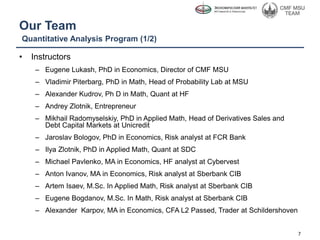

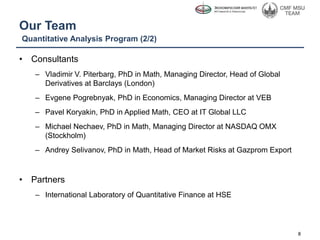

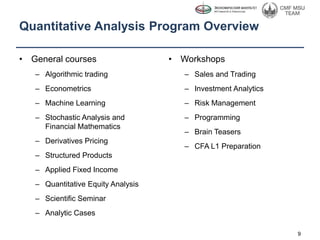

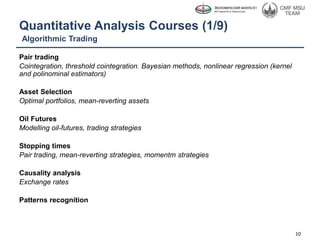

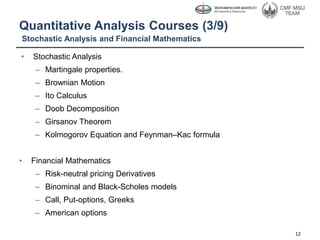

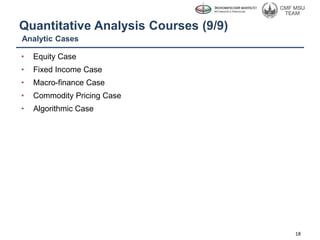

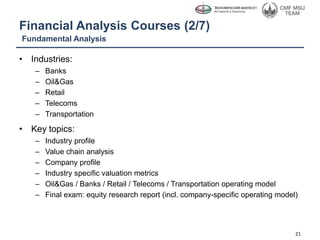

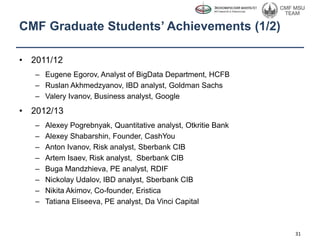

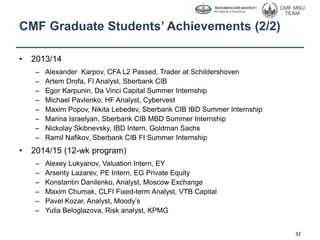

The document provides information about the Center of Mathematical Finance (CMF) programs. It discusses CMF's history and key milestones since 2007. It outlines their current programs, including Financial Analysis, Quantitative Analysis, and new programs in Economic Analysis and Data-Driven Analysis. It also introduces the instructors and consultants involved in the Financial Analysis and Quantitative Analysis programs.