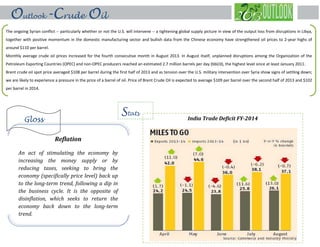

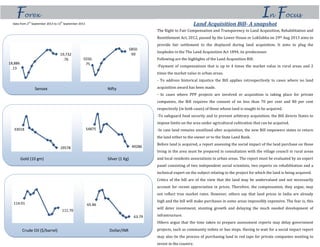

The document discusses the economic challenges facing China, including its slowing growth, increasing corporate and local government debt, and signs of a potential financial crisis, mirroring Japan's past economic struggles. Additionally, it highlights Russia's economic conditions, marked by stagnation and rising inflation, while outlining India's new land acquisition bill aimed at ensuring fair compensation for land acquisitions. The document emphasizes the importance of structural reforms in both China and India to promote sustainable growth.