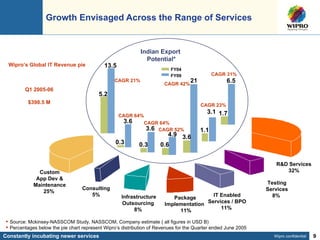

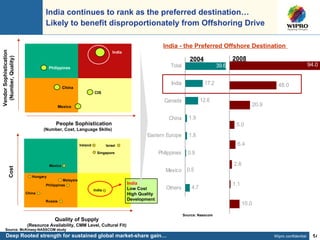

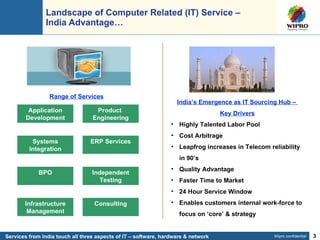

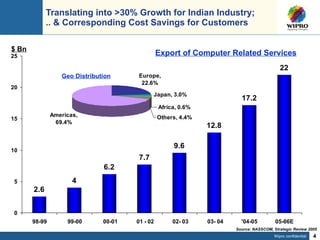

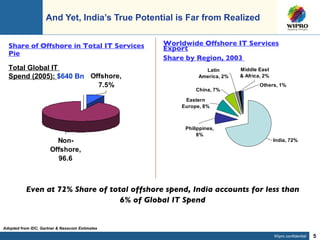

The document discusses the global computer services industry and India's role as an offshore outsourcing hub. It summarizes that India accounts for less than 6% of global IT spending despite having over 30% growth in its domestic IT industry. While offshore adoption is still low at under 10% of global 500 company budgets, it presents opportunities for continued growth. The document also outlines some of the key advantages and challenges for India's IT services industry.

![Wipro Today Ranked leader by IDC, MetaGroup, Forrester – 2004 Awarded the highest rating in Stakeholder Value Creation & Corporate Governance by ICRA, an Associate of Moody’s Investor Services Partner to industry leaders and challengers 89 global 500 clients 151 clients among Forbes 2000 Diverse talent pool 23 nationalities 2000 domain consultants Sustained growth CAGR of 42% in last 5 years Part of NYSE’s TMT (Technology-Media-Telecom) Index, NSE Nifty Index and BSE Sensex 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 217 226 288 339 421 430 10 13 19 29 42 42 (thousands) (millions USD) 384 475 625 934 1354 1595* Clients Employees Revenues *June Quarter Revenues Annualized Incorporated in 1945; 60 years track record of growth & profitability IPO in 1946; Listed at NYSE [WIT] in 2000 Entered IT business in 1980s; IT Services business launched in 1991 Our history – a track record of success Compounded Growth Rate- First 59 Years: Revenues: 21%, Net Income: 31%, M-Cap: 24% IT Services Foot-Print](https://image.slidesharecdn.com/7indiae1-110422090939-phpapp01/85/7india-e-1-8-320.jpg)