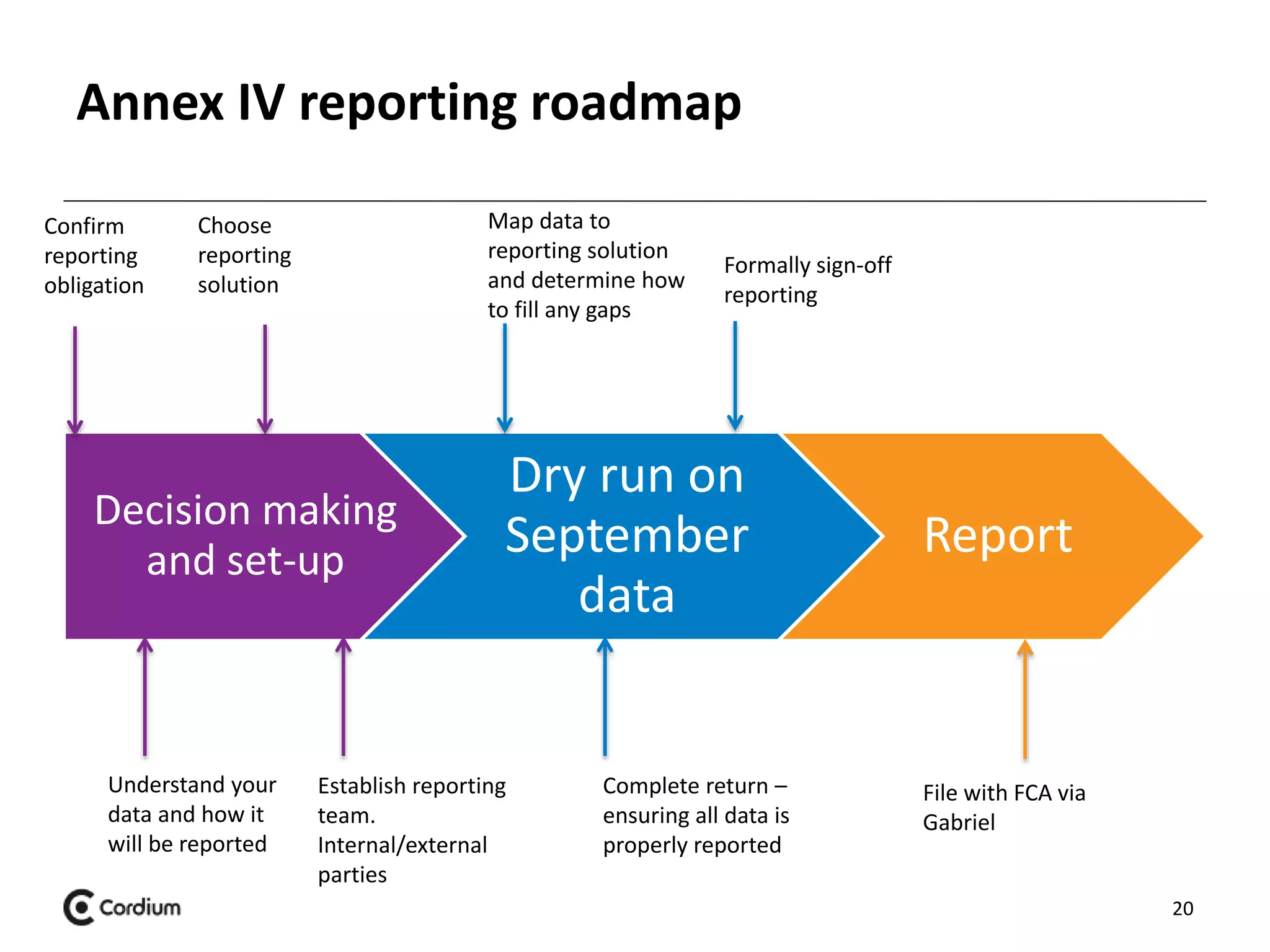

This document provides an overview of Annex IV reporting requirements under the Alternative Investment Fund Managers Directive (AIFMD). It discusses:

- What Annex IV reporting is and which fund managers have to file

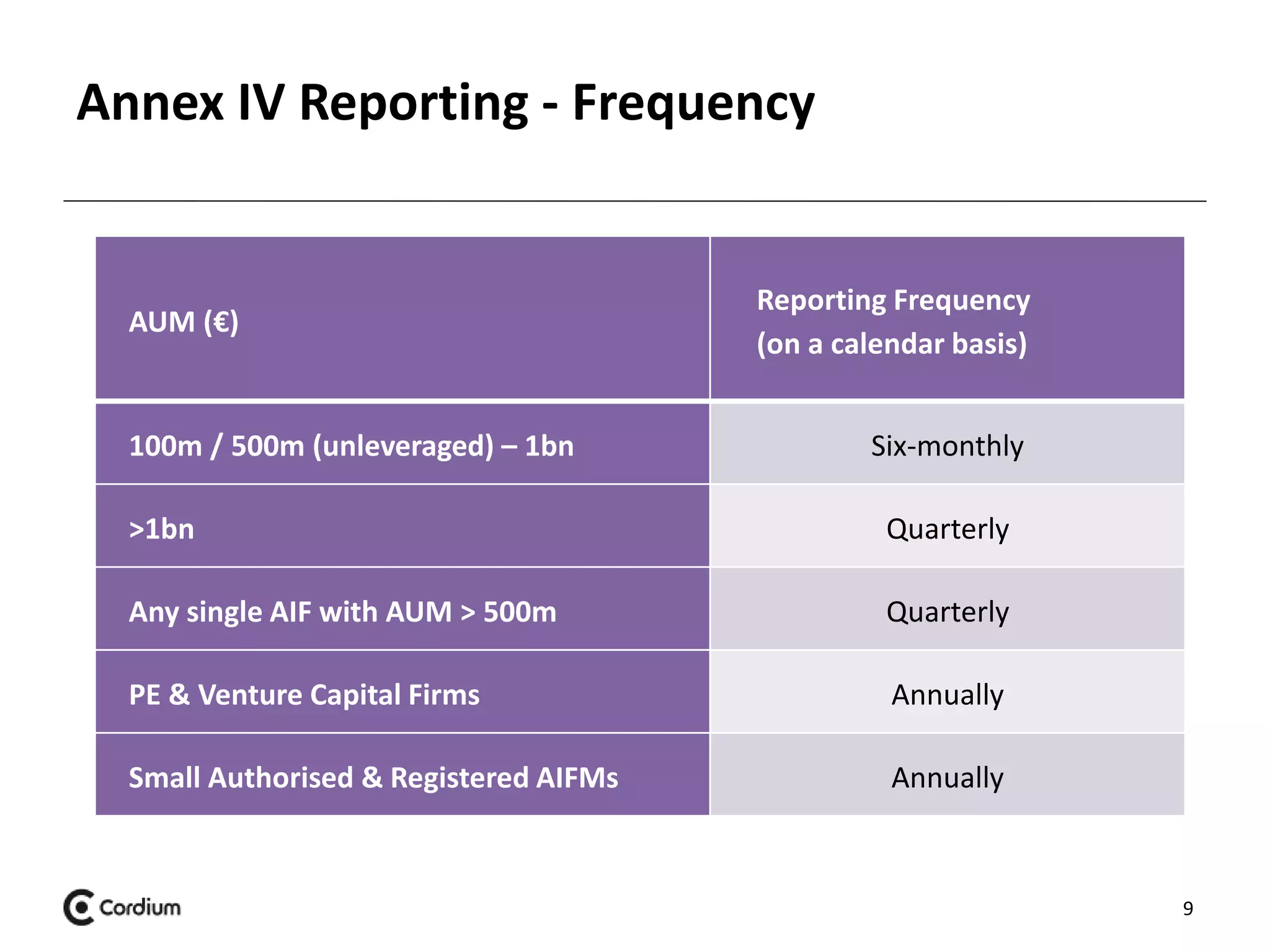

- The required reporting frequency and deadlines, which vary based on factors like fund size and type of investments

- The information that must be reported, including static data on the fund manager and dynamic data on each alternative investment fund

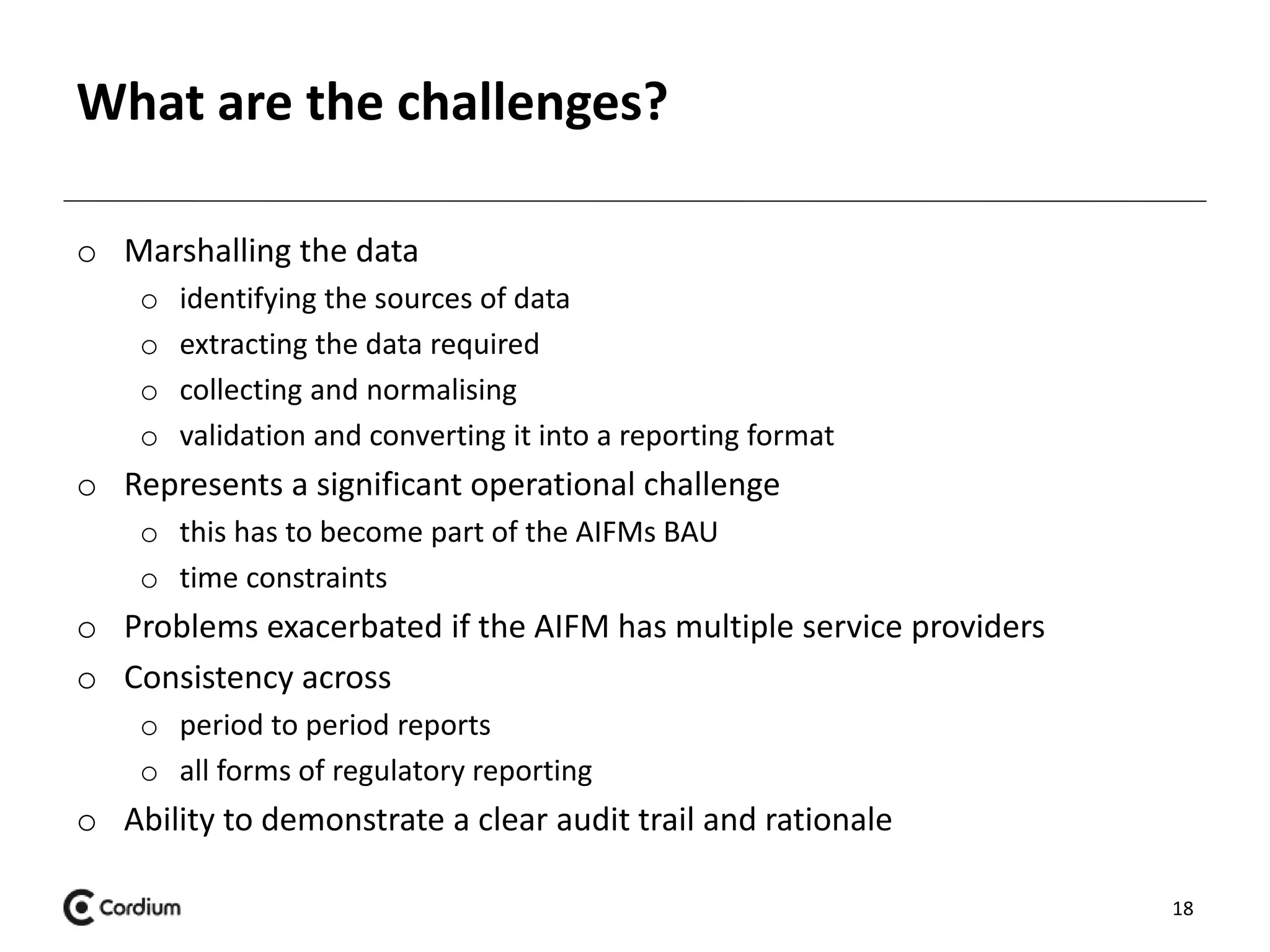

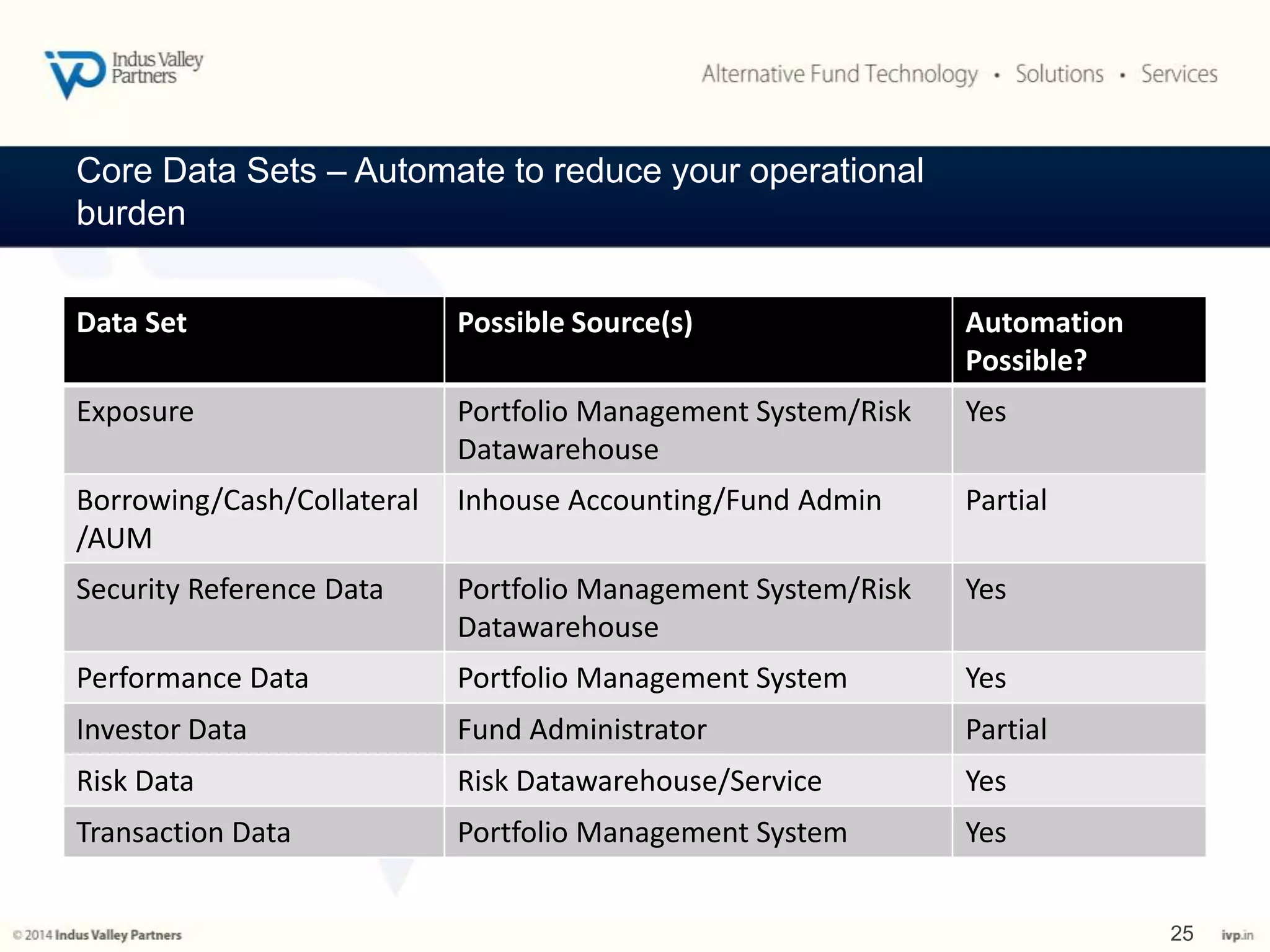

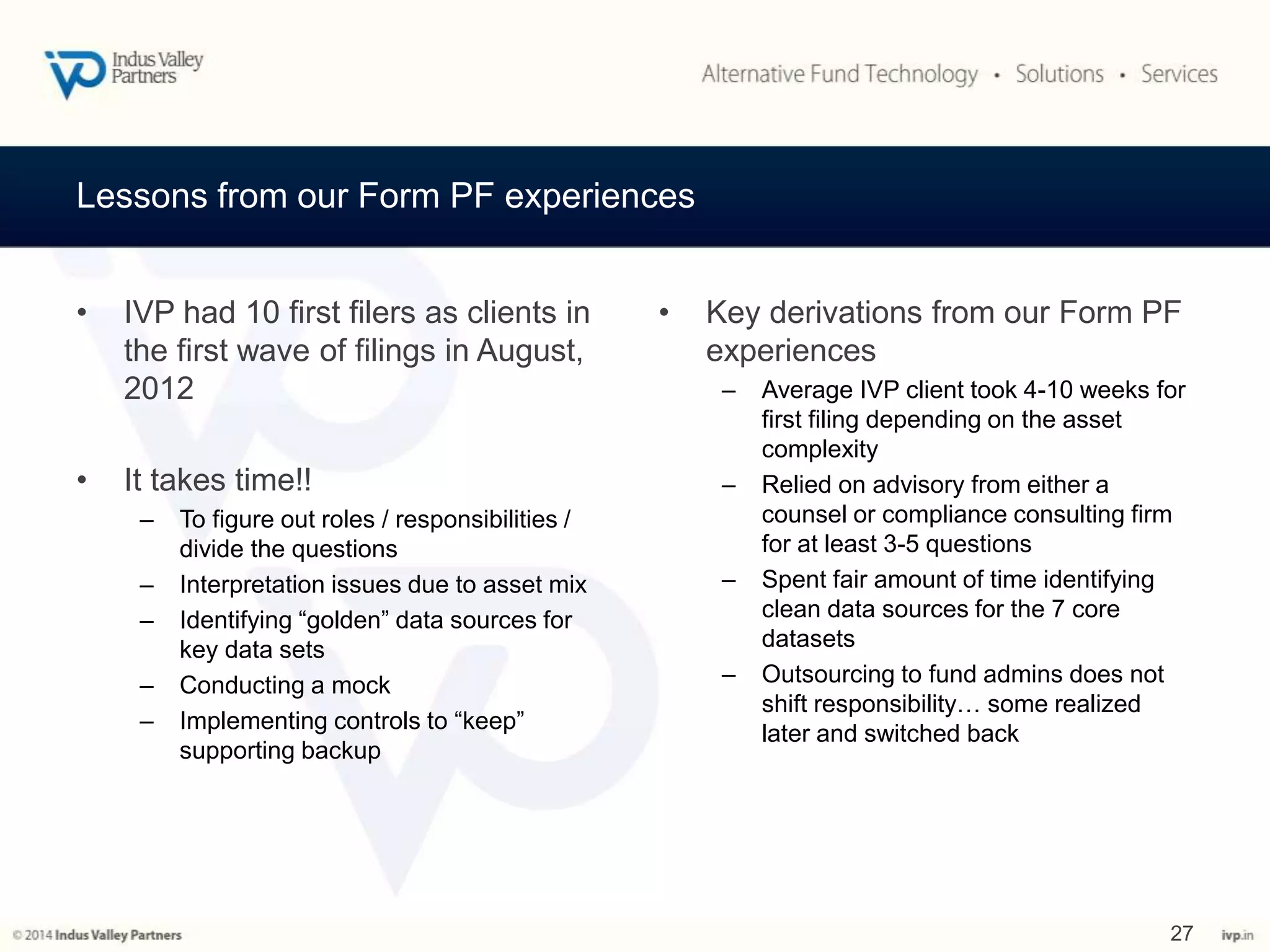

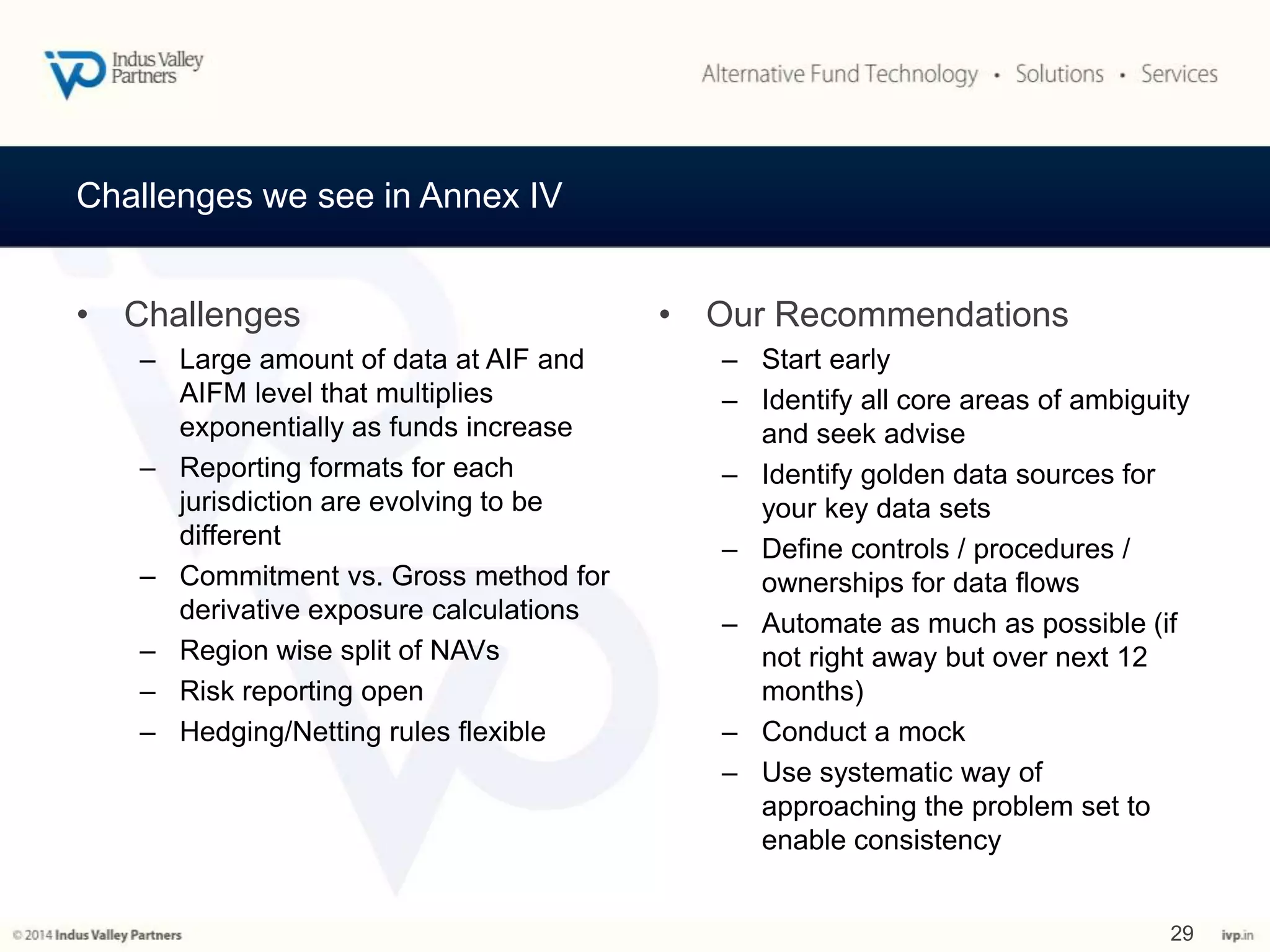

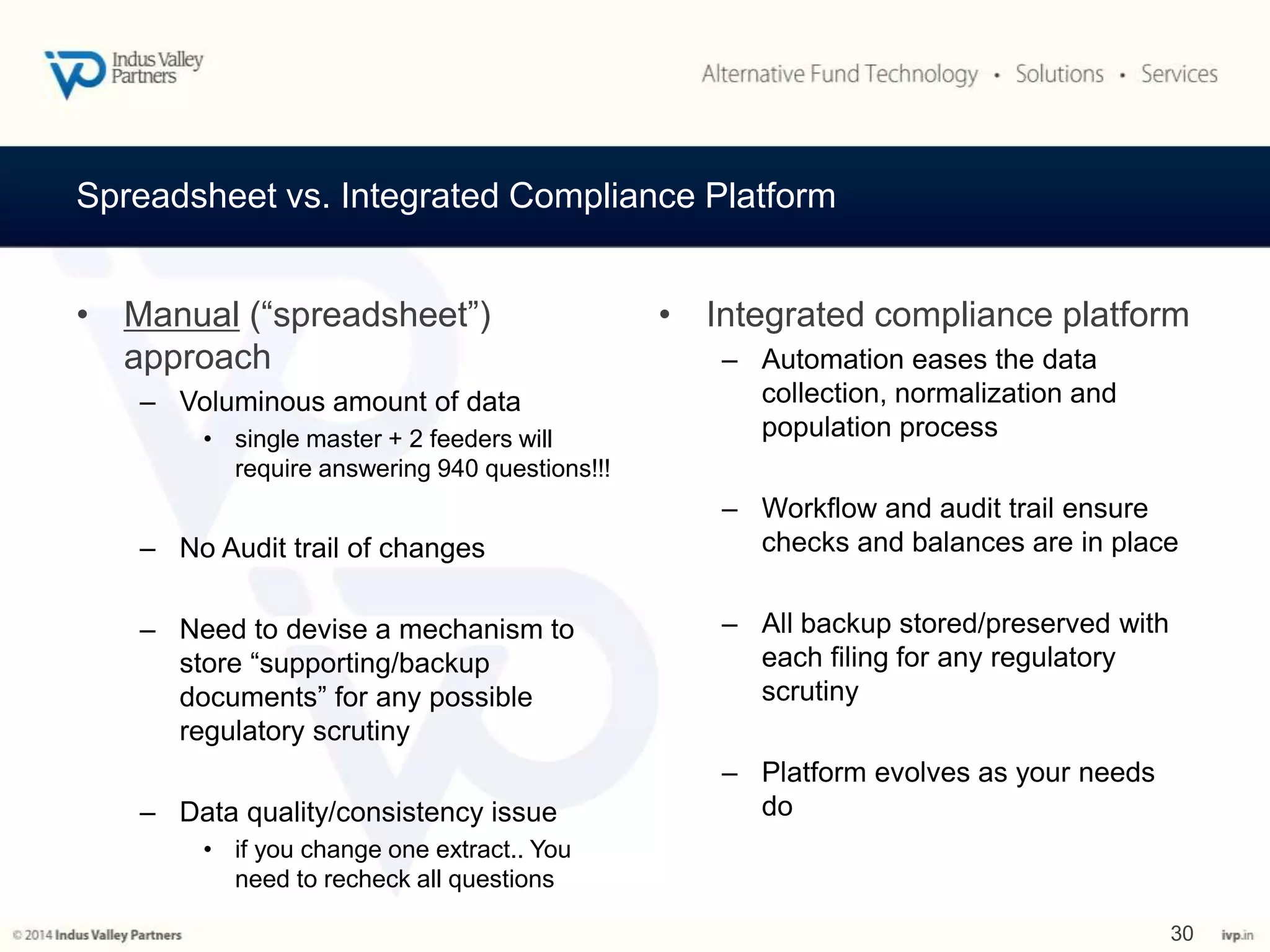

- The challenges of collecting, validating, and converting large amounts of fund data into the required reporting format

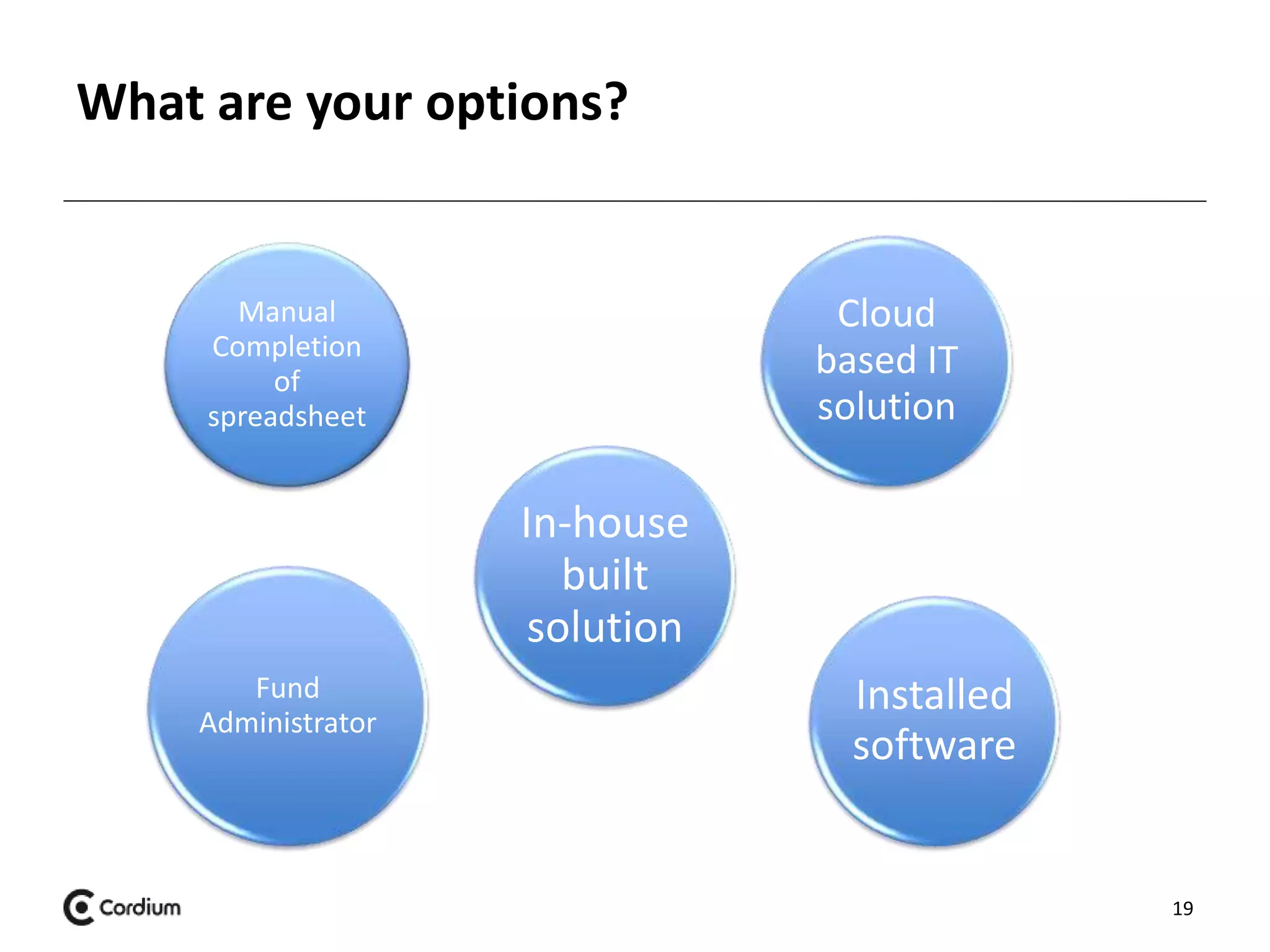

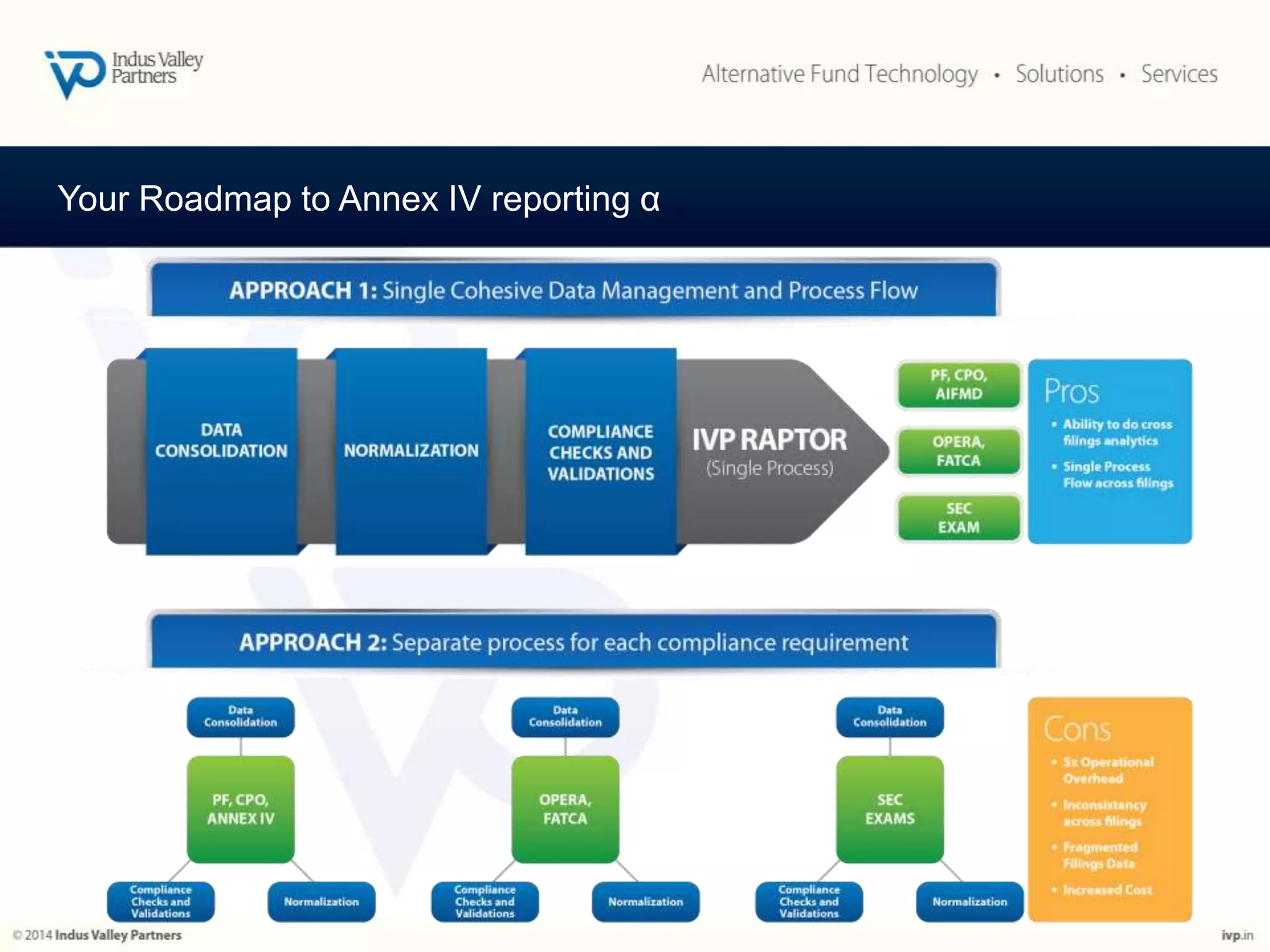

- Options for completing the reporting, ranging from manual spreadsheets to integrated IT solutions

- Tips provided by the UK Financial Conduct Authority on Annex IV reporting, including using