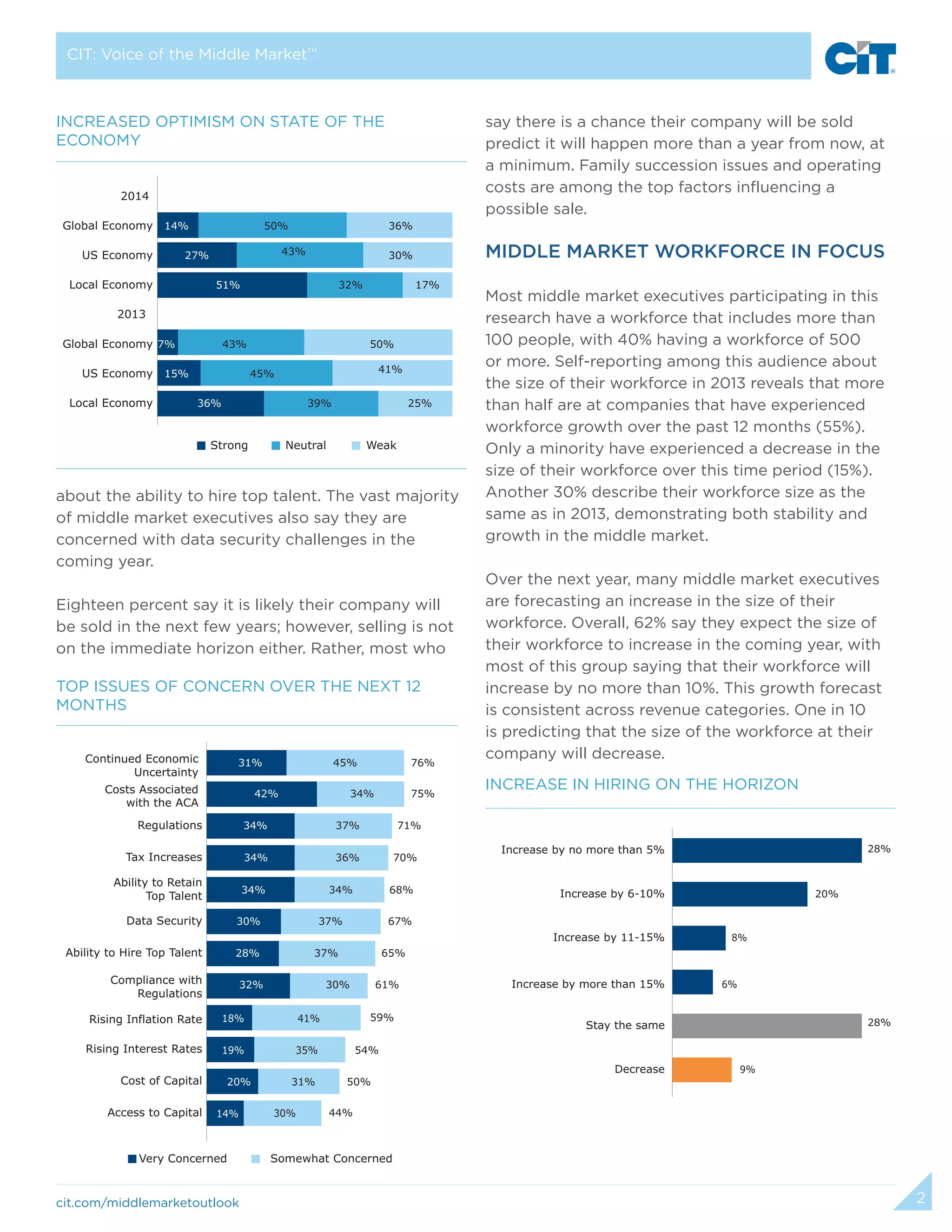

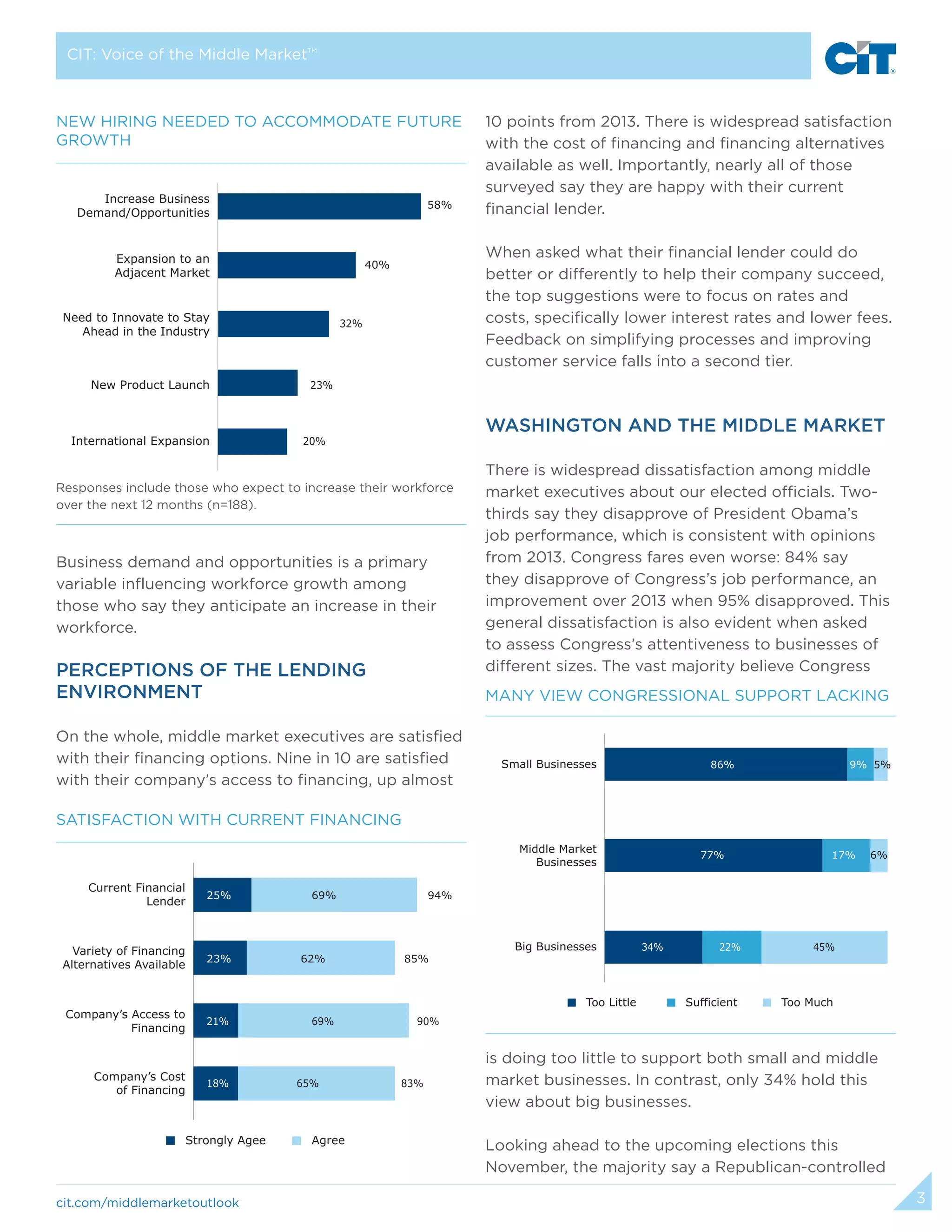

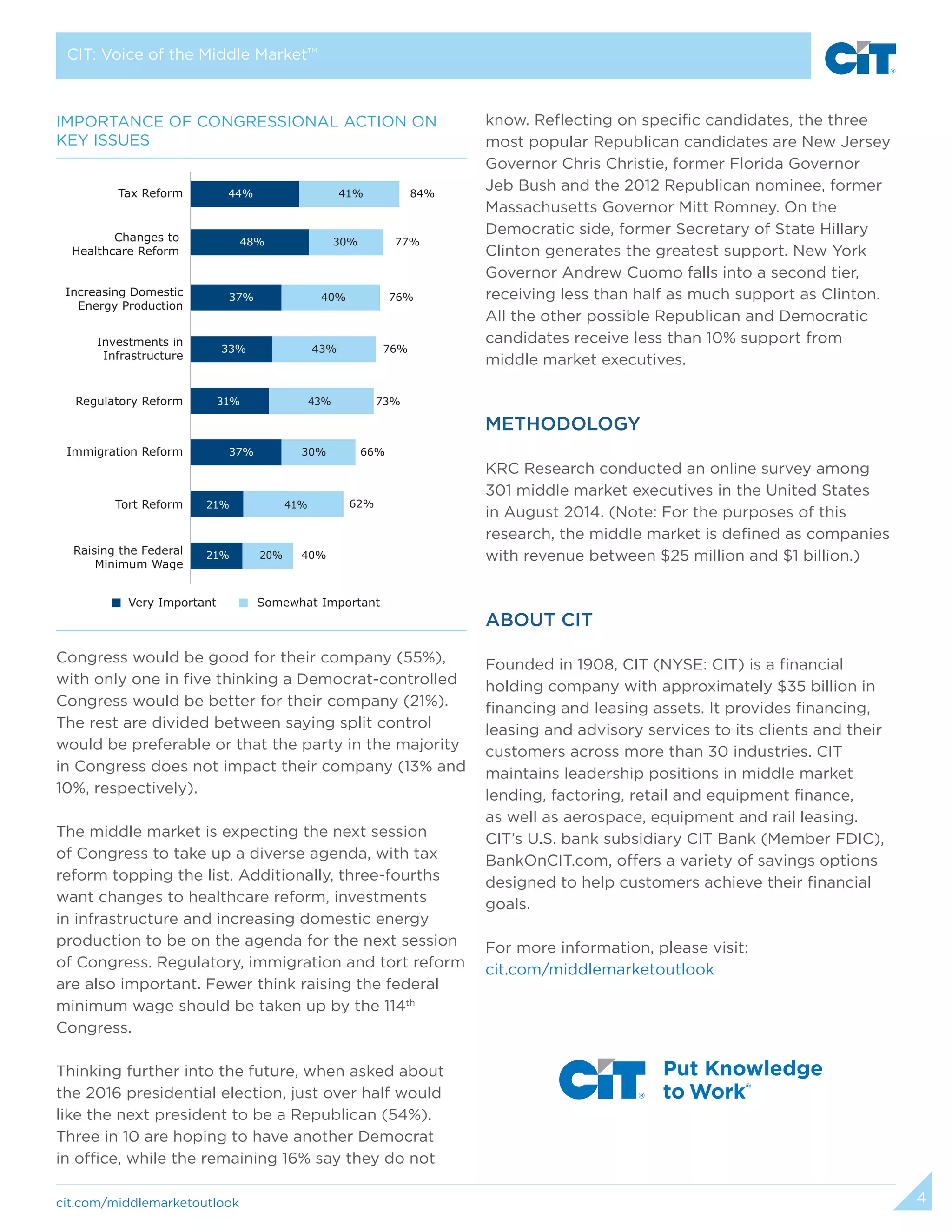

The document summarizes the results of a 2014 study examining the perspectives of 301 U.S. middle market executives on the economy, availability of financing, and health of their companies. Key findings include that the executives have a more positive outlook on the economy than in 2013 and report being in a stronger position than a year ago. Most expect to increase their workforce size over the next year due to business opportunities and demand. The executives are also generally satisfied with their current financing options but want lower interest rates and fees. They have widespread dissatisfaction with Congress and President Obama and want the next Congress to prioritize tax reform and healthcare changes.