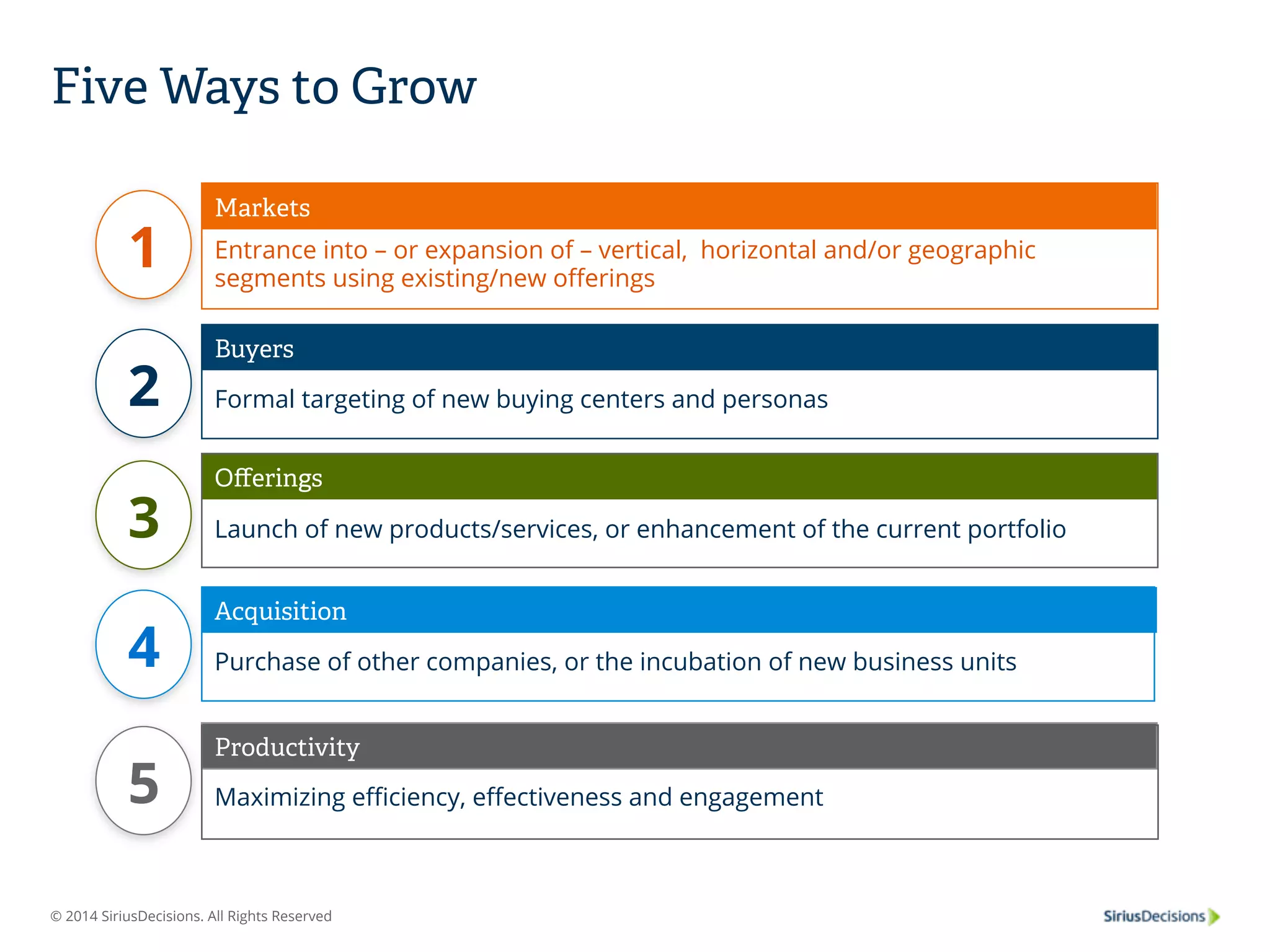

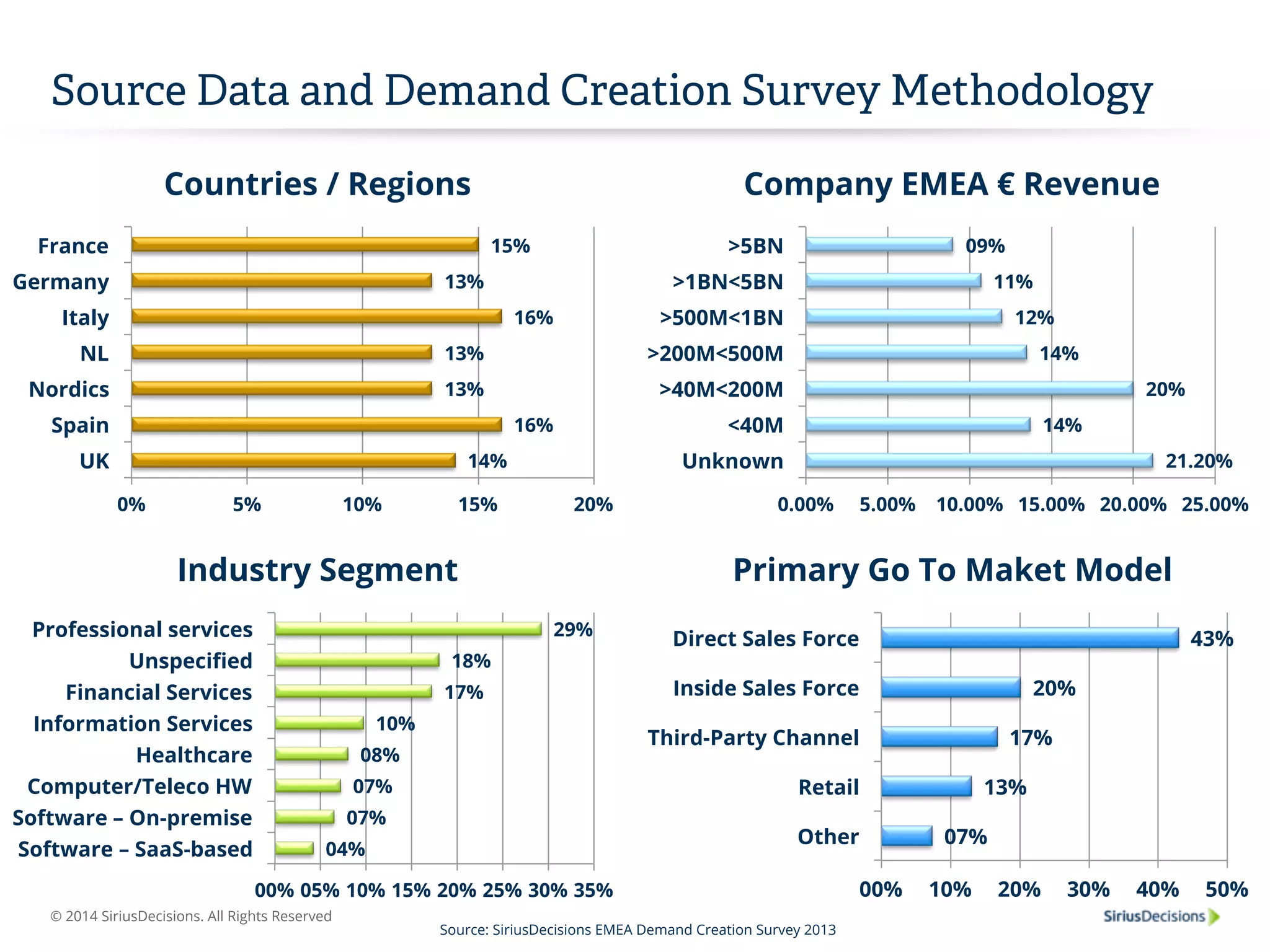

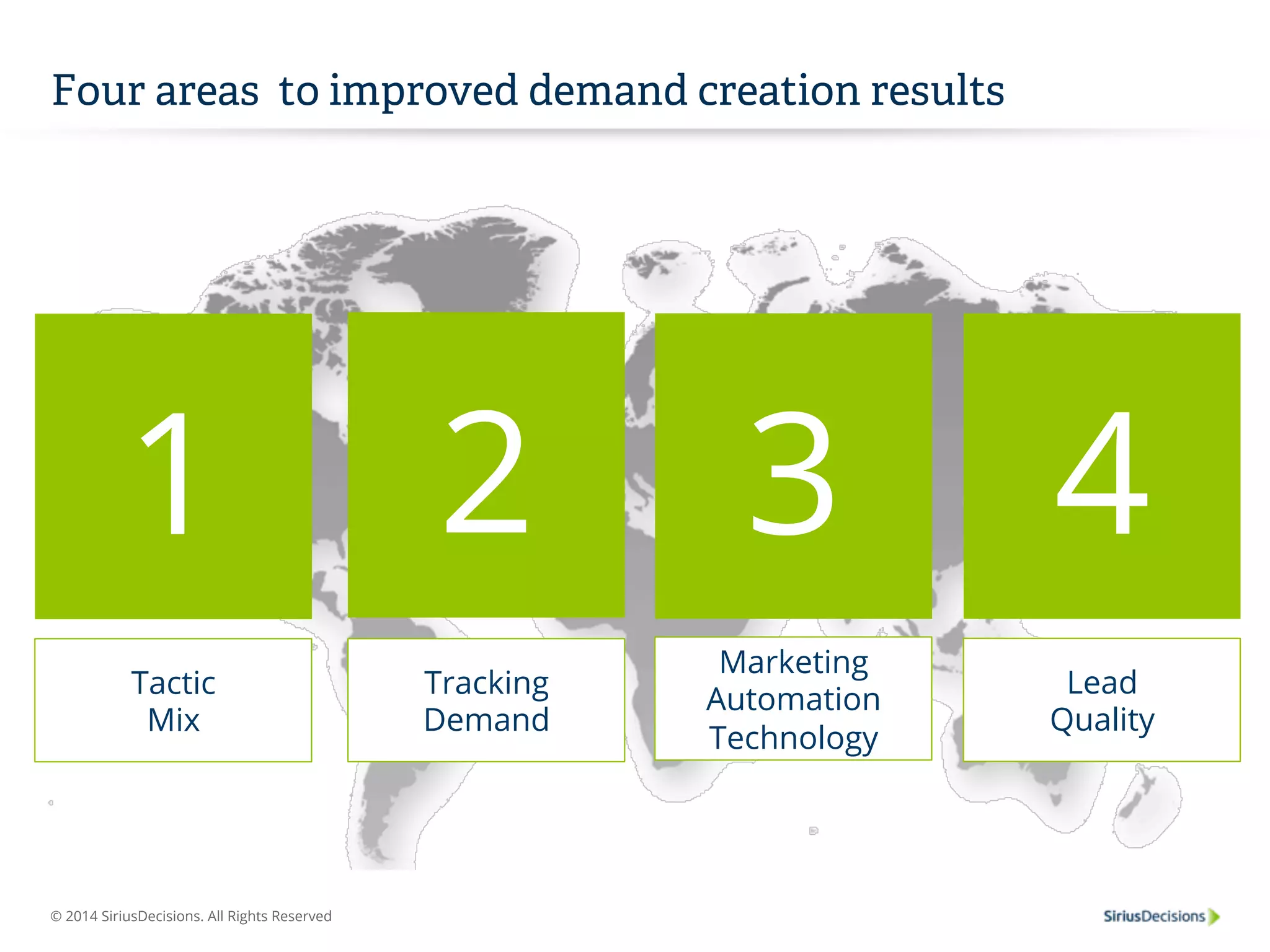

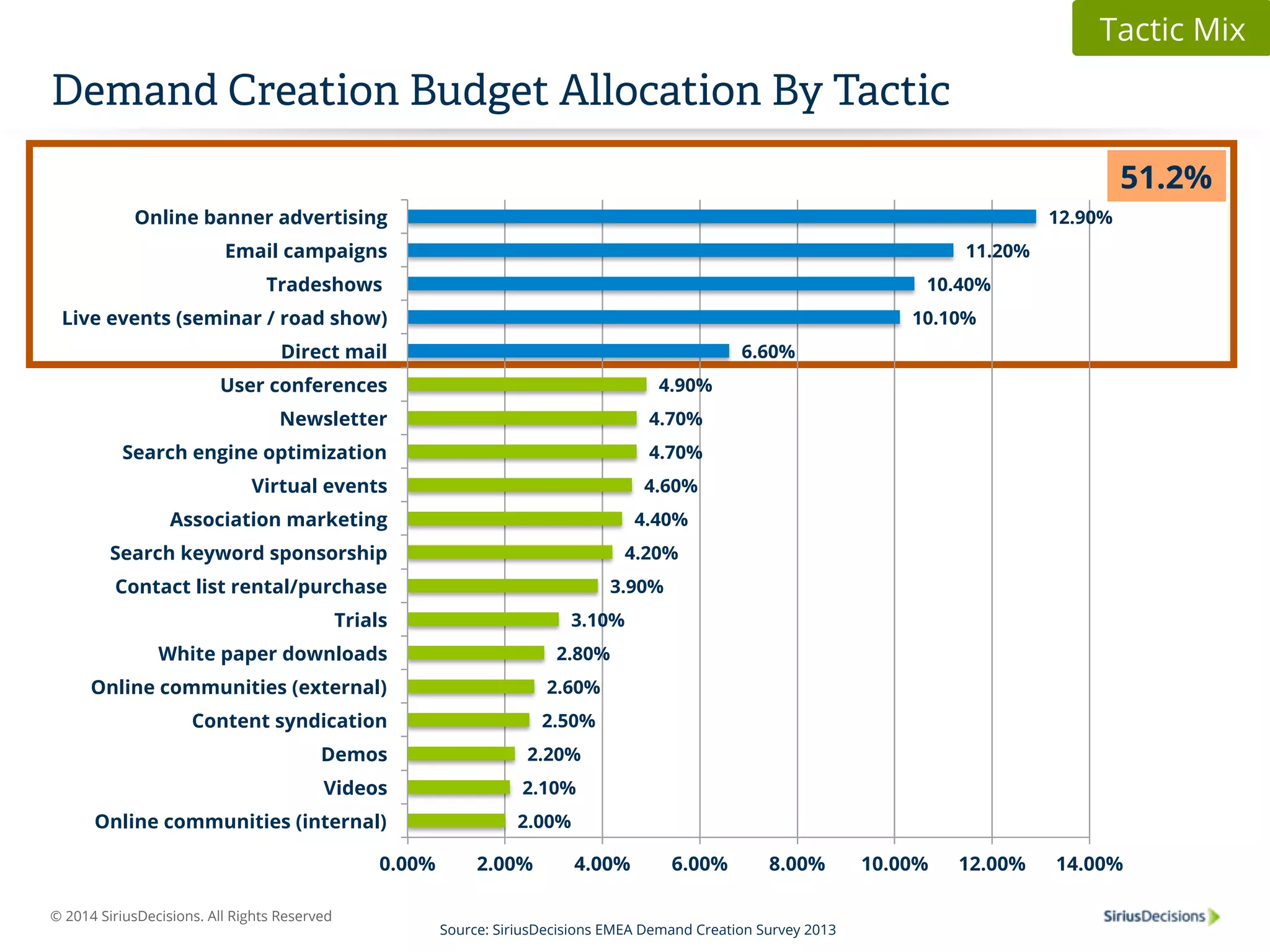

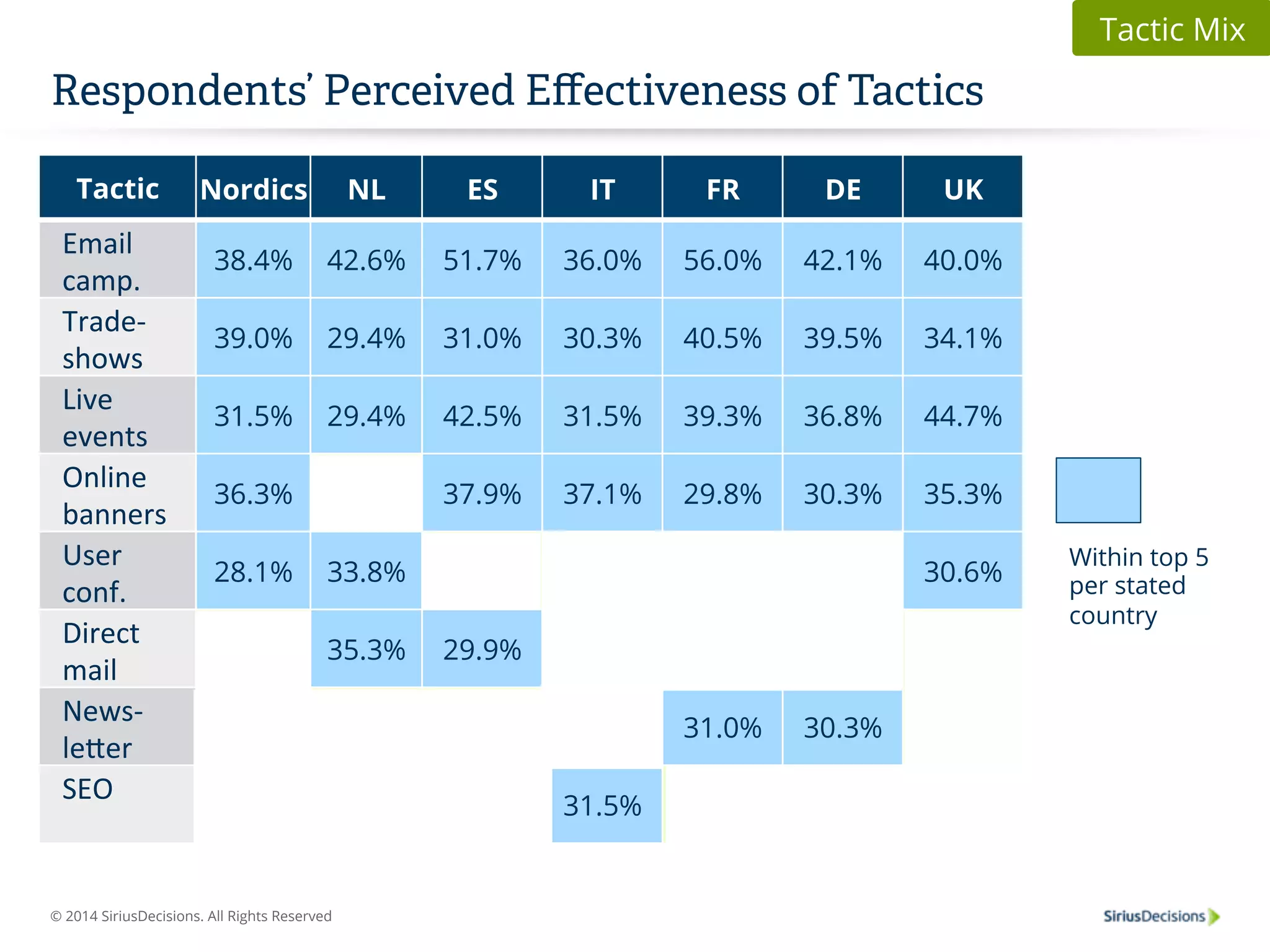

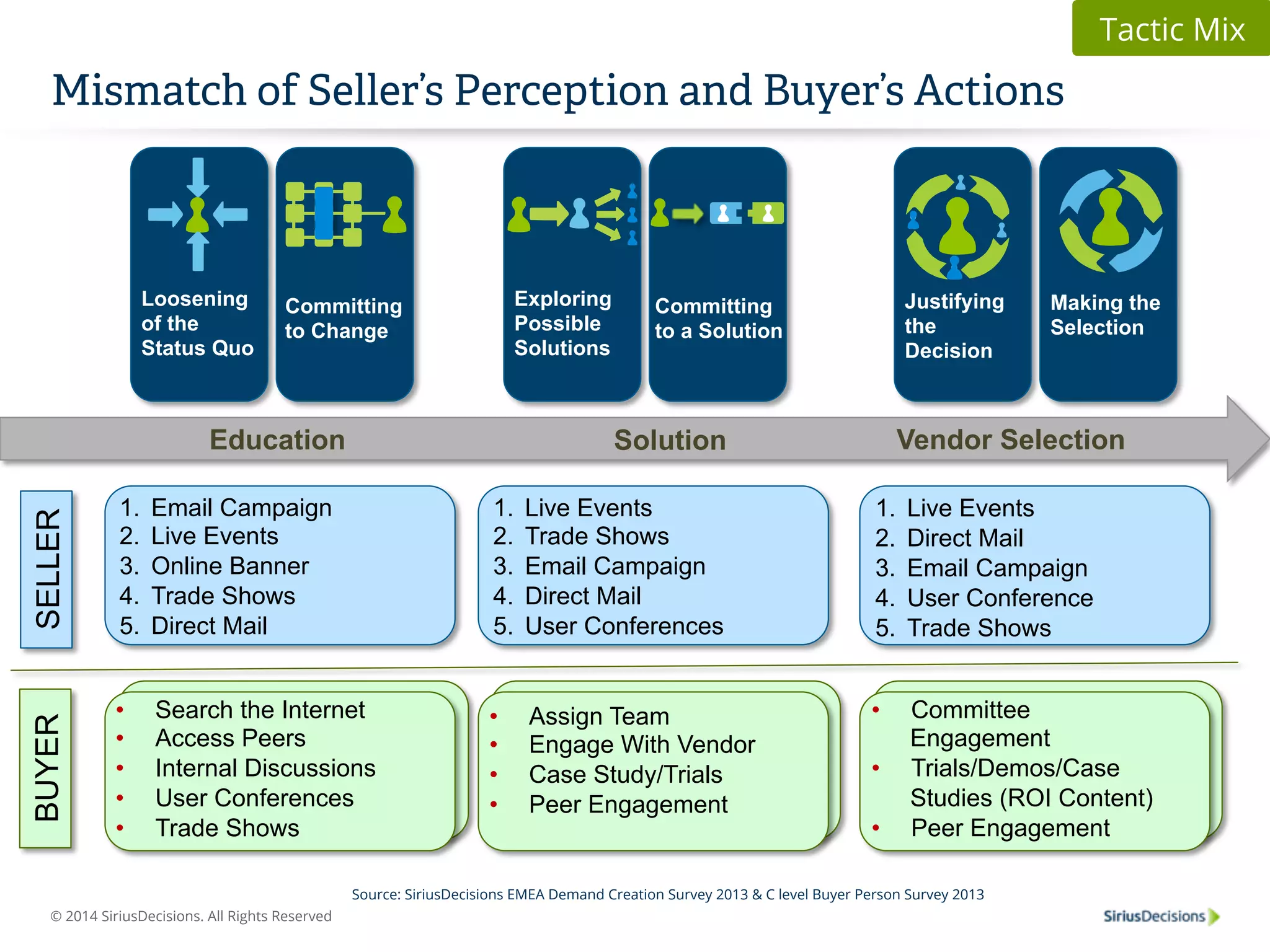

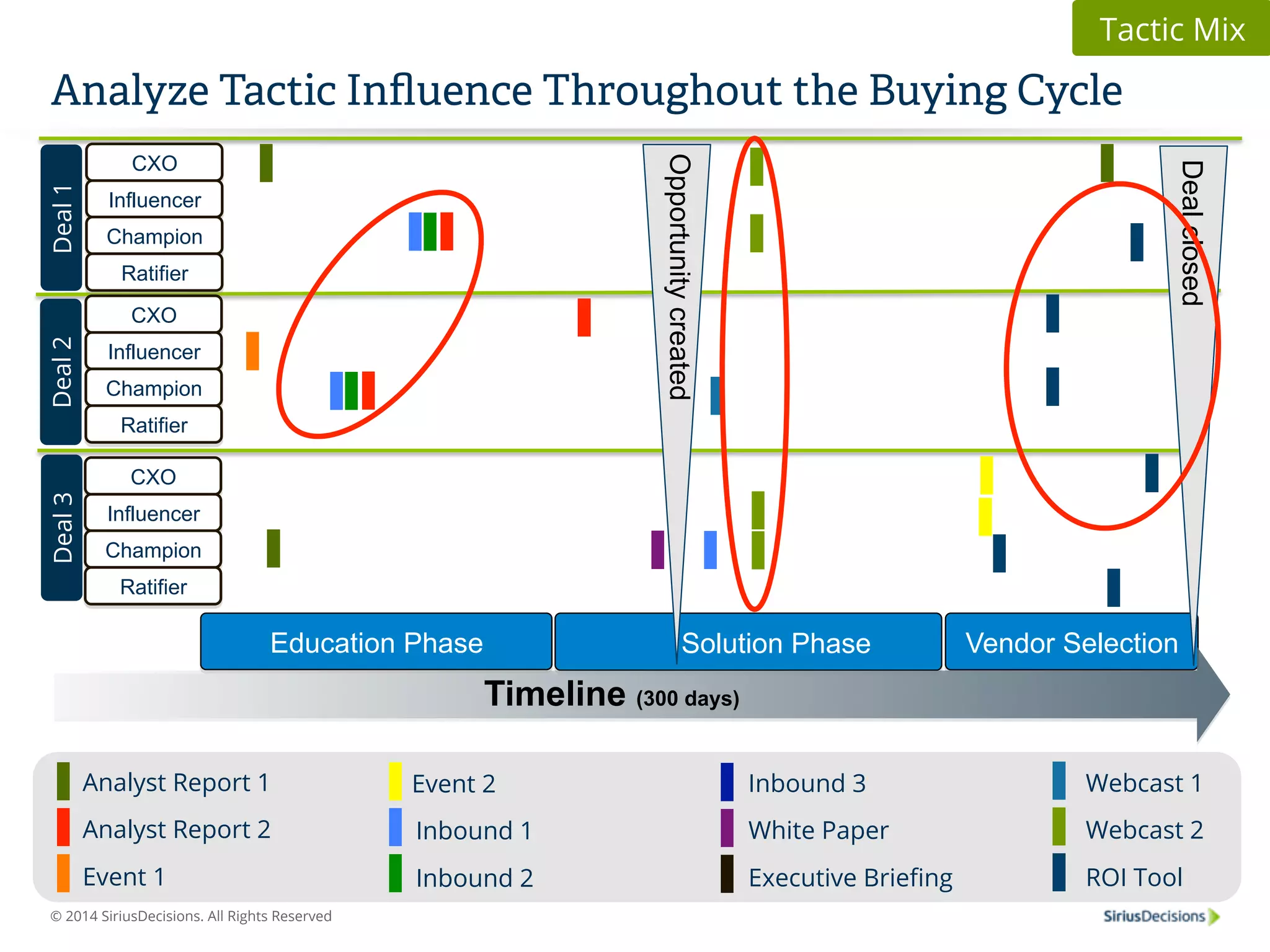

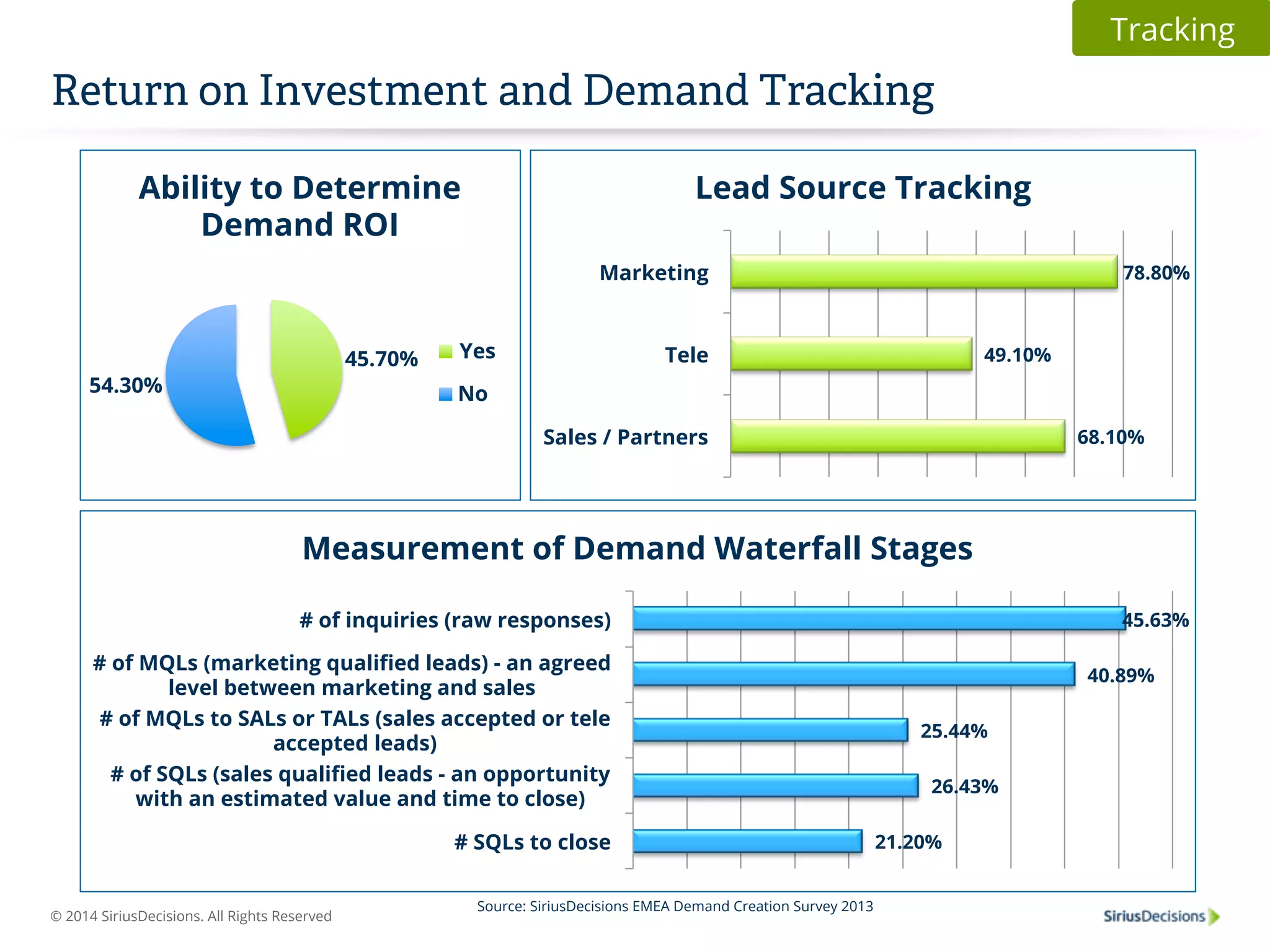

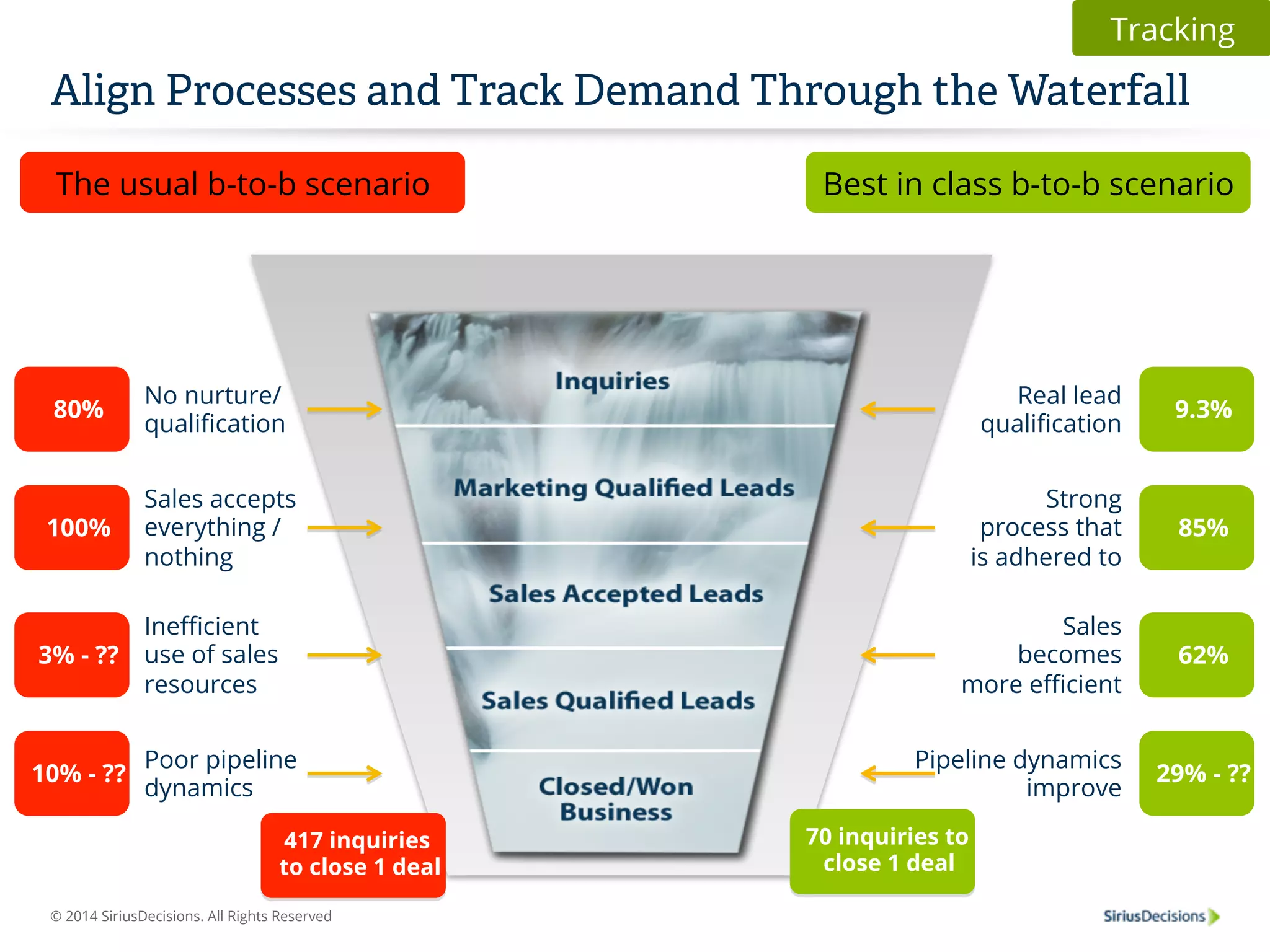

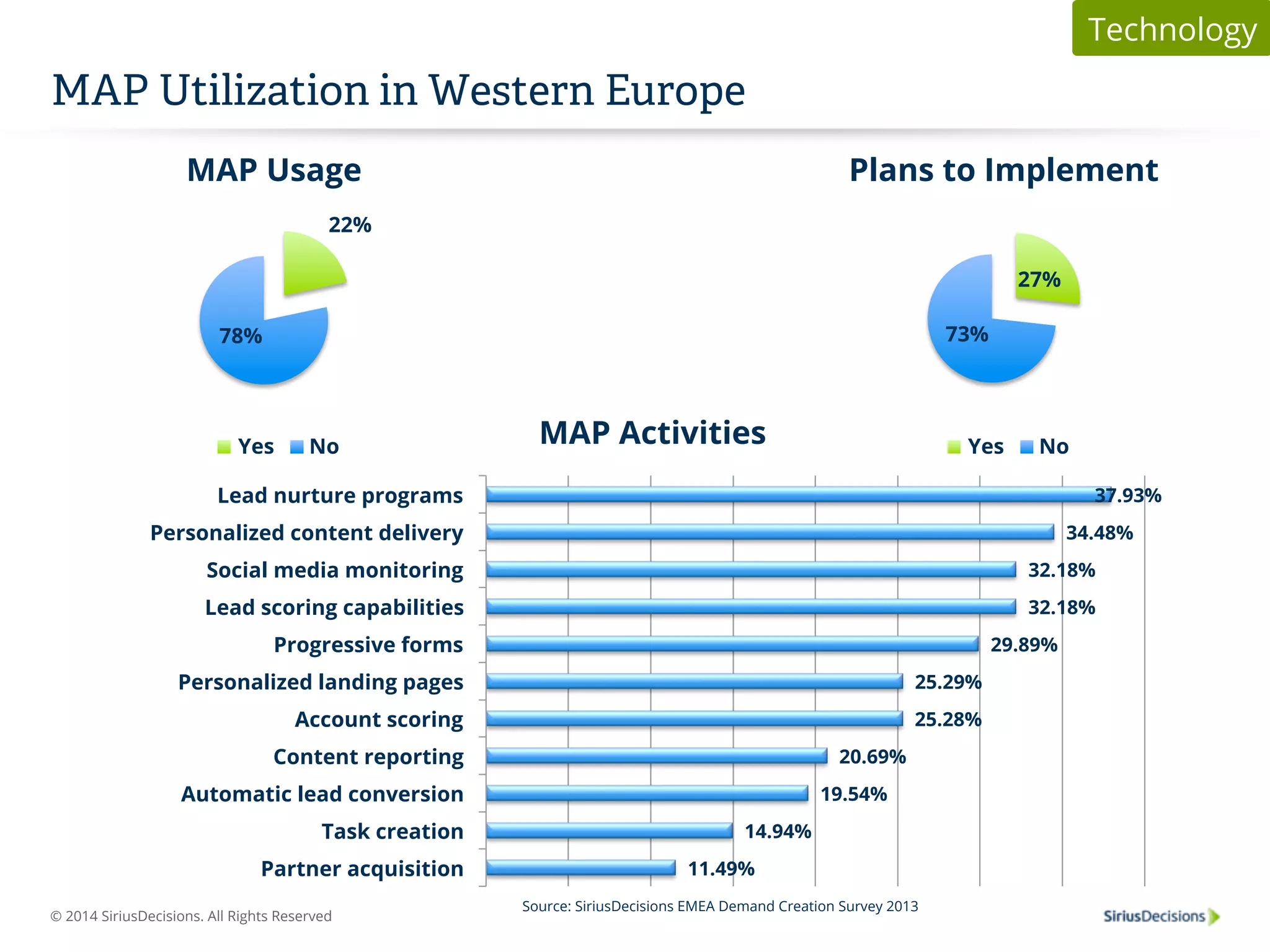

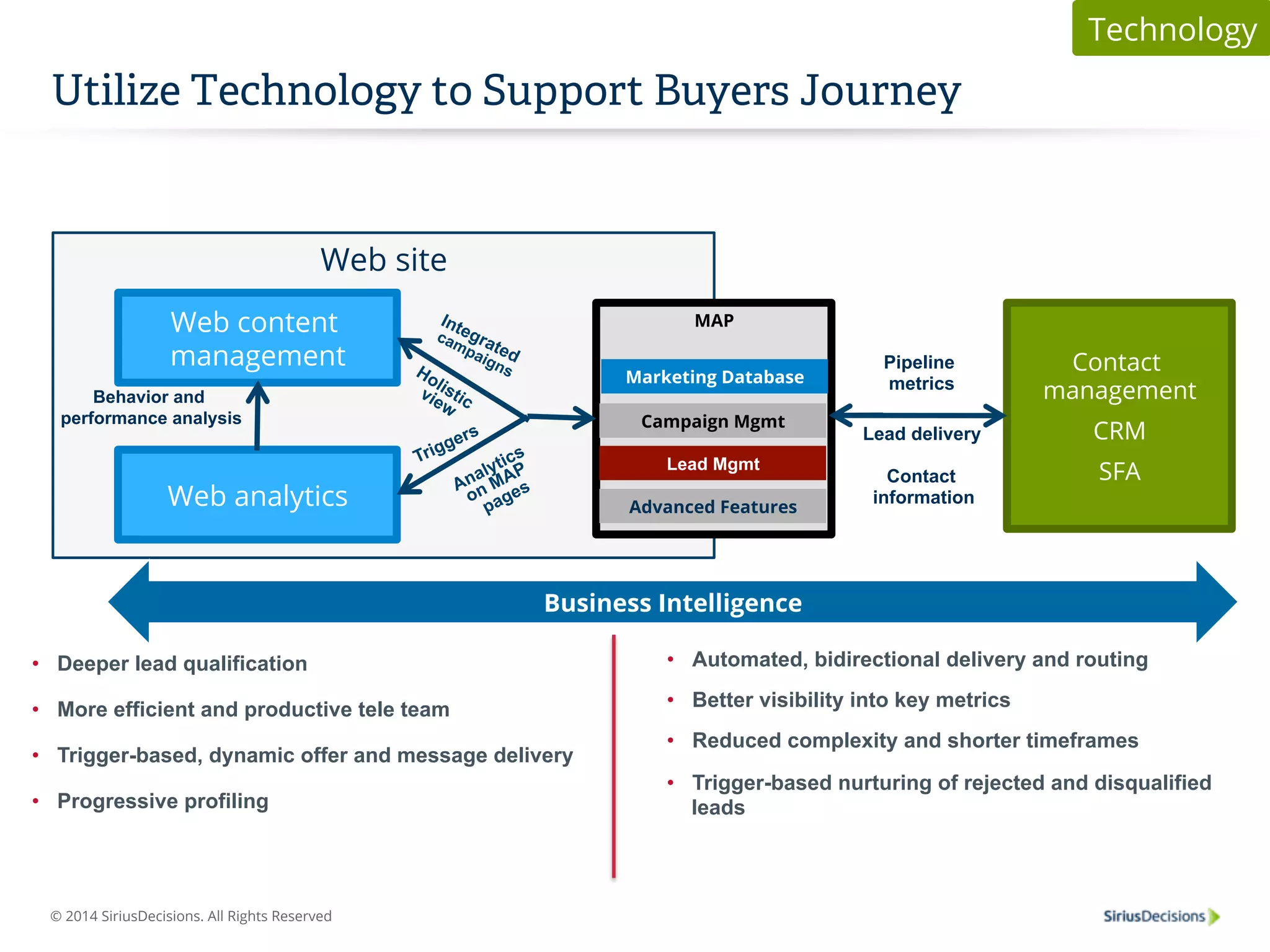

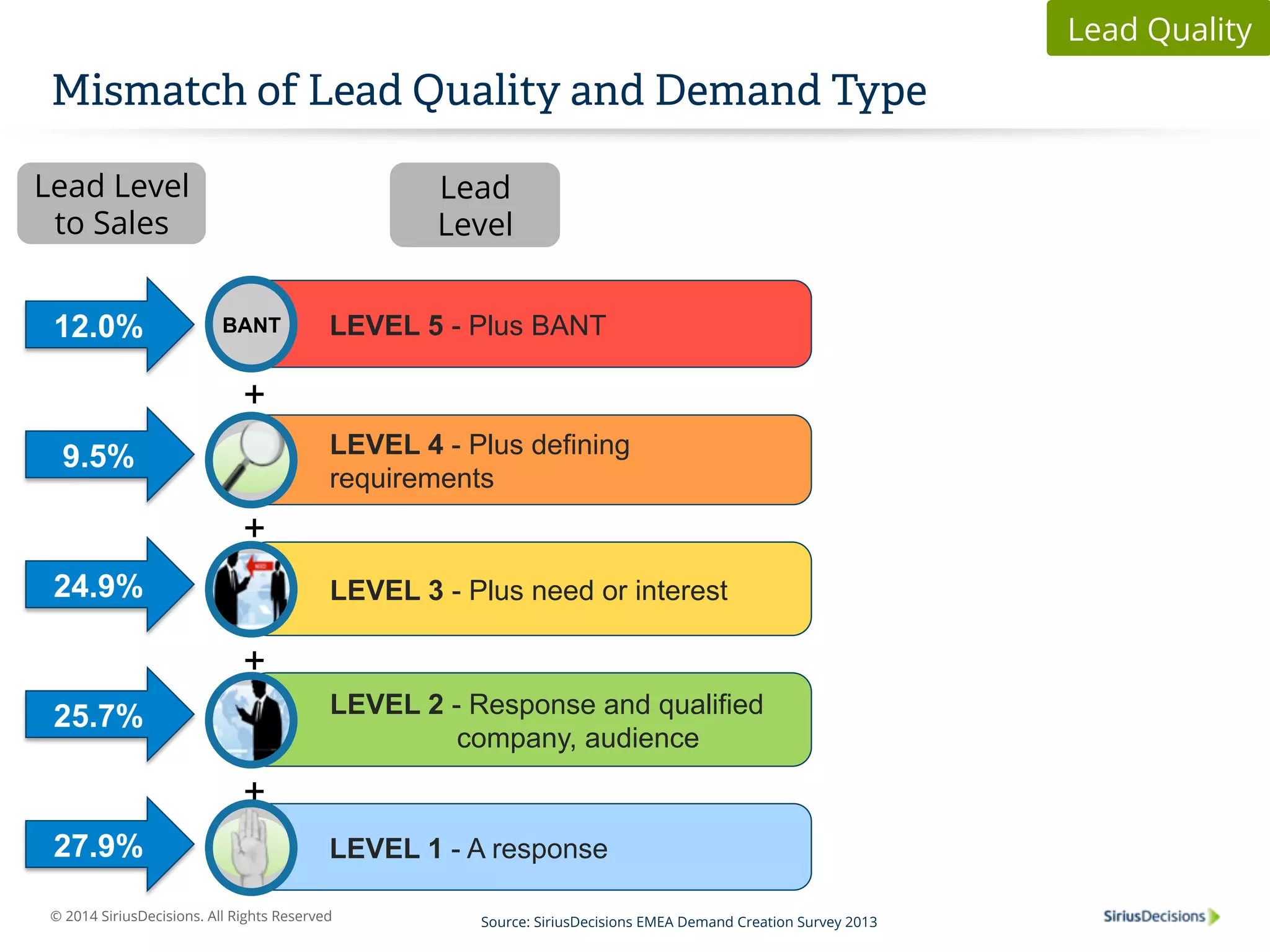

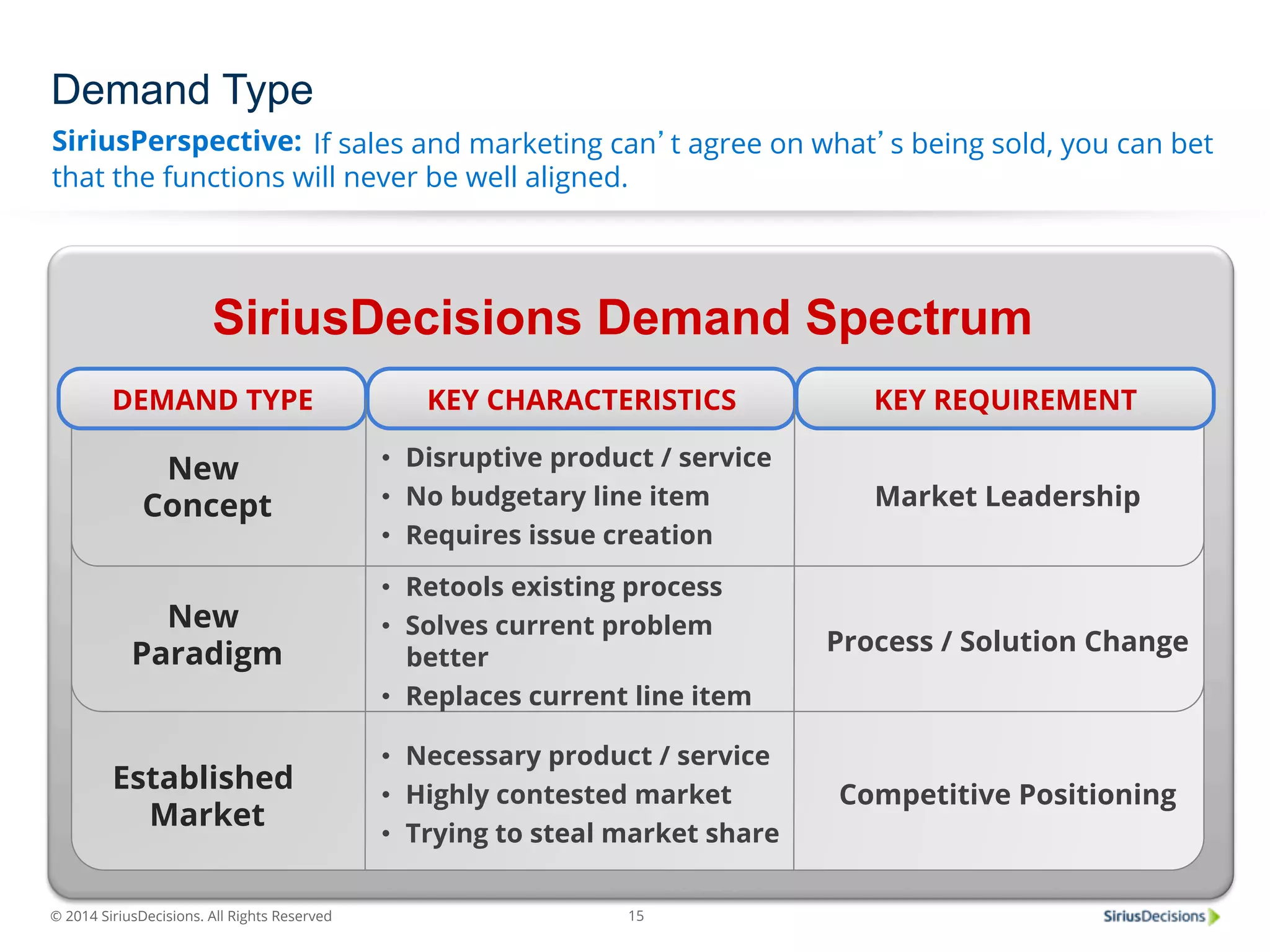

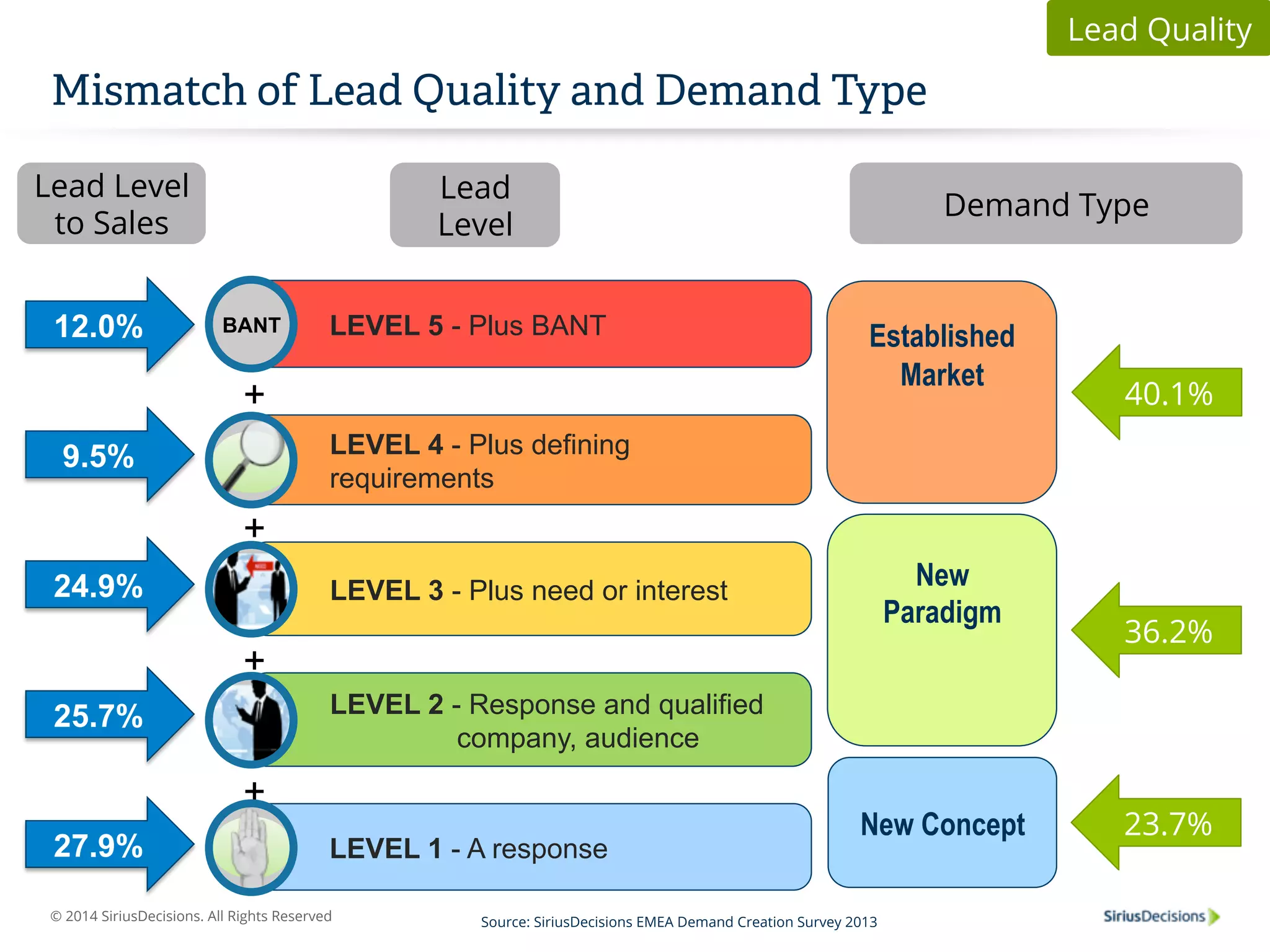

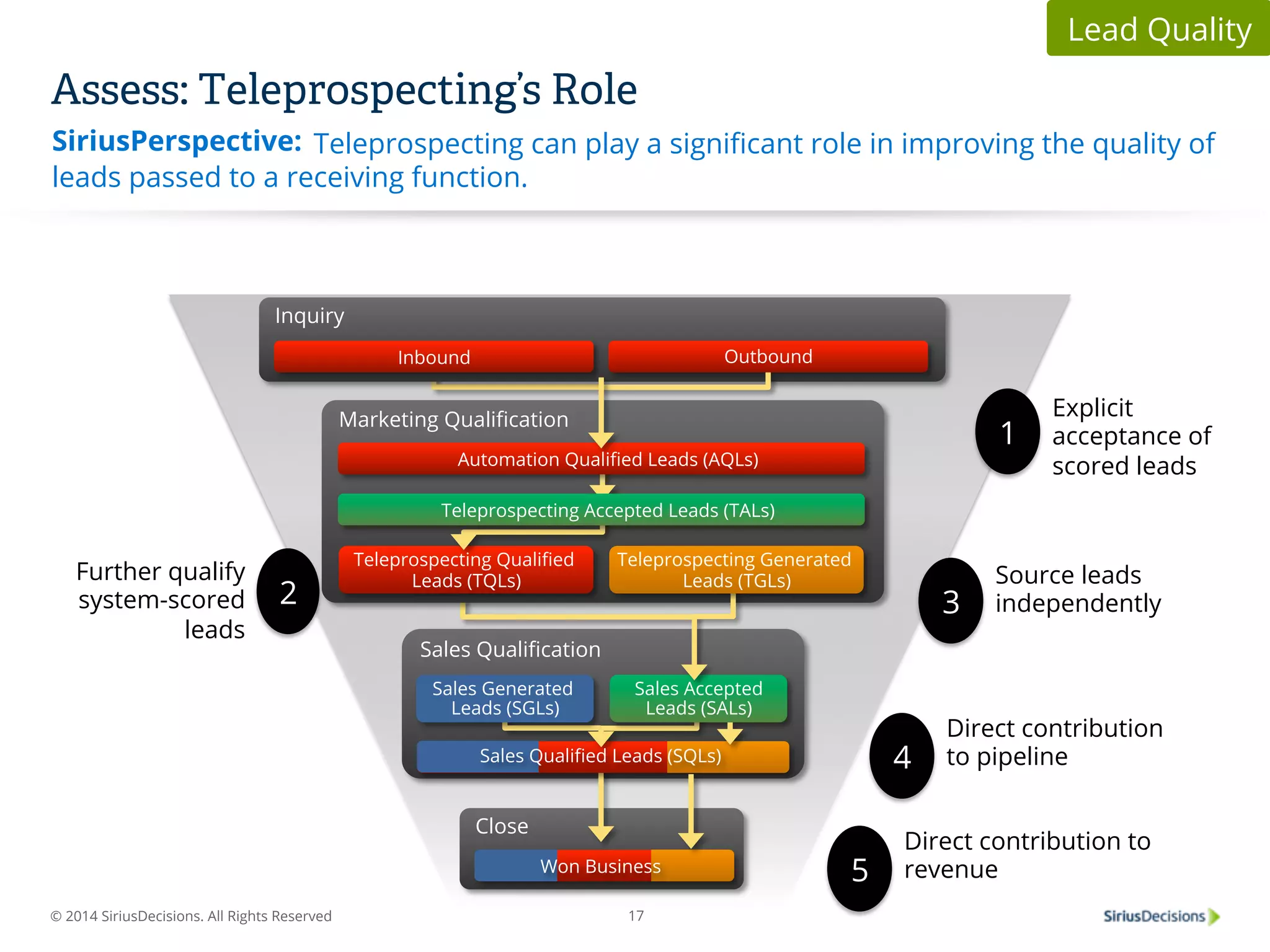

The document discusses the current state of demand creation in Europe, highlighting gaps and providing strategic recommendations based on the SiriusDecisions EMEA Demand Creation Survey. It emphasizes the importance of aligning marketing tactics with buyer preferences and improving lead quality through better tracking and qualification processes. Key recommendations include reviewing budget allocations, adopting technology for transparency, and focusing on effective demand creation strategies to enhance sales outcomes.