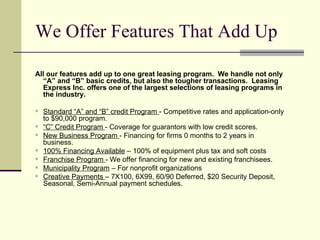

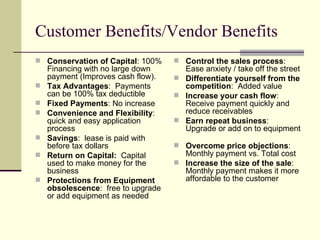

Leasing Express Inc. provides lease and finance solutions to help businesses acquire the equipment they need to compete. They handle a wide range of credit profiles, including standard A/B credits as well as more difficult C credits. The company offers 100% financing with no large down payment, tax advantages, fixed payments, and flexibility through quick application processes. This allows businesses to conserve capital, control costs, and upgrade equipment over time.