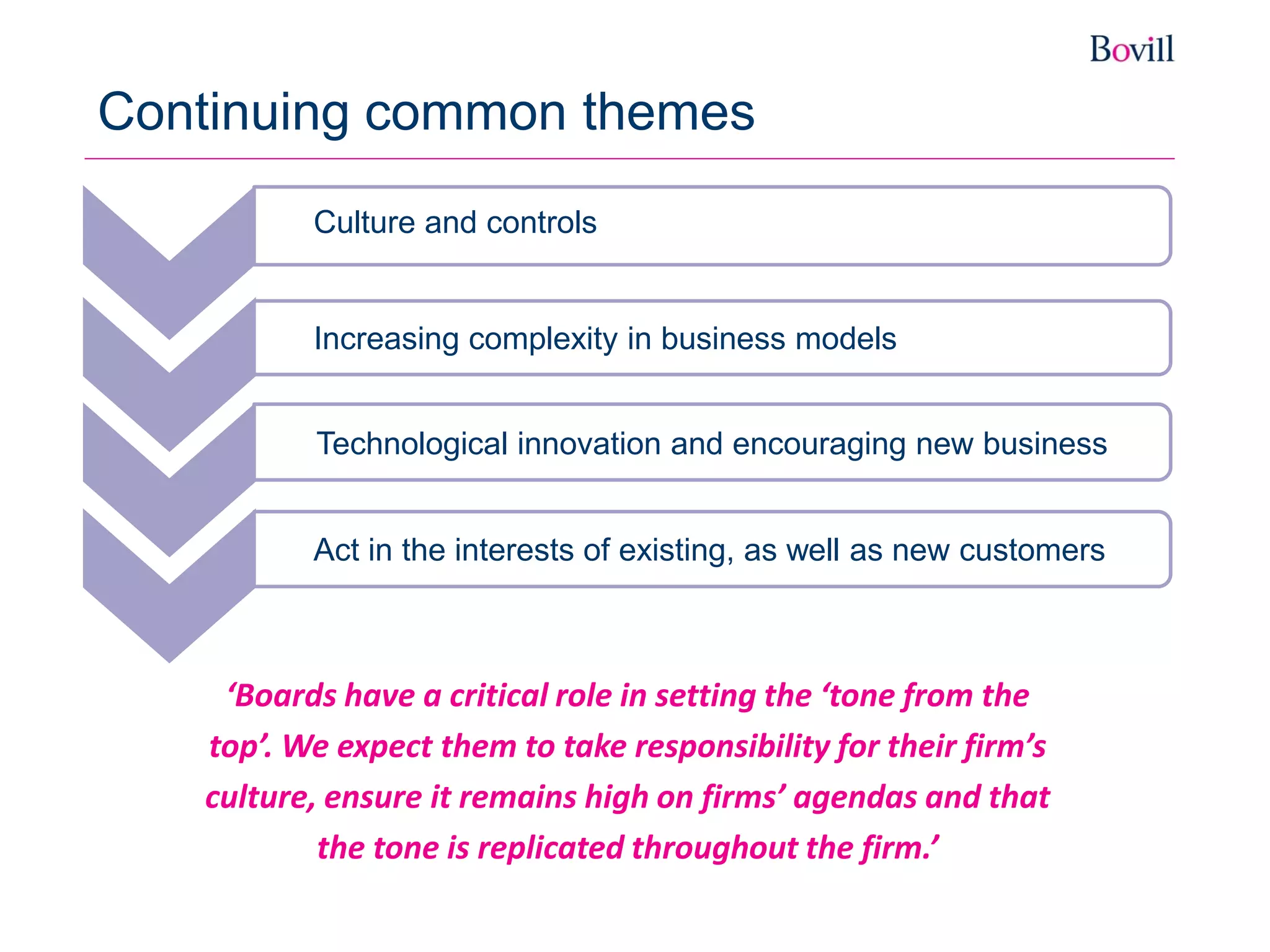

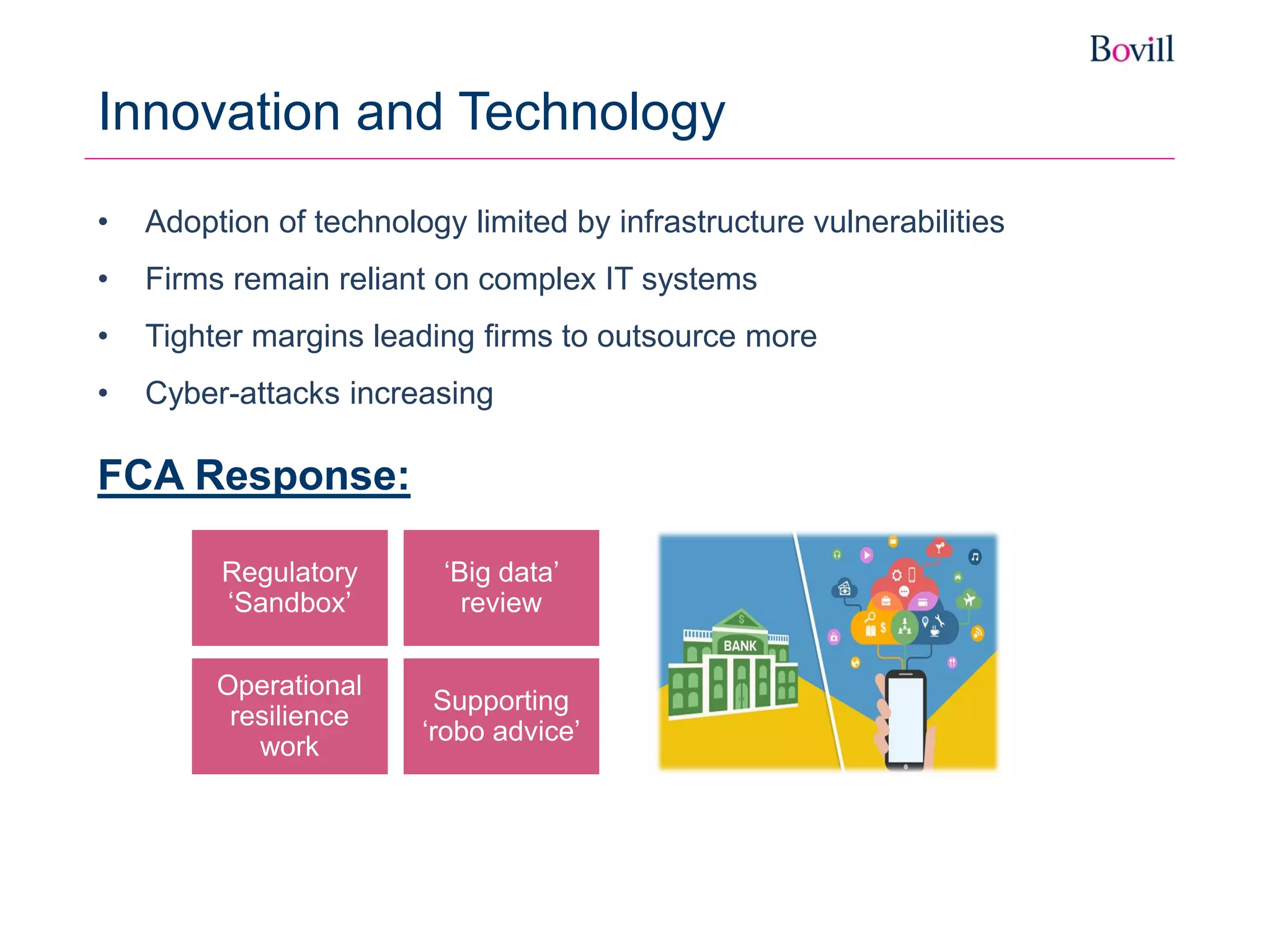

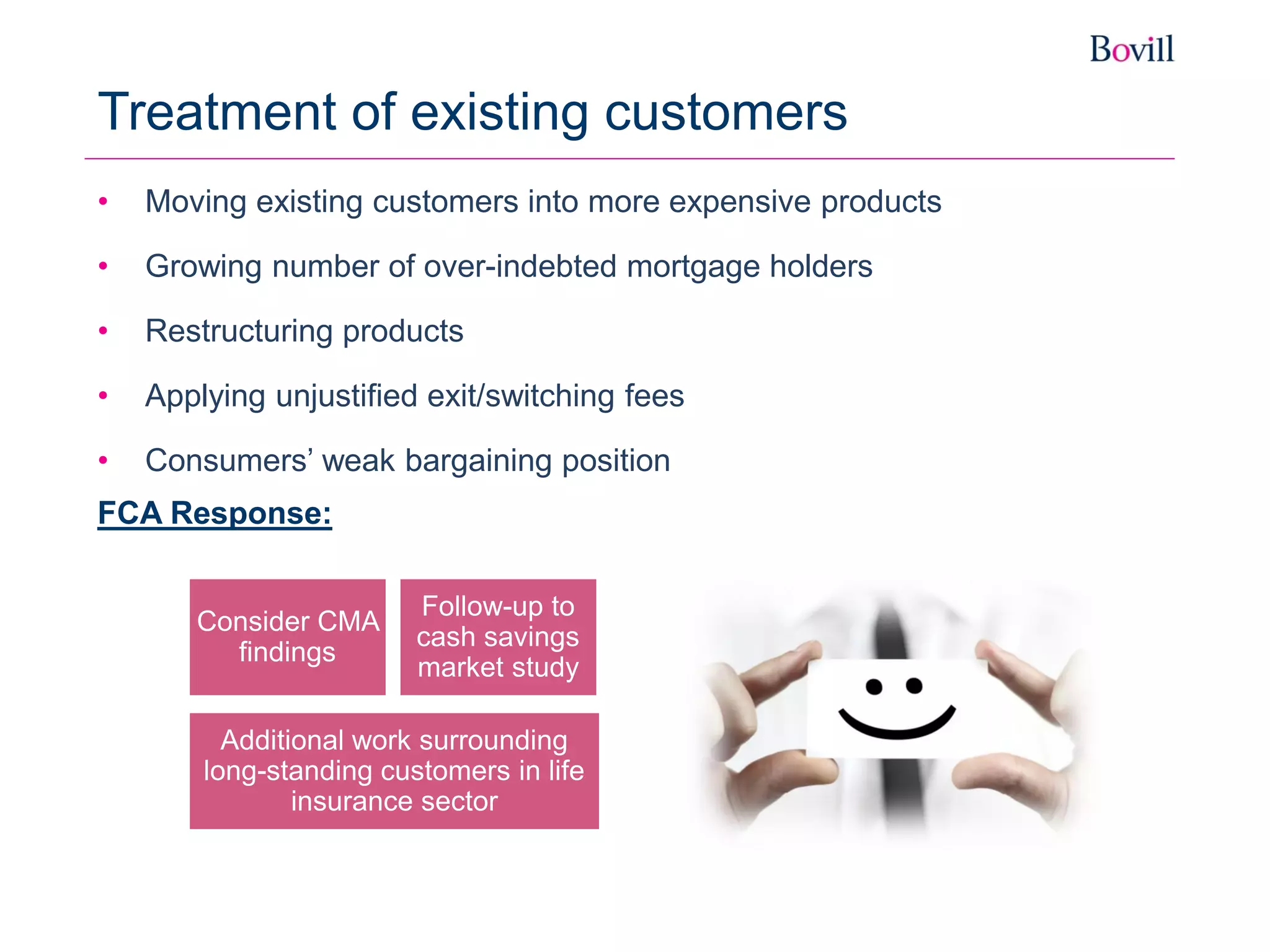

The FCA Business Plan for 2016/17 outlines 7 priorities that are carried over from last year: pensions, financial crime, wholesale markets, advice, innovation/technology, culture/governance, and treatment of existing customers. The plan emphasizes continuing themes of complex business models, acting in customers' interests, and encouraging new technology. Key responses include implementing new regulations on markets and financial crime, focusing on culture and accountability, and protecting customers in advice, pensions and insurance. Brexit is also addressed, with the FCA considering potential short-term market volatility and longer term consequences depending on future UK-EU relations.