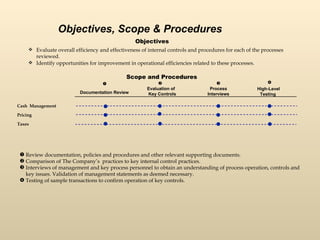

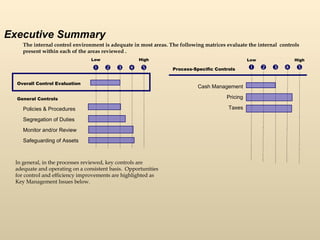

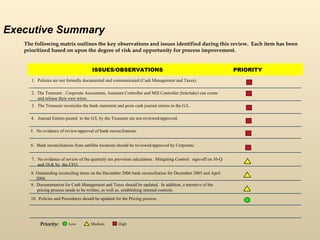

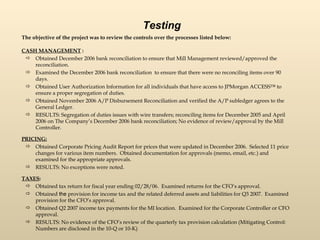

The document summarizes the results of a review of internal controls for cash management, pricing, and taxes processes. For cash management, some segregation of duty issues were identified with wire transfers and outstanding reconciling items. Pricing controls were found to be adequate. For taxes, there was no evidence of review of the quarterly tax provision calculation, though numbers are disclosed in public filings. Opportunities for improvements in documentation and review procedures were identified.