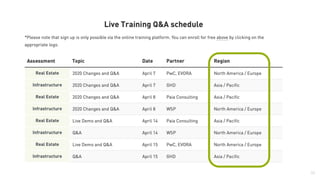

This document provides information about GRESB's preparations for the 2020 assessment year. It discusses the strong momentum around ESG in early 2020 at industry conferences. It then addresses the unexpected impact of COVID-19 and outlines actions GRESB has taken in response, including moving all global trainings to an online format and establishing bi-weekly status checks going forward. The document also reassures participants that the 2020 GRESB portal is on track to open on April 1 while the IT team ensures all systems are functioning properly given the remote work situation.

![GRESB Actions – March 25, 2020

All GRESB staff COVID-19 negative [so far]

• Amsterdam [30] Arlington VA [1] Vancouver BC [1] Sydney [1]

GRESB Portal set to open April 1, 2020

• Currently in testing phase

• All systems OK

• IT team doing an exceptional job

All global trainings moved to online format

• April 7 & 8

• April 14 & 15

Post-April 1 :: Bi-weekly status indicators inform forward decisions

• Global stakeholder feedback

• Portal activity](https://image.slidesharecdn.com/preparingforgresbportalopening-march2020-200326150825/85/Preparing-for-GRESB-Portal-Opening-March-2020-6-320.jpg)

![Takeaways :: Participants

GRESB 2020 timeline

Rapidly changing circumstances, varying by geography

• Some participants report no problem / full steam ahead / all data in hand

• Others concerned with implementing data request processes with property managers

Organizations who can submit earlier than July 1 are encouraged to do so

• GRESB received 1000+ submissions in 2019

• Early submissions help GRESB balance the validation workload

GRESB Helpdesk fully staffed / open all times

• GRESB.com/contact

Bi-Weekly status checks [post-April 1 open]

• Validation / scoring processes in July/Aug have a small amount of built-in slack](https://image.slidesharecdn.com/preparingforgresbportalopening-march2020-200326150825/85/Preparing-for-GRESB-Portal-Opening-March-2020-11-320.jpg)

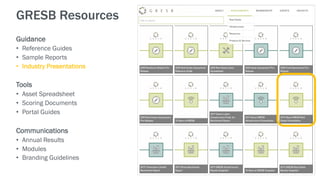

![- Strategy & Leadership

- Policies

- Reporting

- Risk Management

- Stakeholder Engagement

- Risks & Opportunities

- Monitoring

- Performance Indicators

- Energy

- GHG emissions

- Water

- Waste

- Targets

- Building Certifications

- Tenants

- Community Engagement

Advice: Prioritize Management Component

45

April April [set up] | May & June [data]](https://image.slidesharecdn.com/preparingforgresbportalopening-march2020-200326150825/85/Preparing-for-GRESB-Portal-Opening-March-2020-45-320.jpg)

![Property Manager

Asset Operator

Asset

Owners

Global REITs

Private Equity

Asset

Capital Markets

Investors

Lenders

ESGData

Company

Fund Manager

Portfolio Manager

Asset Data :: Required for GRESB Performance Score

location data [required] | consumption data [as available]

46](https://image.slidesharecdn.com/preparingforgresbportalopening-march2020-200326150825/85/Preparing-for-GRESB-Portal-Opening-March-2020-46-320.jpg)