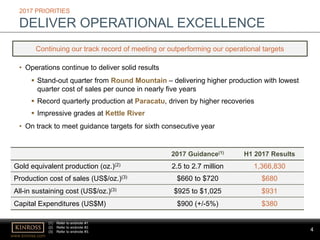

This document is the transcript from Kinross Gold Corporation's Q2 2017 results conference call. Some key points:

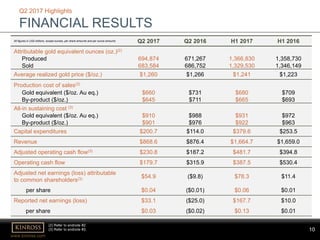

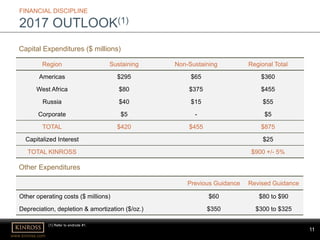

- Kinross is on track to meet its 2017 guidance targets for the sixth consecutive year, including producing 2.5-2.7 million ounces of gold at a production cost of sales of $660-720 per ounce and all-in sustaining costs of $925-1,025 per ounce.

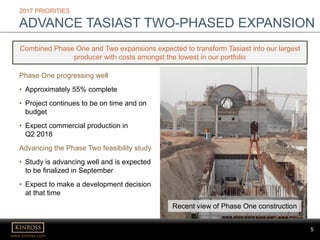

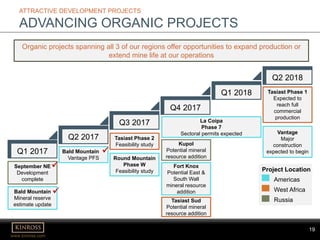

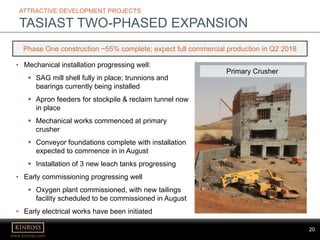

- The two-phased expansion at Tasiast is progressing well, with phase one approximately 55% complete and on budget for commercial production in Q2 2018. Kinross will finalize the phase two feasibility study in September.

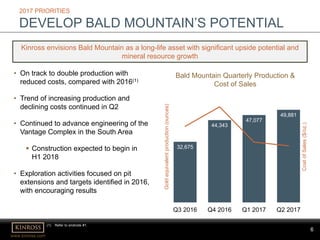

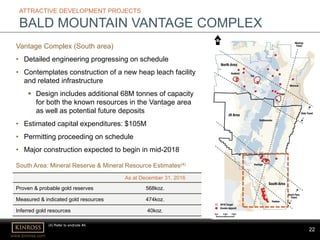

- Bald Mountain is expected to double its production with reduced