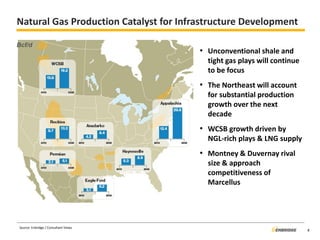

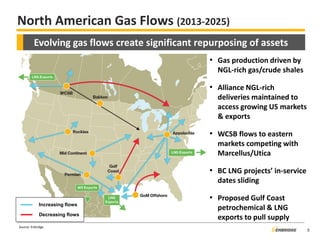

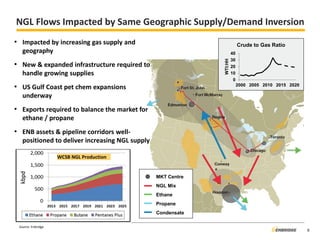

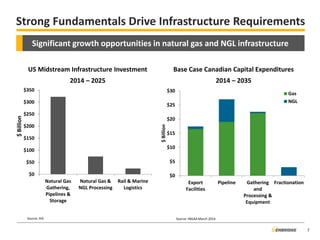

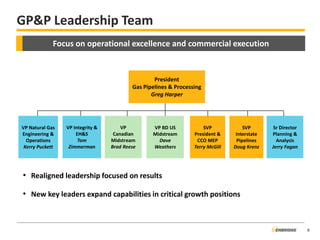

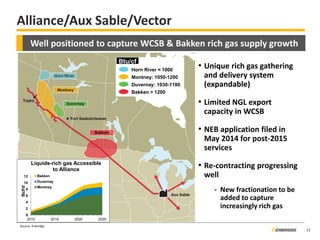

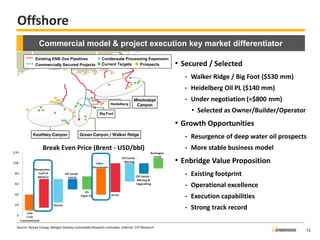

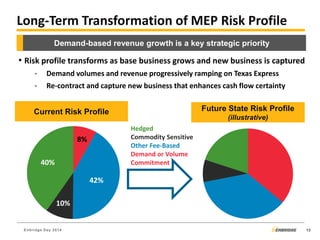

The document discusses opportunities for growth in Enbridge's Gas Pipelines & Processing business. It notes that significant investment will be required over the next 15 years to develop North American gas infrastructure as production increases. Enbridge's assets are well-positioned to capture opportunities from growing gas and liquids production in regions like the Western Canada Sedimentary Basin and U.S. shale plays. The company plans to pursue both expansions of existing assets and new greenfield projects to maximize profits and leverage its operational strengths.