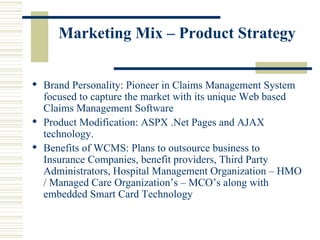

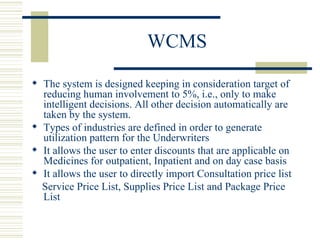

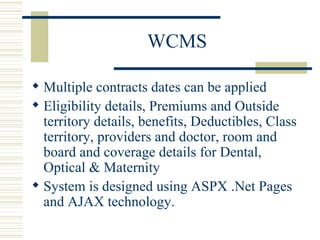

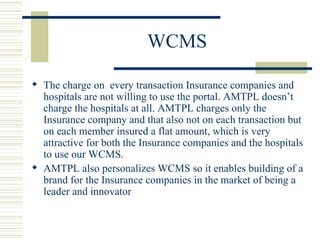

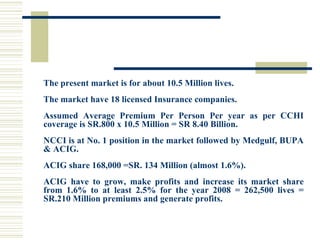

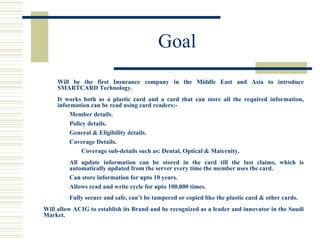

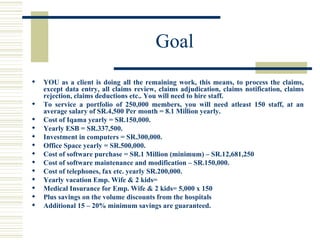

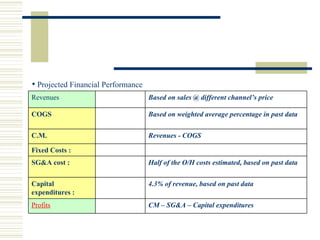

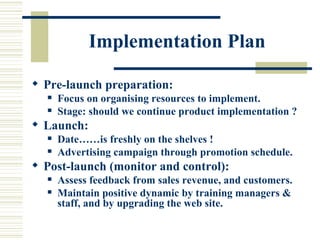

The document discusses a web-enabled claims management system called WCMS being developed by AMTPL to target the insurance market in Middle East and India. WCMS allows online claims processing and management. It has features like storing member details, policies, eligibility details, coverage details etc. on smart cards. AMTPL plans to outsource the system to insurance companies and providers to help them improve efficiency.