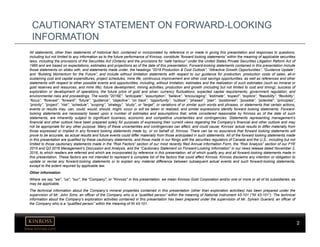

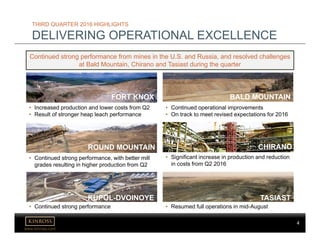

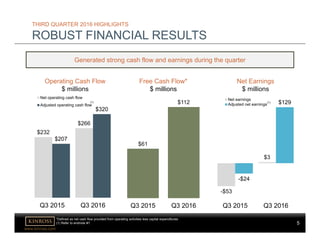

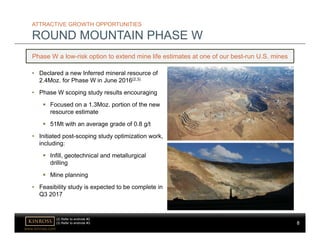

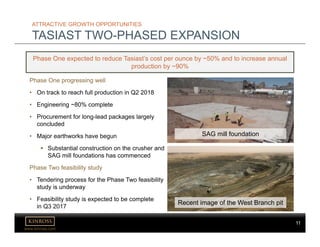

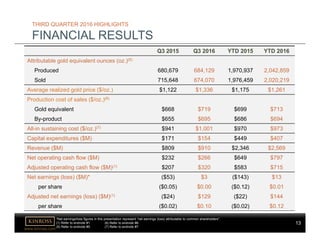

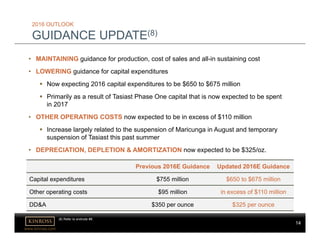

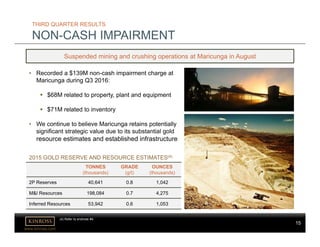

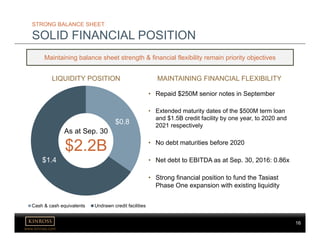

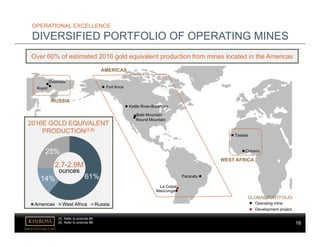

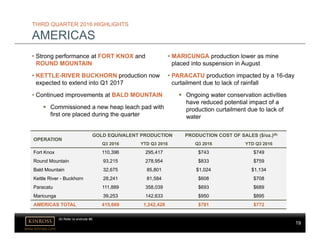

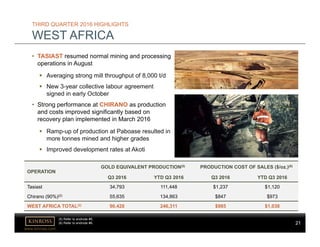

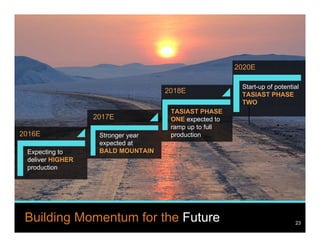

This document provides a summary of Kinross Gold Corporation's Q3 2016 results conference call. It discusses strong operational and financial performance in Q3 2016, with increased production and lower costs compared to Q2 2016. Key growth opportunities are also highlighted, including projects at Bald Mountain, Round Mountain Phase W, La Coipa Phase 7, and Tasiast's two-phased expansion. Guidance for 2016 is updated, with capital expenditures lowered to $650-675 million.