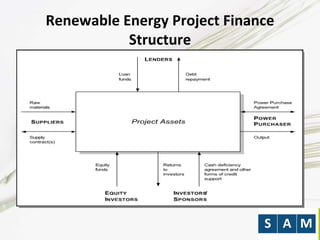

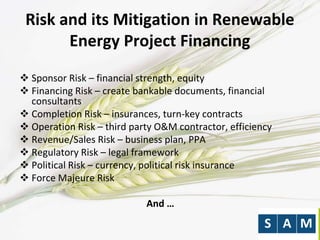

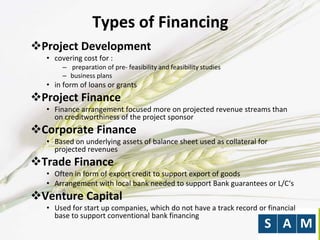

SAM GmbH is an Austrian consulting company specialized in developing sustainable and socially responsible renewable energy investments in emerging markets. It provides technical, financial, legal, and project management services. The company works with private and institutional investors, banks, and technology providers on hydro, solar, wind, and other renewable energy projects. It helps investors mitigate risks at each stage from development to operations. SAM is looking to support more renewable energy projects in emerging markets to help drive economic growth and environmental sustainability.