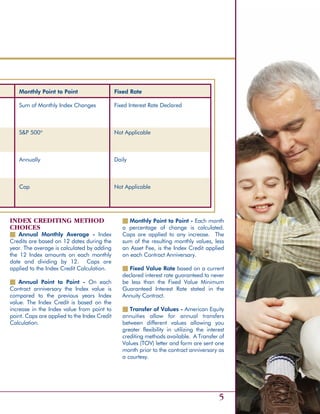

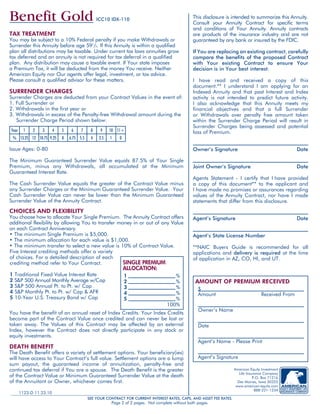

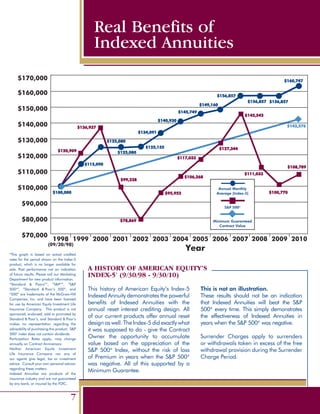

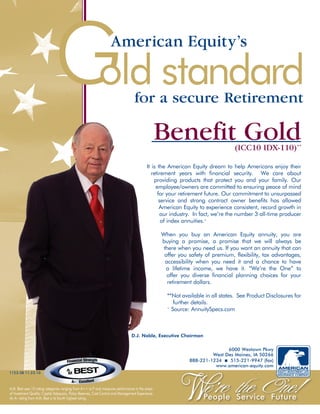

This document summarizes the benefits of an indexed annuity product called Benefit Gold. It discusses how indexed annuities can provide returns linked to market indexes while protecting the principal amount. The document outlines several crediting methods and indexes available under the product. It also highlights some key benefits including a 5% premium bonus, lifetime income rider, death benefit, and penalty-free withdrawal options.