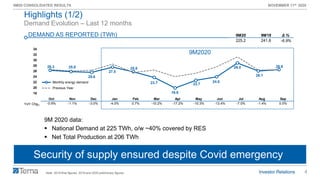

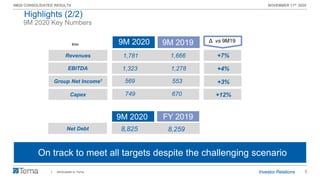

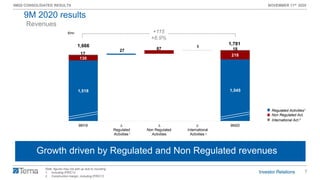

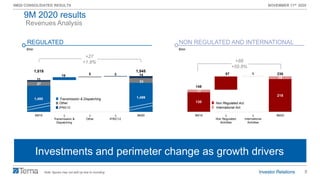

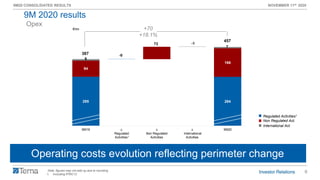

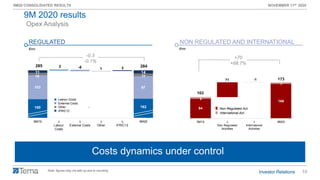

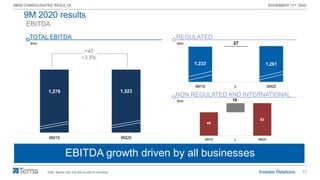

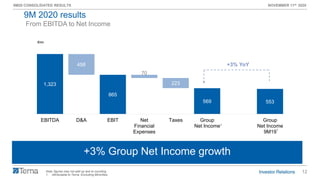

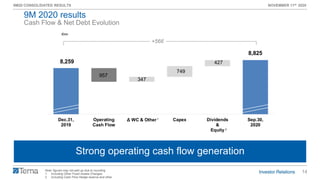

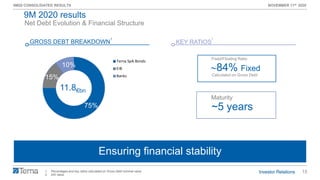

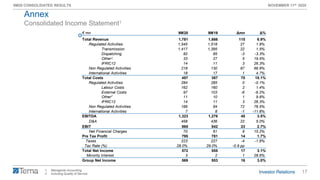

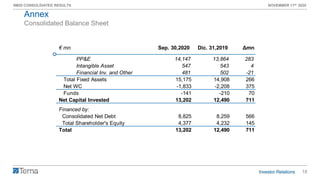

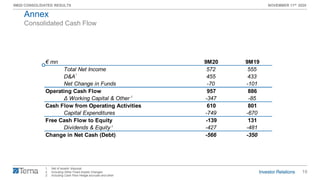

Terna reported its consolidated results for the first nine months of 2020. Revenues increased 7% to €1,781 million driven by growth in regulated and non-regulated activities. EBITDA rose 4% to €1,323 million and group net income increased 3% to €569 million. Capex was up 12% at €749 million as Terna accelerated investments to develop and maintain the transmission grid. Despite the challenges of COVID-19, Terna was able to ensure security of supply and remains on track to meet its targets for the full year.