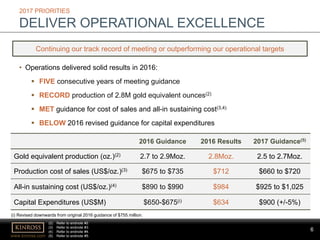

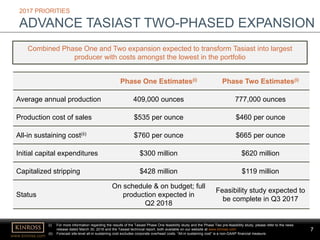

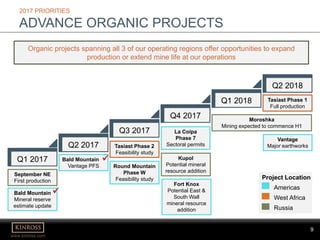

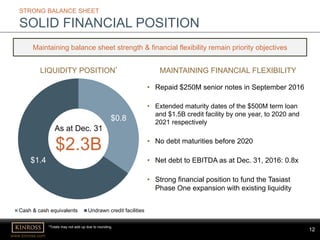

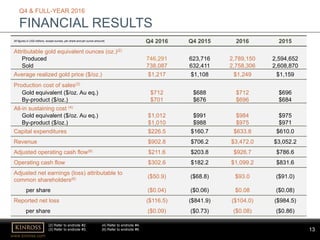

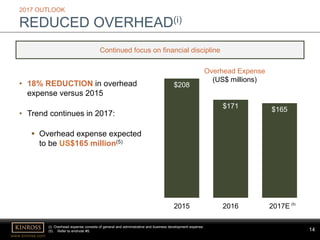

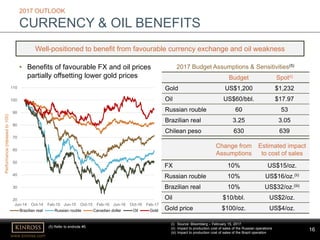

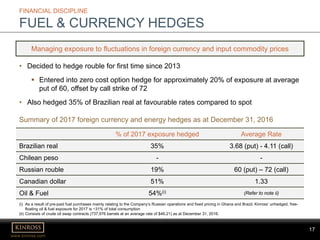

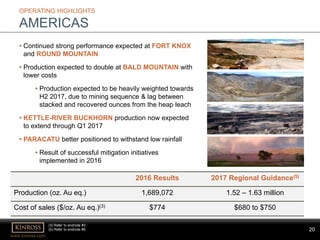

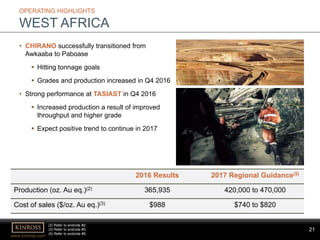

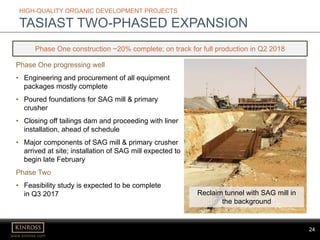

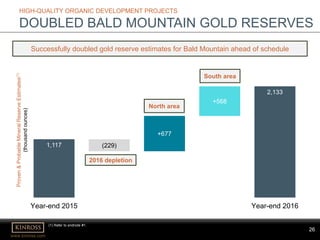

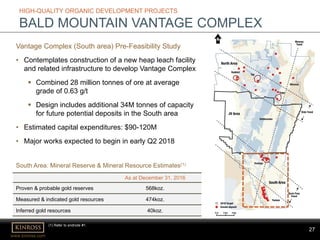

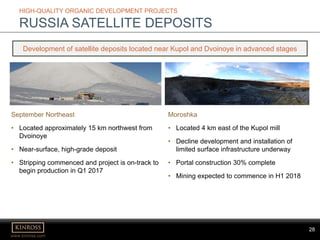

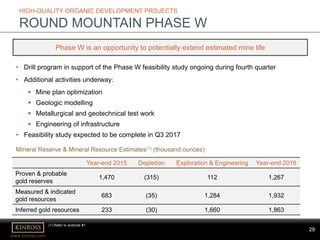

This document provides a summary of Kinross Gold Corporation's Q4 and full-year 2016 results conference call. It discusses 2016 highlights including meeting or exceeding guidance for the fifth consecutive year. Priorities for 2017 include continuing operational excellence, advancing the two-phased expansion at Tasiast, developing Bald Mountain's potential, and advancing organic projects. The document also provides Kinross' 2017 guidance figures and discusses its strong balance sheet and financial discipline.