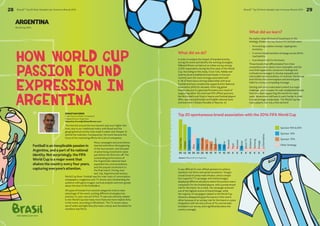

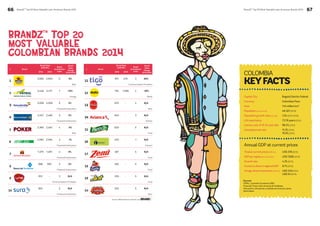

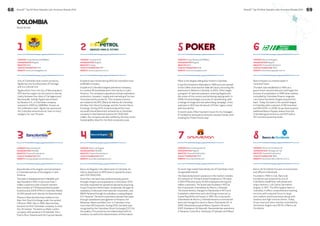

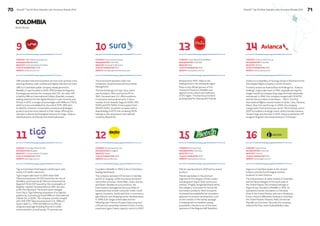

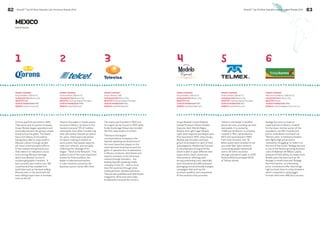

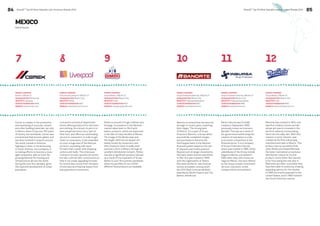

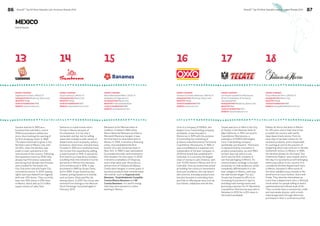

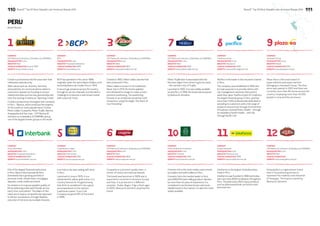

The document discusses brand valuation methodology used by BrandZ. It notes that BrandZ's methodology is unique in that it uses extensive consumer research and data from over 2.2 million consumers in more than 30 countries to establish each brand's contribution and value. This consumer-facing approach combines consumer insights with financial analysis. The document also provides insights into trends seen in Latin American brand valuations compared to other regions.