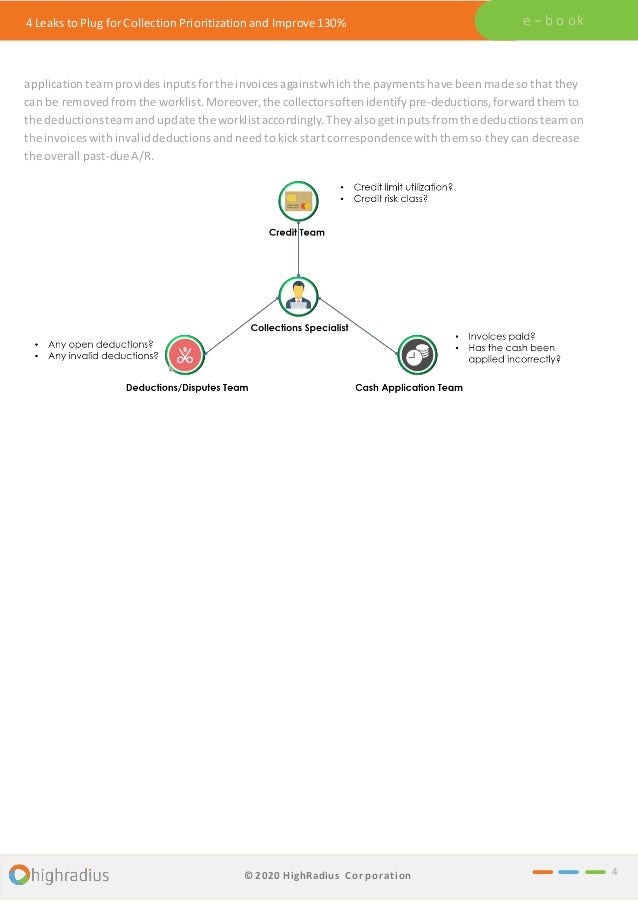

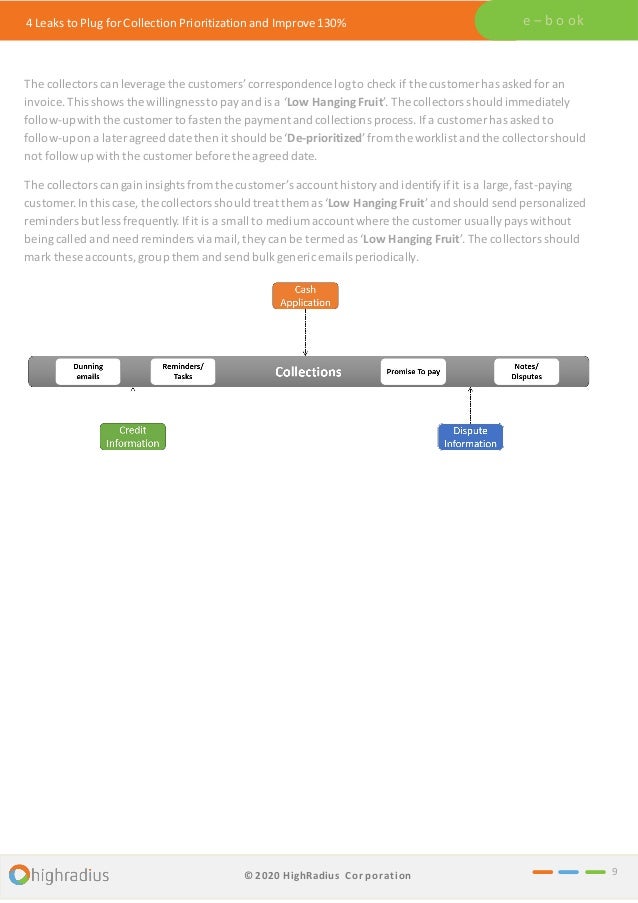

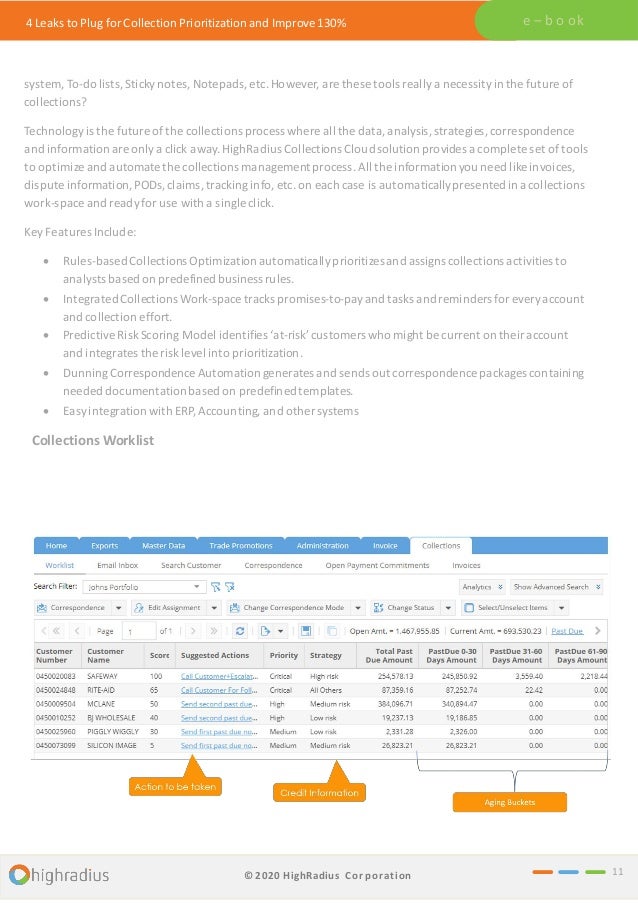

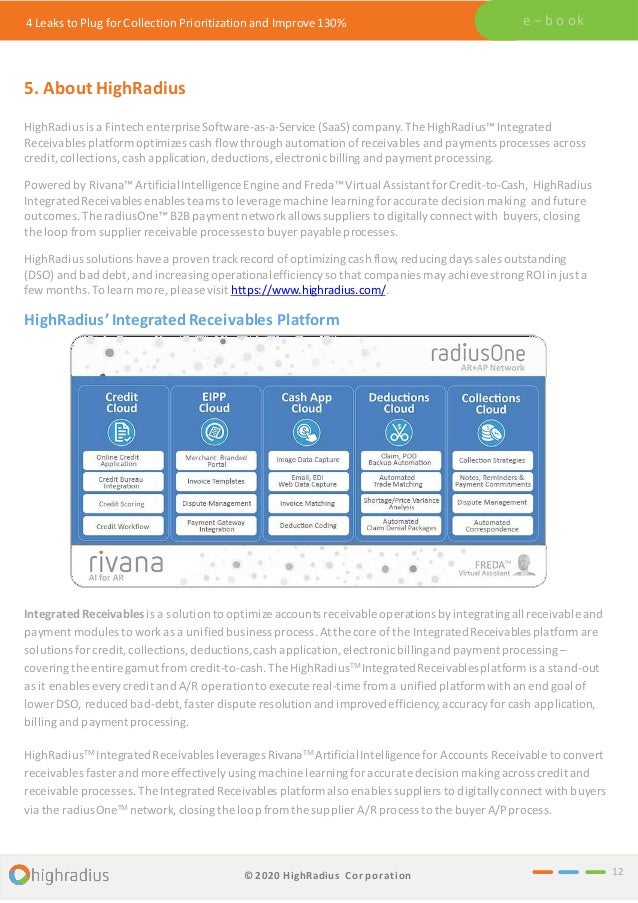

The document discusses four leaks in account prioritization that can inflate past-due accounts receivable and hinder collections productivity. It emphasizes the need for collections teams to adopt more dynamic indicators for account prioritization instead of relying solely on aging data and invoice values, which can lead to inefficiencies. The conclusion highlights strategies like leveraging credit history and insights from other departments to enhance prioritization, ultimately improving collection efforts and reducing overdue accounts.