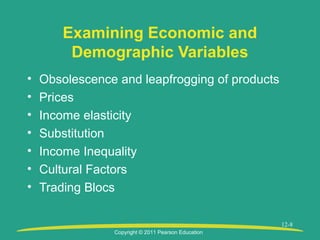

The document discusses factors that companies should consider when evaluating and selecting countries for international operations. It covers scanning techniques to identify opportunities and risks in potential markets. Key variables discussed for country evaluation include economic, demographic, cost, political, monetary and competitive risk factors. The document also addresses tools for comparing countries, approaches for allocating resources among locations, and implications of location decisions over time.