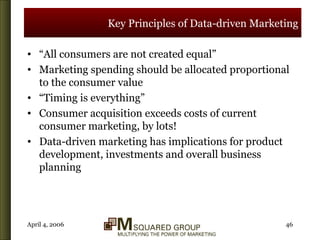

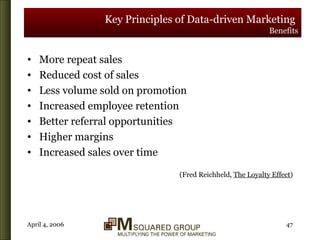

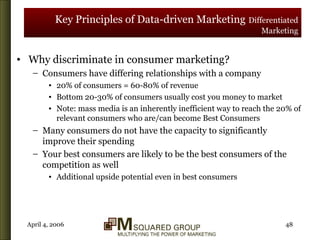

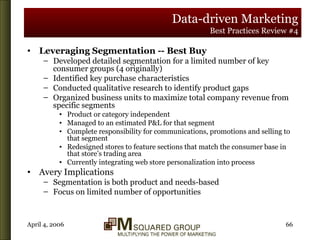

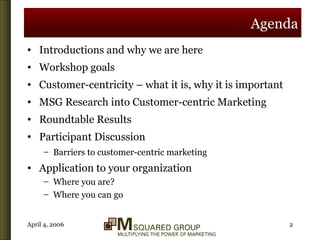

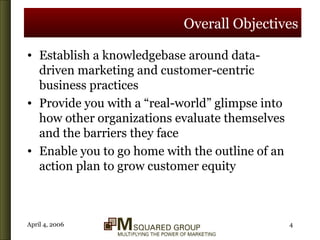

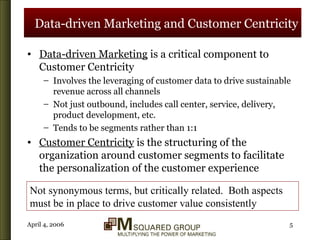

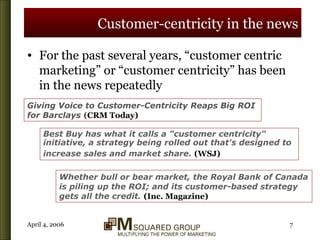

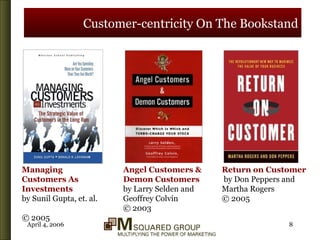

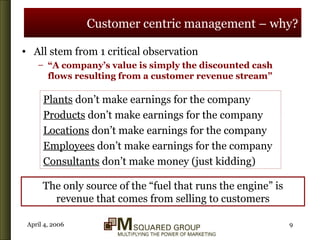

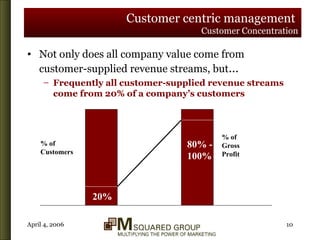

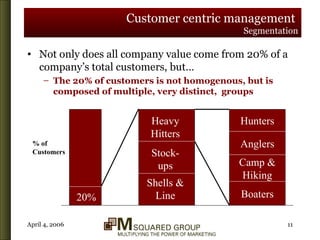

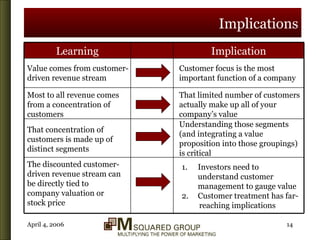

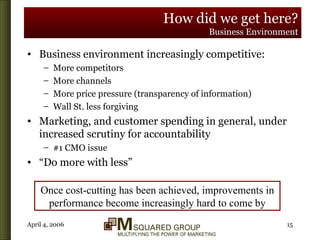

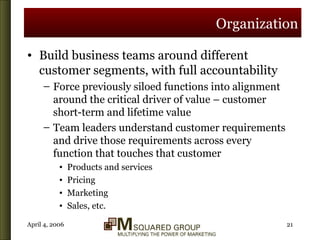

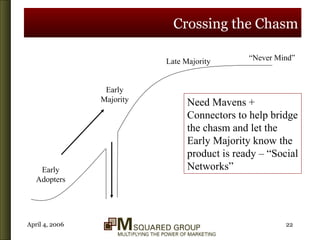

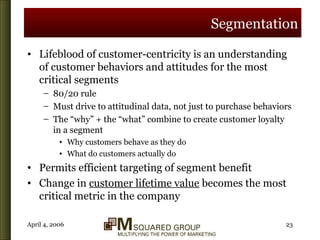

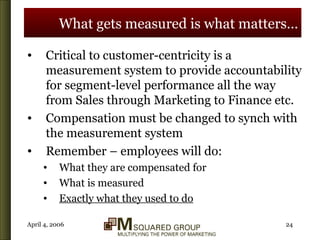

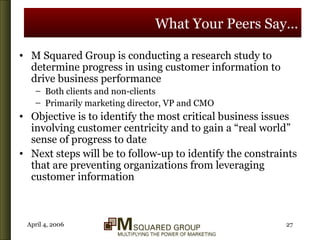

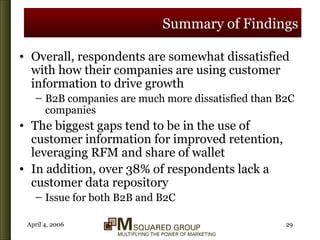

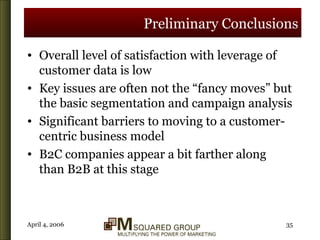

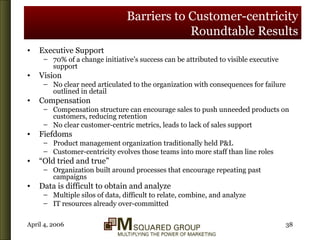

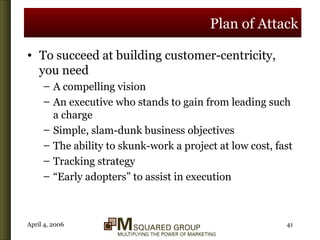

The document discusses building customer equity in organizations through becoming more customer-centric. It outlines an agenda for a workshop on the topic, including establishing a knowledge base around data-driven marketing and customer-centric practices. Barriers to becoming more customer-centric are discussed, such as lack of executive support, no clear vision, compensation not aligned with customer metrics, and data challenges. Participants are asked to rate their own organization on these barriers and develop a plan to advance their customer-centric efforts.

![Thank you! Mark Price Managing Partner, M Squared Group 952-484-0501 [email_address]](https://image.slidesharecdn.com/CustomercentricMarketingSeminar40406v3-123574804131-phpapp01/85/Customer-Centric-Marketing-Seminar-4-04-06v3-44-320.jpg)