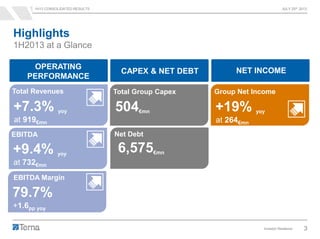

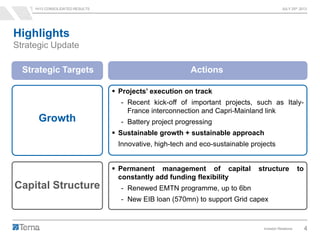

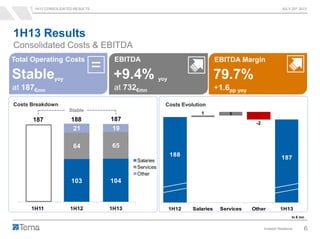

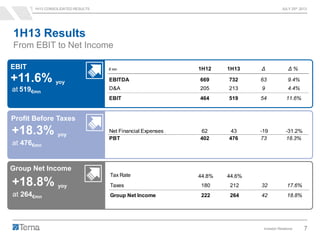

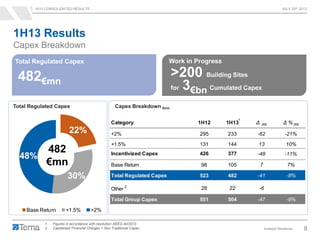

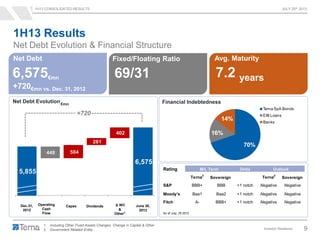

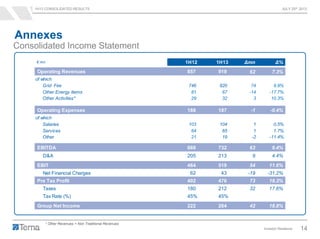

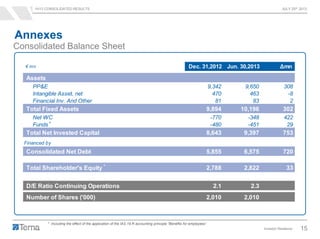

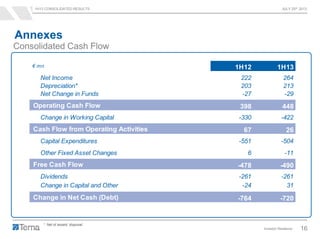

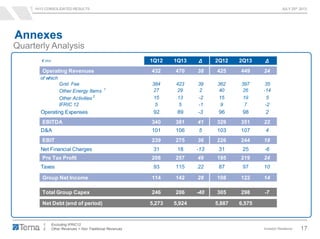

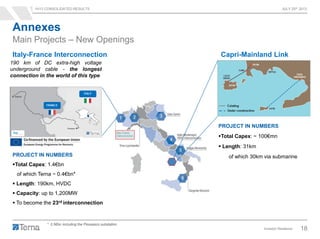

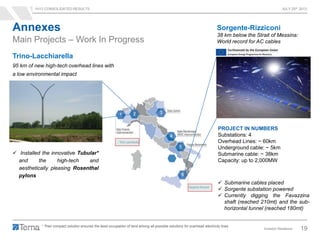

Flavio Cattaneo and Giuseppe Saponaro presented Terna's 1H13 consolidated results. Revenues increased 7.3% to €919 million driven by a 9.9% increase in grid fees. EBITDA rose 9.4% to €732 million and net income increased 18.8% to €264 million. Total capex was €504 million, with regulated capex of €482 million. Net debt was €6.575 billion, an increase of €720 million from year-end 2012. Key projects discussed included the Italy-France interconnection and Capri-Mainland link.