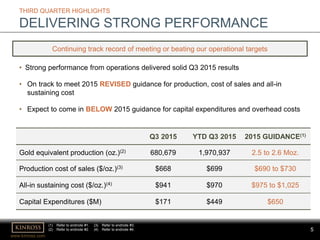

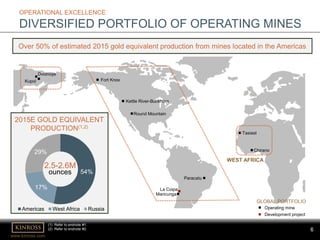

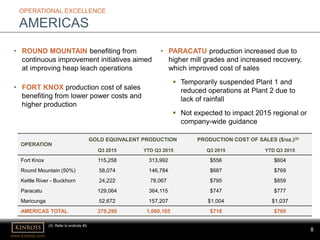

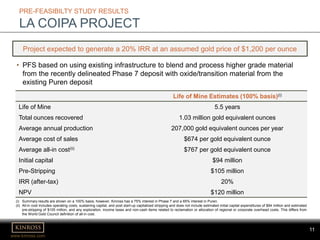

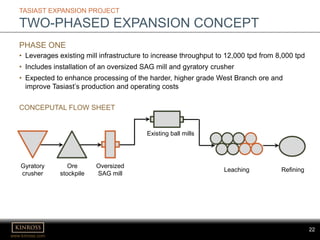

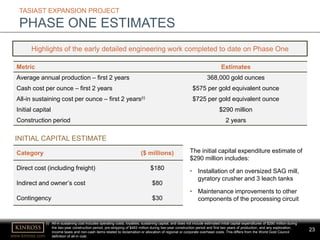

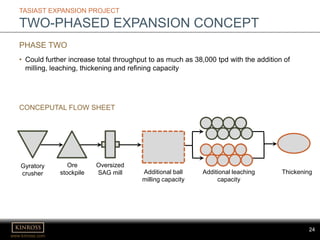

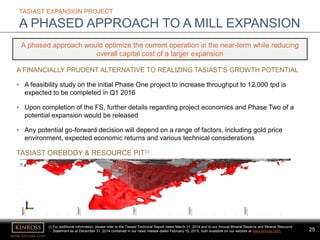

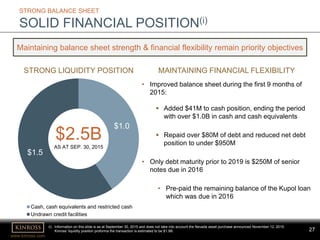

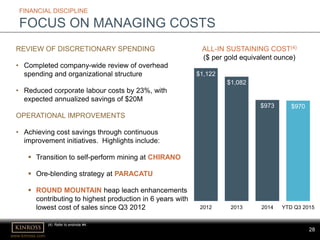

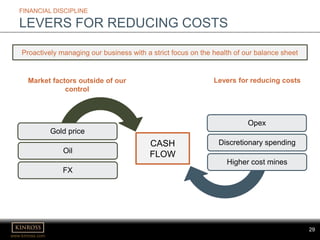

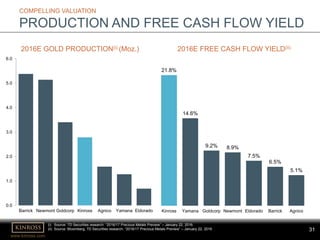

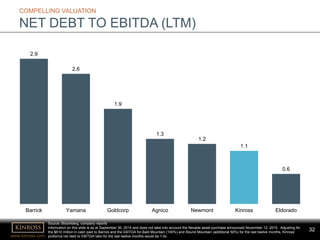

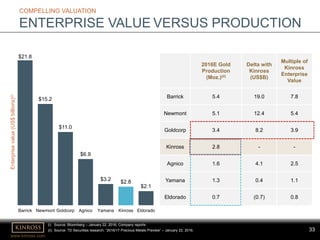

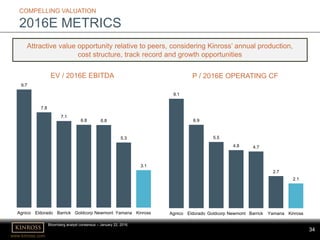

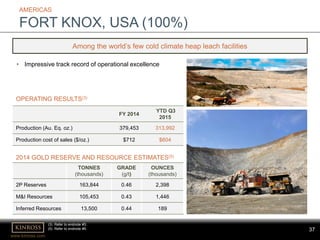

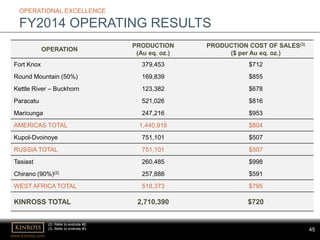

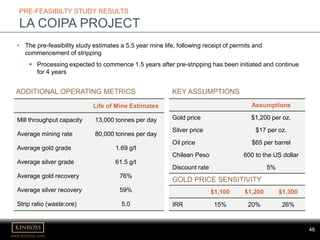

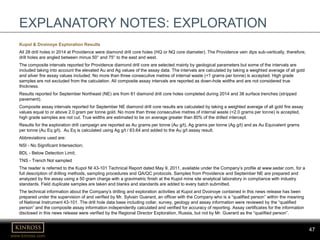

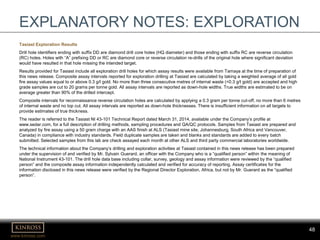

Kinross Gold Corporation presented at the TD Securities 2016 Mining Conference in January 2016. The presentation focused on Kinross' principles of operational excellence, quality over quantity, disciplined capital allocation, and maintaining a strong balance sheet. It provided updates on Kinross' diversified portfolio of operating mines and organic growth opportunities, including positive pre-feasibility study results for the La Coipa Project and concepts for a phased expansion at Tasiast.