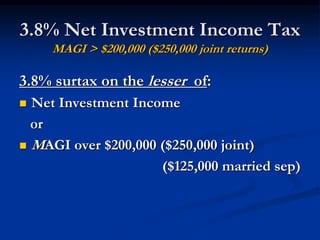

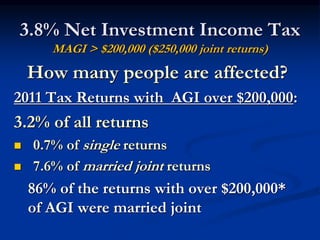

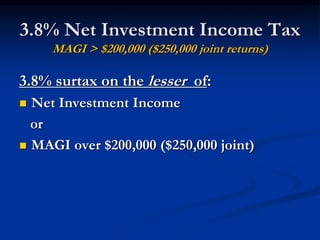

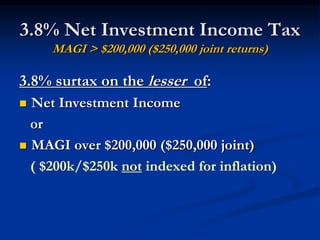

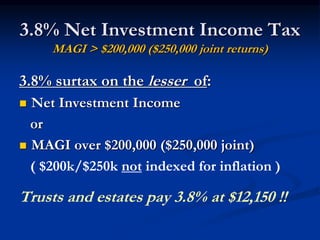

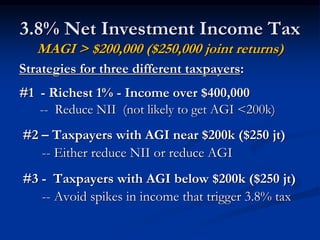

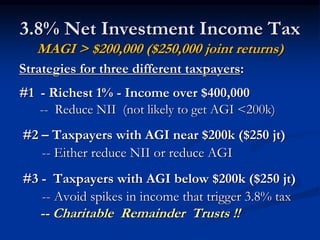

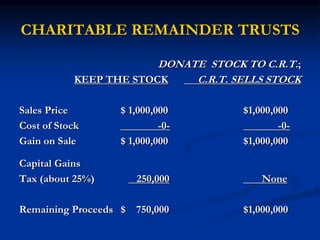

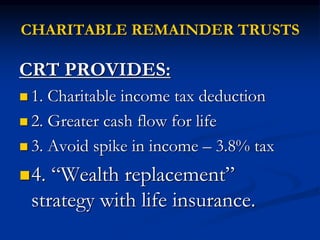

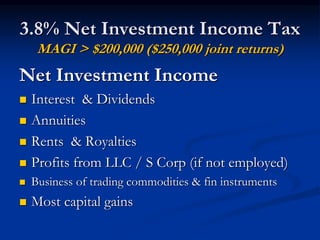

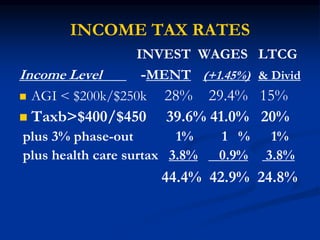

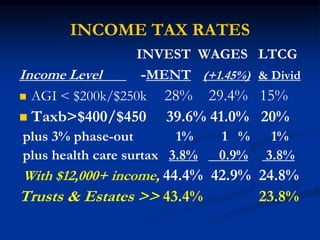

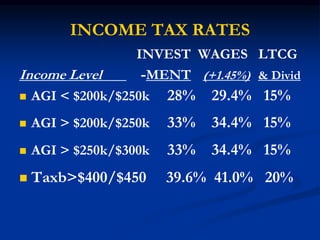

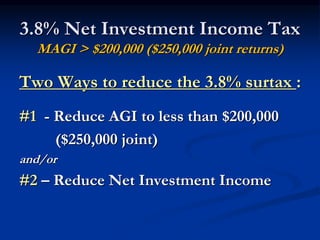

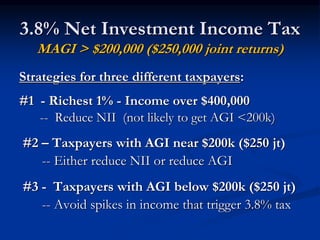

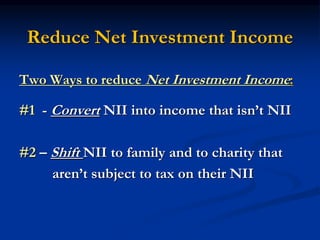

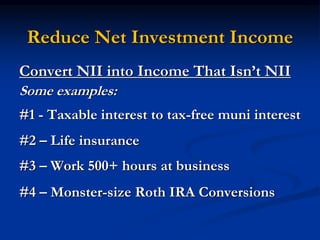

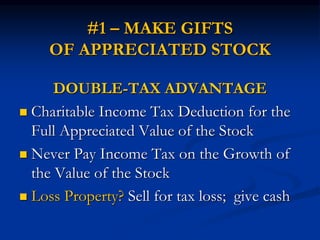

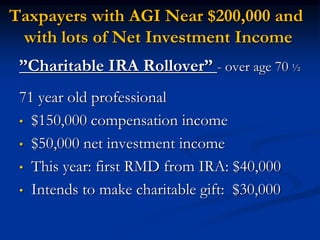

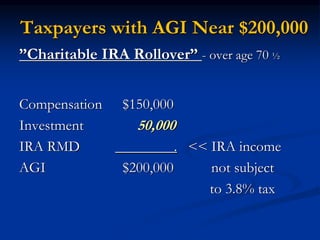

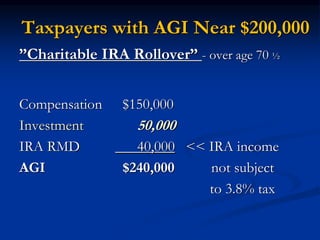

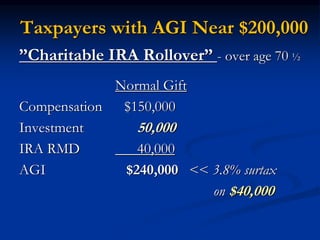

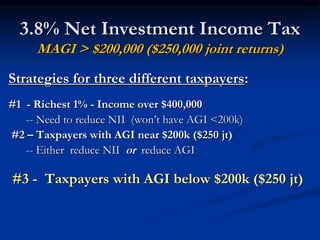

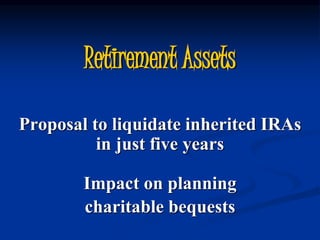

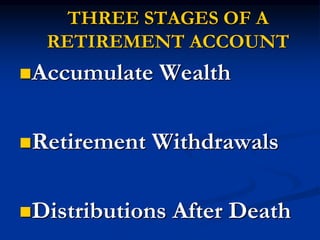

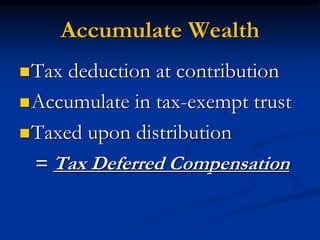

The document discusses strategies for charitable planning aimed at upper-income donors, particularly in relation to tax planning challenges such as the 3.8% surtax on net investment income. It outlines various tax implications based on adjusted gross income and provides insights into how charitable remainder trusts can offer tax deductions and greater cash flow while mitigating tax liabilities. Additionally, it highlights practical strategies for managing income and investment in order to minimize tax burdens for different taxpayer scenarios.

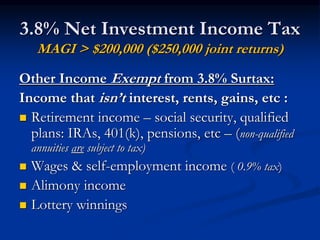

![3.8% Net Investment Income Tax

MAGI > $200,000 ($250,000 joint returns)

Income Exempt from Surtax:

Trade / Business income from an LLC,

partnership, Subchapter S corporation or sole

proprietorship, provided the recipient is

employed at the business.

-- “material participation” test

(work 500+ hours during the year?)

Gain from selling property used in trade/

business [rental property gains -> 3.8% tax]](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-28-320.jpg)

![PHASEOUTS

AGI > $250,000 ($300,000 joint returns)

[2014: > $254,200 ($305,060 joint returns)]

3% Phase-out Itemized Deductions

-- disguised 1% tax rate hike (3% x 33% rate)

Personal and Dependent Exemptions

-- $3,900 apiece for self & each dependent

-- lose 2% for every $2,500 income increase

-- 100% eliminated AGI > $377k ($427k jnt)

(Phase-out $254k-$377k ( $305k-$427k jnt))](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-32-320.jpg)

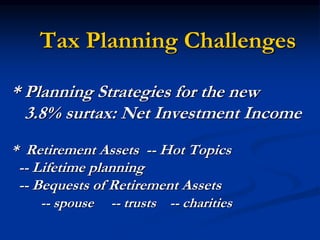

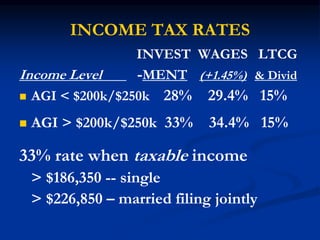

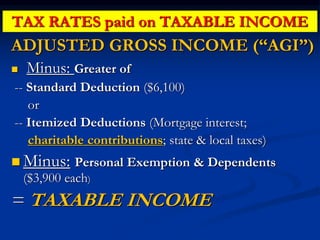

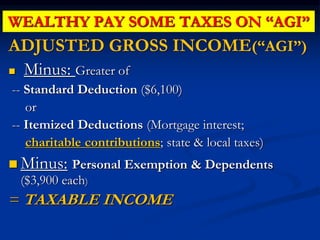

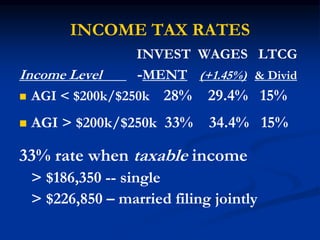

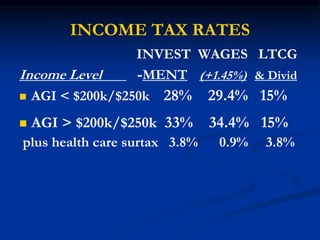

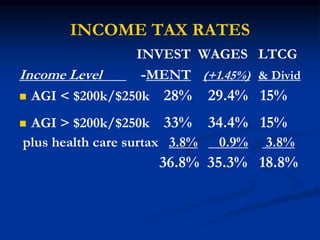

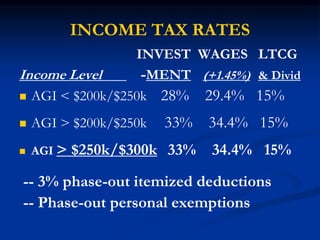

![INCOME TAX RATES

INVEST WAGES LTCG

Income Level -MENT (+1.45%) & Divid

AGI < $200k/$250k 28% 29.4% 15%

AGI > $250k/$300k 33% 34.4% 15%

plus 3% phase-out 1% 1 % 1%

[plus personal exemption phase-out means

extra tax until AGI $377,000 ($427,000 jnt)]](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-34-320.jpg)

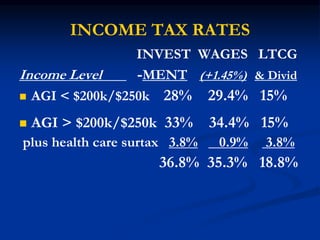

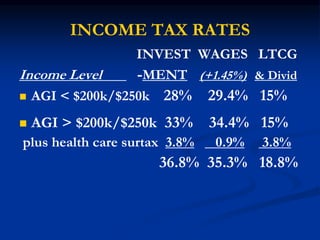

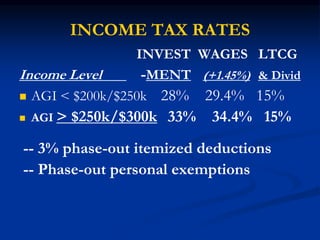

![INCOME TAX RATES

INVEST WAGES LTCG

Income Level -MENT (+1.45%) & Divid

AGI < $200k/$250k 28% 29.4% 15%

AGI > $250k/$300k 33% 34.4% 15%

plus 3% phase-out 1% 1 % 1%

plus health care surtax 3.8% 0.9% 3.8%

37.8% 36.3% 19.8%

[plus personal exemption phase-out means

extra tax until AGI $377,000 ($427,000 jnt)]](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-35-320.jpg)

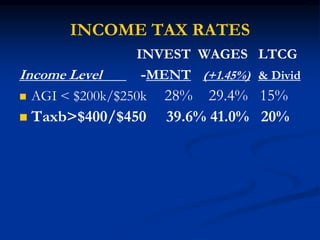

![REAL INCOME TAX RATES

INVEST WAGES LTCG

Income Level -MENT (+1.45%) & Divid

AGI < $200k/$250k 28% 29.4% 15%

AGI > $200k/$250k 36.8% 35.3% 18.8%

AGI > $250k/$300k 37.8% 36.3% 19.8%

Taxb>$400/$450 44.4% 42.9% 24.8%

[higher for AGI between $254-377k ($305-427k

joint) for personal exemption phase-out]](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-40-320.jpg)

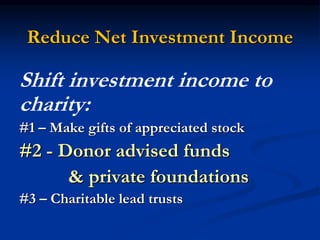

![Reduce Net Investment Income

Shift NII to Family/Charity who pay

no 3.8% tax [note: trusts do pay 3.8%]

Family: Give income-generating investments

Charity:

#1 – Make gifts of appreciated stock

#2 - Donor advised funds & private foundations

#3 – Charitable lead trusts](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-45-320.jpg)

![Reduce Net Investment Income

Shift NII to Family/Charity who pay

no 3.8% tax [note: trusts do pay 3.8%]

Family: Give income-generating investments

Charity:

#1 – Make gifts of appreciated stock

#2 - Donor advised funds & private foundations

#3 – Charitable lead trusts](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-58-320.jpg)

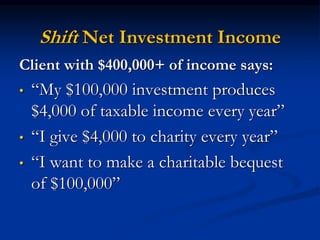

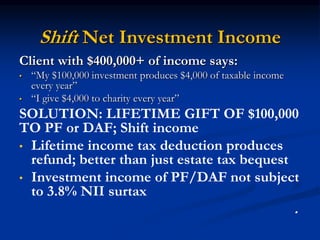

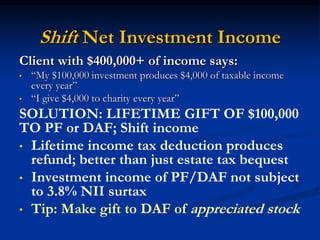

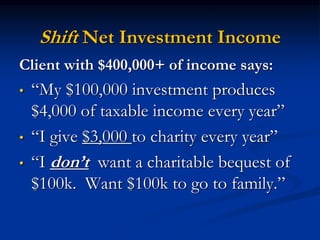

![Shift Net Investment Income

Client with $400,000+ of income says:

• “My $100,000 investment produces $4,000 of

taxable income every year”

• “I give away $3,000 to charity every year”

• “I want family to get the $100,000 investment”

CONCEPT: Put $100,000 into a Charitable

Lead Trust for a term of years. Whereas

donor is paying 3.8% NIIT on all 4%, the

CLT would pay only on undistributed 1%.

[ PLUS: CLT discount on wealth transfer ]](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-60-320.jpg)

![Reduce Net Investment Income

Shift NII to Family/Charity who pay no 3.8% tax

[note: trusts do pay 3.8%]

#1 – Donate appreciated stock

#2 - Donor advised funds & private foundations

#3 – Charitable lead trusts

COST/BENEFIT – Is administrative cost of

PF or CLT worth doing just for 3.8% tax

savings? Other benefits are needed.

( Compare: DAF cheap!)](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-61-320.jpg)

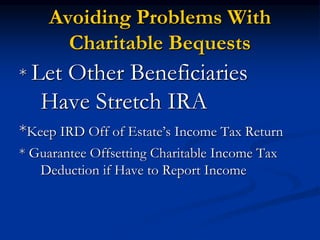

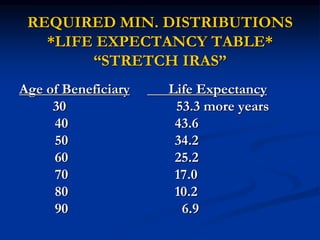

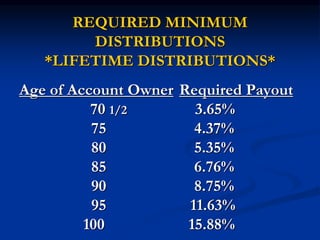

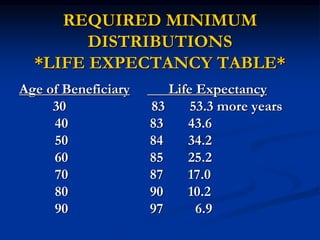

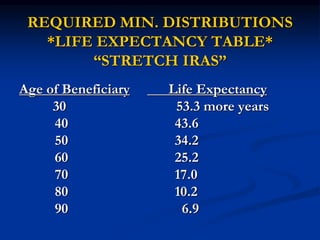

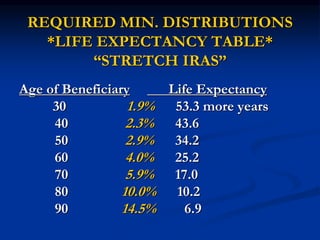

![REQUIRED MINIMUM DISTRIBUTIONS

Example: Death at age 80?

CURRENT LAW: *Life Expectancy Table*

Age of Beneficiary Life Expectancy

30 1.9% 53.3 more years

40 2.3% 43.6

50 2.9% 34.2

60 4.0% 25.2

70 5.9% 17.0

80 10.0% 10.2

90 10.0% 6.9 * [10.2 yrs]](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-99-320.jpg)

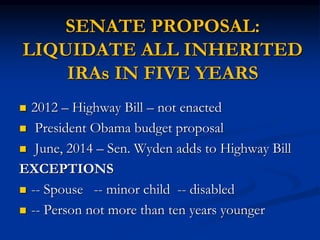

![REQUIRED MINIMUM DISTRIBUTIONS

Example: Death at age 80?

PROPOSED: FIVE YEARS if >10 yrs younger

Age of Beneficiary Life Expectancy

30 5 years

40 5

50 5

60 5

70 5.9% 17.0

80 10.0% 10.2

90 10.00% 6.9 * [10.2 yrs]](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-100-320.jpg)

![2-GENERATION CHARITABLE

REMAINDER TRUST

Typically pays 5% to elderly surviving

spouse for life, then 5% to children for

life, then liquidates to charity

Like an IRA, a CRT is exempt from

income tax

Can operate like a credit-shelter trust

for IRD assets [no marital deduction]](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-104-320.jpg)

![MANDATORY DISTRIBUTIONS

[Assume inherit IRA at age 80 and die at 92]

Own Accumulation Conduit

AGE IRA Trust Trust .

80 5.35% 9.80% 9.80%

85 6.76% 19.23% 13.16%

90 8.78% 100.00% 18.18%

91 9.26% empty 19.23%

92 9.81% empty 20.41%](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-107-320.jpg)

![MANDATORY DISTRIBUTIONS

[Assume inherit IRA at age 80 and die at 92]

Own Accumulation Conduit

AGE IRA Trust Trust . C R T .

80 5.35% 9.80% 9.80% 5.00%

85 6.76% 19.23% 13.16% 5.00%

90 8.78% 100.00% 18.18% 5.00%

91 9.26% empty 19.23% 5.00%

92 9.81% empty 20.41% 5.00%](https://image.slidesharecdn.com/2014-hoyt-ppt-presentation-adnet-clevland-oct182-141013221112-conversion-gate02/85/2014-AdNet-Days-Chris-Hoyt-Presentation-108-320.jpg)