_by_plousio

The major U.S. banks are not interested in lending to small business due to the raising cost in compliance and underwriting, and the small businesses are the ones suffering the consequences.

Let's look at the reasons and impacts behind the small business loan challenges.

Trends in Alternative Financial Services

The term “alternative data” is tossed about in the industry, but what types of alternative data can truly be used when lenders want to make a credit decision? How can it be leveraged to help you grow your credit portfolio wisely? What insights can you glean to expand your consumer universe?

Uncover some of the latest trends attached to the non-prime universe and learn the latest around alternative credit data. This deck additionally explores how some of the newest attributes can benefit lenders of all sizes.

Credit outlook for Millennials and Gen Z

You might be quick to lump Millennials and Gen Z together. After all, both groups are young, tech-savvy and changing the way we shop, consume and save. But like all the generations before them, they are unique. Generation Z (also known as Centennials) is now 28% of the U.S. population, with 5% over the age of 18. Millennials, now the largest generation in the workforce, makes up about 19% of the U.S. population and are deep into making big money decisions as they launch families and careers. This presentation highlights how both groups are behaving in the credit space, illuminates if they embracing certain credit products and touches on how their credit scores are trending.

And most importantly, what do these discoveries and insights mean for lenders?

Louisiana Small Business Loans – Get Approved For Small Business Financing

Are you looking for a loan for your commercial vehicle? If yes, then you should consider applying for commercial vehicle financing. The process of obtaining business loans for vehicles is quite simple. However, there are certain factors that you need to keep in mind while applying for a commercial vehicle loan.

If you are planning to buy a new commercial vehicle, then you should apply for commercial vehicle financing before buying the vehicle. It is because the finance company will give you a better rate of interest if you apply for a commercial vehicle loan before purchasing the vehicle.

Bryan Zhang / Insights from the latest Peer-to-Peer Lending Research

Bryan Zhang: Insights from the Latest P2P Lending Research

Keynote address by Bryan Zhang, of University of Cambridge, at LendIt Europe 2014. The title of this presentation is Insights from the Latest P2P Lending Research.

The Fintech Paradox : Accessing the USD 480 billion of untapped SME and SCF r...

The Fintech Paradox : Accessing the USD 480 billion of untapped SME and SCF revenue banking pools.

The attached thought piece from The Growth Paradigm PARTNERSHIP (GPP) discusses the unfulfilled promise and great potential from the land of Fintechs.

We talk about how Fintechs, both those with business models that look at collaborating with banks and the others that look at disrupting banks by taking their place, are struggling to increase their relevancy and scalability in the global world of trade, supply chain finance and SME lending.

GPP advocates that in order to get a share of the USD 480 billion untapped SME revenue pools , organisations have to get the 4C’s right, which revolve around Credit, Compliance, Capital and Client (acquisition, ease of accessibility and transacting ).

Wharton FinTech - P2P Lending Discussion

Wharton FinTech Club hosted a seminar on P2P (peer-to-peer) lending in October '14. Take a look at our key insights and analyses on this fast-growing industry!

Commercial banking outlook: Views from bankers, disruptors and innovators

Commercial banking outlook: Views from bankers, disruptors and innovators. A five forces analysis on the banking industry and the top challenges facing commercial banking executives.

What's hot (20)

How lenders can capitalize on the growth in personal loans

How lenders can capitalize on the growth in personal loans

Leveraging data, tech and analytics to improve collections

Leveraging data, tech and analytics to improve collections

Top Regulatory Insights for Fintechs & Financial Institutions

Top Regulatory Insights for Fintechs & Financial Institutions

How Alternative Credit Data Provides Lift in Your Portfolio

How Alternative Credit Data Provides Lift in Your Portfolio

How do consumers feel about alternative credit data?

How do consumers feel about alternative credit data?

Credit Marketing Strategies to Capture Today's Digital Consumer

Credit Marketing Strategies to Capture Today's Digital Consumer

Why is it_so_hard_to_get_a_business_loan_by_plousio

Why is it_so_hard_to_get_a_business_loan_by_plousio

Louisiana Small Business Loans – Get Approved For Small Business Financing

Louisiana Small Business Loans – Get Approved For Small Business Financing

Bryan Zhang / Insights from the latest Peer-to-Peer Lending Research

Bryan Zhang / Insights from the latest Peer-to-Peer Lending Research

The Fintech Paradox : Accessing the USD 480 billion of untapped SME and SCF r...

The Fintech Paradox : Accessing the USD 480 billion of untapped SME and SCF r...

Commercial banking outlook: Views from bankers, disruptors and innovators

Commercial banking outlook: Views from bankers, disruptors and innovators

Viewers also liked

Top 20 Social Networking Sites To Drive Huge Traffic to Your Website

Top 20 Social Networking Sites To Drive Huge Traffic to Your WebsiteTeam Mango Media Private Limited

Social networking websites is a online websites where users can create, add, edit and share bookmarks of images, video, blog posts,web documents and webpages. To Submitting our product related content to these social bookmarking sites helps us to increase brand awareness and drive huge traffic to our website.13.55 Regelefterlevnaden inom yrkestrafiken, Mikael Kyller

Presentation dag 2 Tylösandsseminariet 2016

15 Solid Reasons Why One Should Never Blow Off Text Marketing

Here you'll find 15 amazing facts about text/sms marketing. To know more about Text marketing, visit - https://sarv.com/

14.30 En medelstor kommuns metoder, Petter Skarin, Eskilstuna

Tylösandsseminariet 2016. ”Nollvisionen –världens grej” talarpresentation tisdag 30/8

Укрепление грунта (Кратко о технологии укрепления грунта)

Краткое описание особенностей технологии укрепления грунта в дорожном строительстве через призму деятельности компании Статус-Грунт

www.status-grunt.ru

+7(495) 125-29-35

Viewers also liked (10)

Top 20 Social Networking Sites To Drive Huge Traffic to Your Website

Top 20 Social Networking Sites To Drive Huge Traffic to Your Website

13.55 Regelefterlevnaden inom yrkestrafiken, Mikael Kyller

13.55 Regelefterlevnaden inom yrkestrafiken, Mikael Kyller

15 Solid Reasons Why One Should Never Blow Off Text Marketing

15 Solid Reasons Why One Should Never Blow Off Text Marketing

14.30 En medelstor kommuns metoder, Petter Skarin, Eskilstuna

14.30 En medelstor kommuns metoder, Petter Skarin, Eskilstuna

Укрепление грунта (Кратко о технологии укрепления грунта)

Укрепление грунта (Кратко о технологии укрепления грунта)

Similar to Small Business Lending Index November 2015

Small Business Lending Index December 2015

Biz2Credit revealed that Big Banks approved 22.9% small business loans in December. Year closed with a post-recession high, marking 0.1% increase from November.

Small Business Lending Index July 2018

Biz2Credit: https://www.biz2credit.com/

Related Resource: https://www.biz2credit.com/small-business-lending-index/july-2018

According to the month of July 2018, Big banks approved 26.3% of small business loans in July 2018, which is up from June’s figure of 26.1%

For further queries, contact us at: 800-200-5678

Follow us at:

Twitter: https://twitter.com/biz2credit

Facebook: https://www.facebook.com/biz2credit

Linkedin: https://www.linkedin.com/company/biz2credit-llc

Pinterest: http://www.pinterest.com/biz2credit/

Google+: https://plus.google.com/u/0/+Biz2credit/

Getting a business loan is easier

Get an insight into what do lending institutions look for while lending, 5 mistakes that should be avoided when applying for loan, ten steps to secure funding and much more.

Loan Matter Advocate in Delhi

According to Mr. Kislay Pandey-Loan Matter Advocate, the Supreme Court of India, "Interest rate in India changes so frequently that it affect the borrowers in all types of loans and processes.

Small Business Lending Report

A behind-the-scenes look at how American small business owners approach financing in 2018.

IDBI gives news ways for funding your home

IDBI Bank home loans offer flexible loan repayment options and lower EMIs at attractive interest rates. Calculate your eligliblity now!

Financing Small Business Success: The Rise of Online Lending

As part of its ongoing efforts to solve persistent pain points for small business, Intuit released a new research report, “Financing Small Business Success” which shows how online lenders are reshaping the small business financing market.

The research was conducted by Ebiquity and based on 500 interviews held July 20-27. Research was completed online among owners and managers of U.S. small businesses that have attempted, either successfully or unsuccessfully, to secure funding for their company through business financing channels.

The forecast was prepared by Emergent Research, based on existing assessments of the small business credit market outlined in the Harvard Business School paper, “The State of Small Business Lending: Credit Access During the Recovery and How Technology May Change the Game.” The forecast assumes moderate U.S. economic growth averaging 2-3 percent over the forecast timeframe.

Transparency in banking comes into spotlight

New legislations take years to develop, but once approved, they can alter the entire way an industry functions. In the UAE, the banking sector is undergoing major transformations as the government takes transparency to the next level.

Peer-to-Peer Lending: Examining the Industry and the Borrower Experience

Online peer-to-peer (P2P) lending websites, often referred to as “Shadow Lenders”, have gained significant traction since the credit crunch resulting from the 2008 financial crisis. The purpose of these rapidly-growing websites is to facilitate loans of under $35,000 between borrowers and investors. The result is a transparent loan platform where individual investors can determine a borrower’s credit worthiness and partially or fully fund a loan at an attractive interest rate.

This slide deck offers background on the P2P lending industry and takes a closer look at the borrower experience by profiling two leading firms in the space – Prosper and Lending Club. Five key takeaways and tips for P2P lenders are also highlighted.

Rainstar Capital Group's Business Acquisition Financing Program(2)

Rainstar Capital Group's Business Acquisition Financing Program(2)Kurt A.Nederveld- CEO of Rainstar Capital Group

Rainstar Capital Group’s lender is one of the nation’s leading online, technology-powered lenders to small business.

We are a direct lender, funding business loans with our own capital. We are backed by Garrison Investment Group, a leading NYC-based private equity firm.

7 small business lenders report to credit bureaus in 2019

Wondering where your credit score comes from? Here is a list of seven business lenders that report your borrowing habits to business credit bureaus in 2019. For more information, visit at https://www.onlinecheck.com/blog/business-loans/report-to-credit-bureaus/

MultiFunding Lending Snapshot - Q1 May 2011

This report is a summary of key findings from MultiFunding’s First Quarter National Lending Snapshot. The objective of the study is to determine amongst small business owners looking for loans in today’s market – what loan types they qualify for and what interest rates they can expect to pay for their loans.

Similar to Small Business Lending Index November 2015 (20)

Online Lending - A Prudent Disruption to the Loaning Economy

Online Lending - A Prudent Disruption to the Loaning Economy

Financing Small Business Success: The Rise of Online Lending

Financing Small Business Success: The Rise of Online Lending

Peer-to-Peer Lending: Examining the Industry and the Borrower Experience

Peer-to-Peer Lending: Examining the Industry and the Borrower Experience

Rainstar Capital Group's Business Acquisition Financing Program(2)

Rainstar Capital Group's Business Acquisition Financing Program(2)

7 small business lenders report to credit bureaus in 2019

7 small business lenders report to credit bureaus in 2019

More from Biz2Credit

Answers to Cares Act PPP Loans FAQs

Check the various FAQs answers here about the implementation of the Paycheck Protection Program (PPP) Loans, established by section 1102 of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act or the Act). CARES Act is the largest economic relief bill in United States history which will support individuals and businesses affected by the COVID-19 pandemic.

Small Business Lending Index August 2018

Biz2Credit: https://www.biz2credit.com/

Related Resource: https://www.biz2credit.com/small-business-lending-index/june-2018

According to the month of August 2018, Big banks approved 26.5% of small business loans in August 2018, which is up from July’s figure of 26.3%

For further queries, contact us at: 800-200-5678

Follow us at:

Twitter: https://twitter.com/biz2credit

Facebook: https://www.facebook.com/biz2credit

Linkedin: https://www.linkedin.com/company/biz2credit-llc

Pinterest: http://www.pinterest.com/biz2credit/

Google+: https://plus.google.com/u/0/+Biz2credit/

Women Small Business Finance Webinar 2017

Biz2Credit: https://www.biz2credit.com/

Related Resource: http://www.biz2credit.com/knowledge-center/webinar/womens-small-business-finance-2017

Biz2Credit hosted a webinar on Wednesday, March 8, 2017 from 3:00 PM (EST). The Webinar focused on personal branding for women entrepreneurs and develop business leadership skills.

For further queries, contact us at: 800-200-5678

Follow us at:

Twitter: https://twitter.com/biz2credit

Facebook: https://www.facebook.com/biz2credit

Linkedin: https://www.linkedin.com/company/biz2credit-llc

Pinterest: http://www.pinterest.com/biz2credit/

Google+: https://plus.google.com/u/0/+Biz2credit/

Marketing and Managing your Small Business this Summer

Biz2Credit: https://www.biz2credit.com/

Related Resource: https://www.biz2credit.com/knowledge-center/webinar/marketing-managing-small-business-this-summer

Biz2Credit hosted a webinar on Wednesday, June 29, 2016 from 3:00 (Eastern Time). The webinar featured topics of seasonal marketing tips and challenges that small business owners face.

For further queries, contact us at: 800-200-5678

Follow us at:

Twitter: https://twitter.com/biz2credit

Facebook: https://www.facebook.com/biz2credit

Linkedin: https://www.linkedin.com/company/265111

Pinterest: http://www.pinterest.com/biz2credit/

Google+: https://plus.google.com/u/0/+Biz2credit/

Women's Small Business Outlook 2016

Biz2Credit: https://www.biz2credit.com/

Related Resource: https://www.biz2credit.com/knowledge-center/webinar/women-small-business-outlook-2016

Biz2Credit hosted a webinar on Tuesday, March 8, 2016 from 3:00 (Eastern Time). The webinar featured topics of importance to women entrepreneurs.

For further queries, contact us at: 800-200-5678

Follow us at:

Twitter: https://twitter.com/biz2credit

Facebook: https://www.facebook.com/biz2credit

Linkedin: https://www.linkedin.com/company/265111

Pinterest: http://www.pinterest.com/biz2credit/

Google+: https://plus.google.com/u/0/+Biz2credit/

Unlock the Secrets of a Million Dollar Company

Biz2Credit: https://www.biz2credit.com/

Related Resource: https://www.biz2credit.com/knowledge-center/webinar/part3-unlocking-secrets-million-dollar-company-valuation

In the 3rd webinar of her 3-part webinar series with Biz2Credit, hidden profit prophet & small business expert, Dawn Fotopulos counts ways to building a Million Dollar Sellable Business. She further explains easy-to-apply ways to build assets, owner’s equity & getting a million dollar valuation.

For further queries, contact us at: 800-200-5678

Follow us at:

Twitter: https://twitter.com/biz2credit

Facebook: https://www.facebook.com/biz2credit

Linkedin: https://www.linkedin.com/company/265111

Pinterest: http://www.pinterest.com/biz2credit/

Google+: https://plus.google.com/u/0/+Biz2credit/

Unlock the Secrets of 50 Percent More Cash Flow

With to double cash-flows in 5 short weeks? Dawn Fotopulos along with Biz2Credit reveals secrets to unlocking 50% more cashflow for any business.

Unlocking the Secrets to 50 Percent More Profit - Biz2Credit

Biz2Credit presented first of 3-part webinar series with Small Business Consultant & Author, Dawn Fotopolus, revealing secrets to unlocking 50% more profit.

The Changing Face of Small Business Owners - Biz2Credit

This webinar focused on the explosive growth of Latino-owned companies, challenges facing entrepreneurs searching for startup capital and other funding & the tips for making financing, marketing, and personnel decisions.

Latino Small Business Owners Lagging Behind - Biz2Credit

According to Biz2Credit study, Latino small business loan applications grew by 18 percent this year. Latino business owners lag behind in the necessary factors needed to secure financing.

Small Business Lending Index June 2015 – Biz2Credit

For the 8th consecutive month big banks registered an increase in the loan approval rates with an approval of 22.19% of small business loan requests in June 2015, up from 21.9% in May.

Independence Day, Celebration, America

Let each one of us make a promise to ourselves that as long as we live, we will help America grow into a better nation with each passing day.

Happy 4th of July to you!

Small Business Lending Index January 2015 - Biz2Credit

Big banks approved 21.3% of small business loan requests in January 2015, up from 21.1% in December 2014.

Small Business Lending Index May 2015 – Biz2Credit

Big banks approved 21.9% of small business loan requests in May 2015, up from 21.7% in April, marking the seventh consecutive month that approval rates have increased in this category of lenders. A year-to-year comparison shows that loan approval rates are up approximately 12 percent.

Small Business Lending Index February 2015 - Biz2Credit

Big banks approved 21.5% of small business loan requests in February 2015, up from 21.3% in January. Loan approval rates at big banks have increased consistently for 10 out of the last 11 months, and a year-to-year comparison shows that they have increased by 12.5%.

Biz2Credit Small Business Lending Index - March 2015

Big banks approved 21.6% of small business loan requests in March 2015, slightly up from 21.5% in February. Loan approval rates at big banks have increased each month for nearly a year.

Biz2Credit Small Business Lending Index - April 2015

Big banks approved 21.7% of small business loan requests in April 2015, up from 21.6% in March. Moreover, big banks' loan approval rates have improved for six consecutive months and in 12 of the last 13 months.

Credit Desert Study - 2014

Biz2Credit released the results of a study of bank failures sorted by state and their impact on small business borrowers.

Small business 2015 outlook

Biz2Credit and Small Business Trends hosted a free webinar, Small Business 2015 Outlook, featuring money-saving tax advice from experts in accounting, finance and business incorporation.

Women's small business outlook 2015

The research found that the credit gap between men and women is closing and that average revenues of women-owned firms increased nearly 40% in a year-to-year comparison.

More from Biz2Credit (20)

Marketing and Managing your Small Business this Summer

Marketing and Managing your Small Business this Summer

Unlocking the Secrets to 50 Percent More Profit - Biz2Credit

Unlocking the Secrets to 50 Percent More Profit - Biz2Credit

The Changing Face of Small Business Owners - Biz2Credit

The Changing Face of Small Business Owners - Biz2Credit

Latino Small Business Owners Lagging Behind - Biz2Credit

Latino Small Business Owners Lagging Behind - Biz2Credit

Small Business Lending Index June 2015 – Biz2Credit

Small Business Lending Index June 2015 – Biz2Credit

Small Business Lending Index January 2015 - Biz2Credit

Small Business Lending Index January 2015 - Biz2Credit

Small Business Lending Index May 2015 – Biz2Credit

Small Business Lending Index May 2015 – Biz2Credit

Small Business Lending Index February 2015 - Biz2Credit

Small Business Lending Index February 2015 - Biz2Credit

Biz2Credit Small Business Lending Index - March 2015

Biz2Credit Small Business Lending Index - March 2015

Biz2Credit Small Business Lending Index - April 2015

Biz2Credit Small Business Lending Index - April 2015

Recently uploaded

Best Crypto Marketing Ideas to Lead Your Project to Success

In this comprehensive slideshow presentation, we delve into the intricacies of crypto marketing, offering invaluable insights and strategies to propel your project to success in the dynamic cryptocurrency landscape. From understanding market trends to building a robust brand identity, engaging with influencers, and analyzing performance metrics, we cover all aspects essential for effective marketing in the crypto space.

Also Intelisync, our cutting-edge service designed to streamline and optimize your marketing efforts, leveraging data-driven insights and innovative strategies to drive growth and visibility for your project.

With a data-driven approach, transparent communication, and a commitment to excellence, InteliSync is your trusted partner for driving meaningful impact in the fast-paced world of Web3. Contact us today to learn more and embark on a journey to crypto marketing mastery!

Ready to elevate your Web3 project to new heights? Contact InteliSync now and unleash the full potential of your crypto venture!

Create a spend money transaction during bank reconciliation.pdf

Create a spend money transaction during bank reconciliation.

Office Furniture | Furniture Store in Sarasota, Florida | Sarasota Collection

Office Furniture | Furniture Store in Sarasota, Florida | Sarasota CollectionThe Sarasota Collection Home Store

Discover elegant office furniture, desks, and chairs at Sarasota Collection Home Store. Elevate your workspace with style and comfort. Shop now!Web Technology LAB MANUAL for Undergraduate Programs

Web Technology LAB MANUAL for Undergraduate Programs

Textile Chemical Brochure - Tradeasia (1).pdf

Explore Tradeasia’s brochure for eco-friendly textile chemicals. Enhance your textile production with high-quality, sustainable solutions for superior fabric quality.

Dining Tables and Chairs | Furniture Store in Sarasota, Florida

Explore Sarasota Collection's exquisite and long-lasting dining table sets and chairs in Sarasota. Elevate your dining experience with our high-quality collection!

How to Build a Diversified Investment Portfolio.pdf

Building a diversified investment portfolio is a fundamental strategy to manage risk and optimize returns. For both novice and experienced investors, diversification offers a pathway to a more stable and resilient financial future. Here’s an in-depth guide on how to create and maintain a well-diversified investment portfolio.

Get To Know About Salma Karina Hayat.pdf

Salma Karina Hayat is Conscious Digital Transformation Leader at Kudos | Empowering SMEs via CRM & Digital Automation | Award-Winning Entrepreneur & Philanthropist | Education & Homelessness Advocate

How To Leak-Proof Your Magazine Business

What You're Going to Learn

- How These 4 Leaks Force You To Work Longer And Harder in order to grow your income… improve just one of these and the impact could be life changing.

- How to SHUT DOWN the revolving door of Income Stagnation… you know, where new sales come into your magazine while at the same time existing sponsors exit.

- How to transform your magazine business by fixing the 4 “DON’Ts”...

#1 LEADS Don’t Book

#2 PROSPECTS Don’t Show

#3 PROSPECTS Don’t Buy

#4 CLIENTS Don’t Stay

- How to identify which leak to fix first so you get the biggest bang for your income.

- Get actionable strategies you can use right away to improve your bookings, sales and retention.

Michael Economou - Don't build a marketplace.pdf

When listening about building new Ventures, Marketplaces ideas are something very frequent. On this session we will discuss reasons why you should stay away from it :P , by sharing real stories and misconceptions around them. If you still insist to go for it however, you will at least get an idea of the important and critical strategies to optimize for success like Product, Business Development & Marketing, Operations :)

Reflect Festival Limassol May 2024.

Michael Economou is an Entrepreneur, with Business & Technology foundations and a passion for Innovation. He is working with his team to launch a new venture – Exyde, an AI powered booking platform for Activities & Experiences, aspiring to revolutionize the way we travel and experience the world. Michael has extensive entrepreneurial experience as the co-founder of Ideas2life, AtYourService as well as Foody, an online delivery platform and one of the most prominent ventures in Cyprus’ digital landscape, acquired by Delivery Hero group in 2019. This journey & experience marks a vast expertise in building and scaling marketplaces, enhancing everyday life through technology and making meaningful impact on local communities, which is what Michael and his team are pursuing doing once more with Exyde www.goExyde.com

Recently uploaded (11)

Best Crypto Marketing Ideas to Lead Your Project to Success

Best Crypto Marketing Ideas to Lead Your Project to Success

Create a spend money transaction during bank reconciliation.pdf

Create a spend money transaction during bank reconciliation.pdf

Office Furniture | Furniture Store in Sarasota, Florida | Sarasota Collection

Office Furniture | Furniture Store in Sarasota, Florida | Sarasota Collection

Web Technology LAB MANUAL for Undergraduate Programs

Web Technology LAB MANUAL for Undergraduate Programs

Dining Tables and Chairs | Furniture Store in Sarasota, Florida

Dining Tables and Chairs | Furniture Store in Sarasota, Florida

How to Build a Diversified Investment Portfolio.pdf

How to Build a Diversified Investment Portfolio.pdf

Small Business Lending Index November 2015

- 1. 62.4%62.2% Small Business Loan Approval Rates by Institutional Lenders Continue Increase Looming Interest Rate Hike Could Lead to Higher Loan Approval Rates NOVEMBER 2015Small Business Lending Index According to the Biz2Credit Small Business Lending IndexTM , a monthly analysis of 1,000 loan applications on Biz2Credit.com Small business loan approval rates at institutional lenders continued their gradual ascent, according to Biz2Credit’s November Small Business Lending IndexTM , an analysis of more than 1,000 loan requests of qualifying small business owners. While big banks maintained their overall healthy approval rates. However, loan approval rates for small business loans at small banks, credit unions and alternative lenders faltered. About the Biz2Credit Small Business Lending IndexTM Biz2Credit analyzed loan requests ranging from $25,000 to $3 million from companies in business more than two years with an average credit score above 680. Unlike other surveys, the results are based on primary data submitted by more than 1,000 small business owners who applied for funding on Biz2Credit's online lending platform, which connects business borrowers and lenders. TM Loan Approvals at Small banks Lending approval rates at small banks dropped to 48.9% in November, from 49% in October. In addition, for a full calendar year, small banks have denied more than half of their loan requests. “Institutional lenders are offering better terms to borrowers, and they are noticing,” Arora explained. “Investors are purchasing a greater number of loans at lower yields and longer terms as well as low regulatory risks. They are becoming very active players in small business lending. ” - Biz2Credit CEO Rohit Arora “ Loan Approvals at Institutional Lenders Institutional lenders continued month-over-month growth in November, reaching 62.4%, up from 62.2% in October. Loan Approvals at Big banks Big banks ($10 billion+ in assets) approved 22.8% of small business loan approvals in November, which matched last month’s figure. However, there is optimism that small business lending by big banks will increase in the coming months as Federal Reserve Chairwoman Janet Yellen recently hinted that the Fed would raise interest rates in the near future. yearly comparison 22.8% 20.8% MONTHLY comparison OCT’15 NOV’15 22.8%22.8% yearly comparison 48.9% 49.8% MONTHLY comparison OCT’15 NOV’15 48.9%49.0% yearly comparison 62.4%59.9% MONTHLY comparison NOV’15OCT’15 Credit union approvals Credit unions approved 42.4% of loan applications in November, down one-tenth of a percent compared to October. yearly comparison 42.4% 43.4% MONTHLY comparison NOV’14 NOV’15 OCT’15 NOV’15 42.4%42.5% NOV’14 NOV15 NOV’14 NOV’15 NOV’14 NOV’15 Small business loan approvals by Alternative lenders Loan approval rates at alternative lenders dropped for a third straight month from 60.8% to 60.7% in November. Alternative lenders' approval percentages have steadily declined since January 2014, coinciding with the emergence of institutional lenders in the small business lending marketplace. yearly comparison 60.7% 62% MONTHLY comparison “Alternative lenders are not offering competitive terms on their loans and thus are one of the final options for small business owners seeking capital,” Arora stated. “This has resulted in less qualified borrowers and a gradual drop in loan approvals, despite the high interest rates that alternative lenders charge. ” - Biz2Credit CEO Rohit Arora“ NOV’14 NOV’15 OCT’15 NOV’15 60.7%60.8% “An increase in interest rates would boost the incentive for big banks to approve a higher percentage of loan requests,” suggested Arora. “As the financial spreads on these requests improves, I expect to see more loans approved with the mainstream lenders. Higher profitability on loans will lead to more loan approvals. ” - Biz2Credit CEO Rohit Arora“ “We are seeing more creditworthy borrowers opting for loans at big banks and institutional lenders. Small banks have suffered in the last year due to their failure to adapt to improvements in technology and other areas of operations, thus making it more difficult for small business owners to apply for loans. However, the looming interest rate increase should provide small banks with an opportunity to approve more loans.” - Biz2Credit CEO Rohit Arora “ “Credit unions are still limited, in part because of the failure to increase the credit union member business-lending (MBL) cap from 12.25% of their assets to 27.5%. ” - Biz2Credit CEO Rohit Arora“