This document provides an overview of Bayesian statistical analysis compared to classical frequentist approaches. It discusses some key problems with classical methods like misinterpretation of confidence intervals and p-values. Bayesian analysis uses Bayes' theorem to update the prior probability of parameters based on observed data, synthesizing external prior information with internal sample information. This provides a unified framework for statistical inference that does not require imagining hypothetical repeated samples. The document also introduces some important figures in the development of Bayesian statistics like Thomas Bayes, Pierre-Simon Laplace, and Bruno de Finetti.

![Monte Carlo (MC) sampling

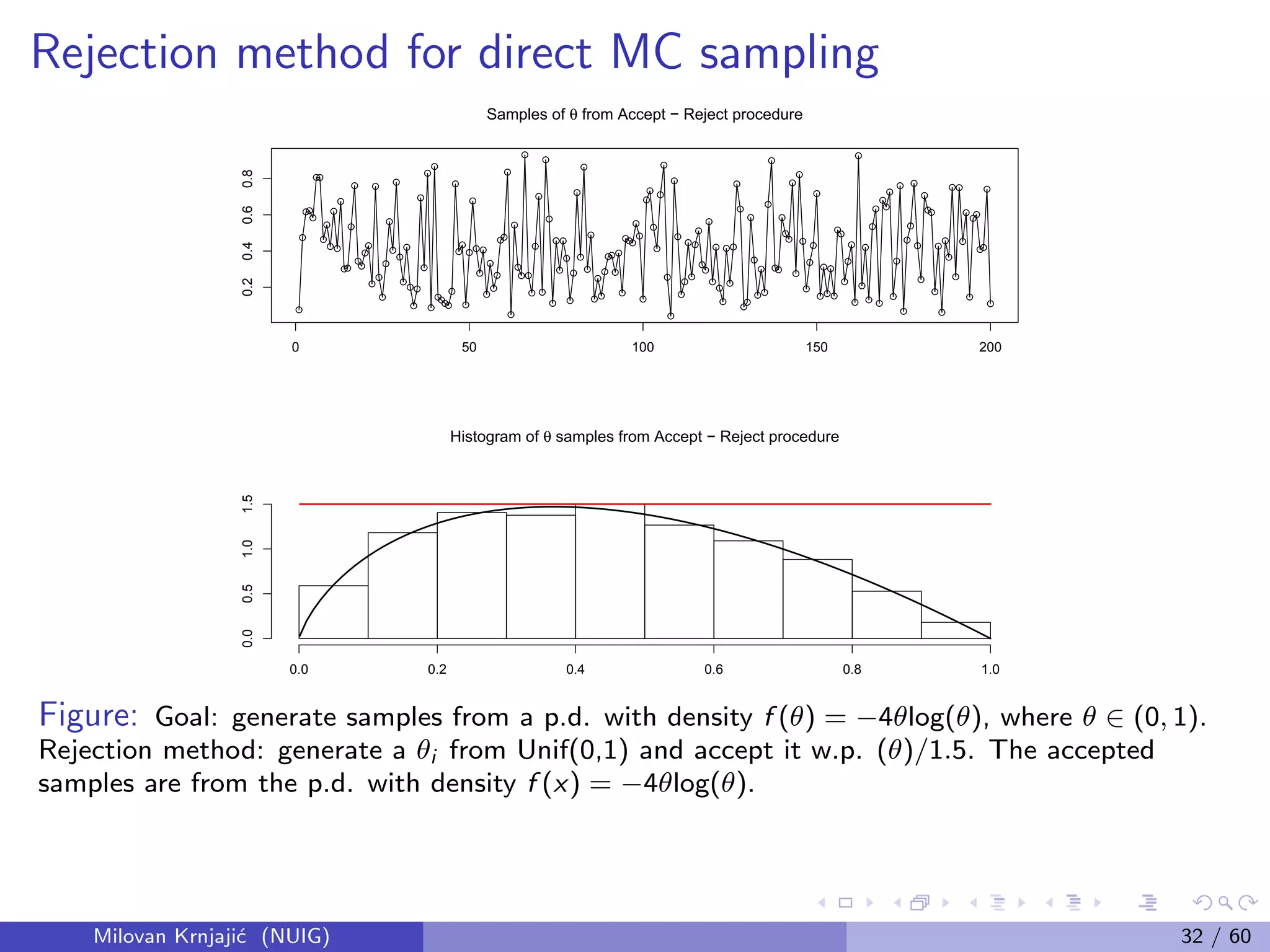

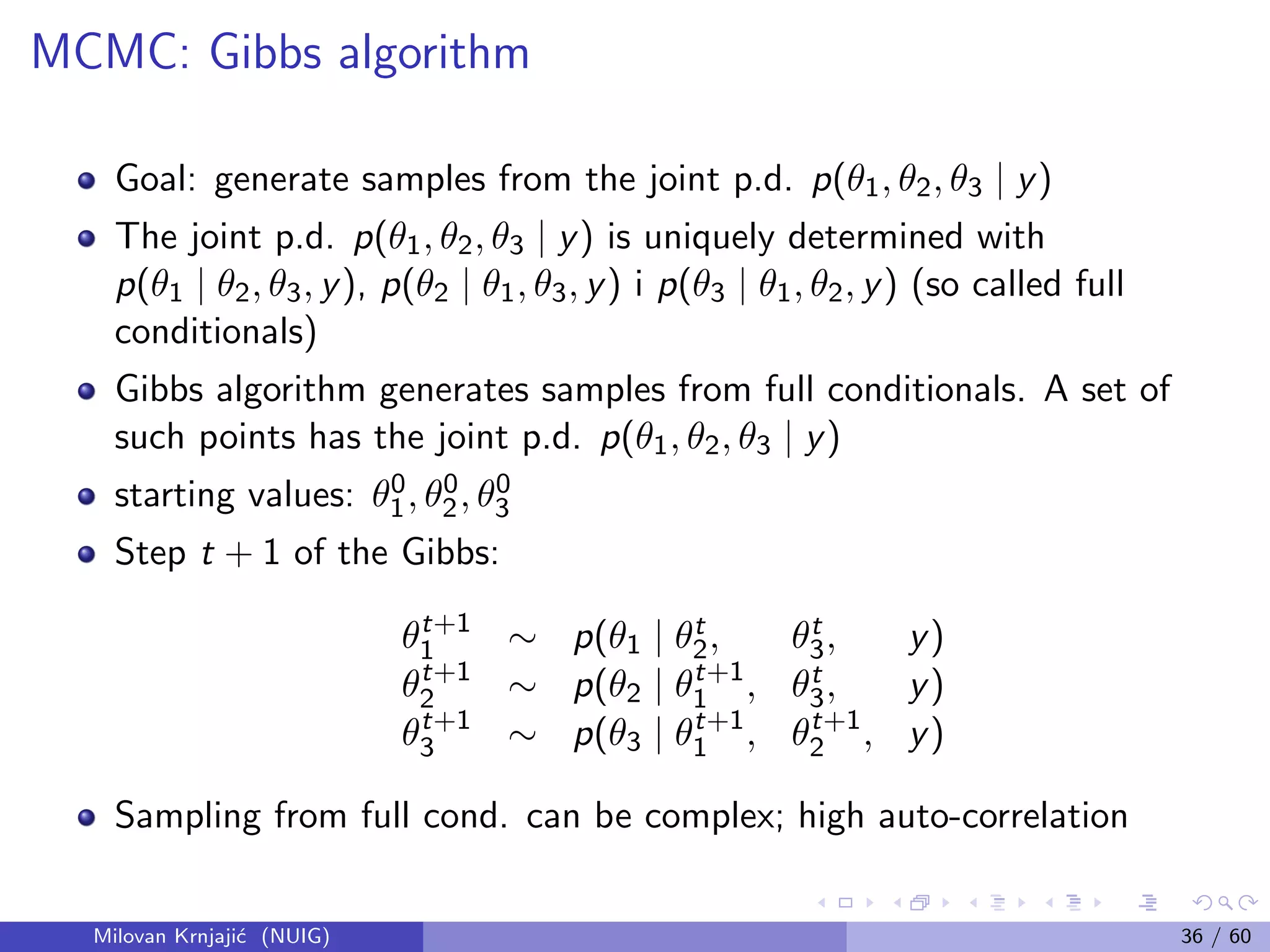

In practice, p(θ | y) = p(θ) × L(θ | y), complex and dim(θ) large

Problem: no closed form for integrals; no numerical integration;

A solution: Can learn anything about a probability

distribution from a large sample.

If xi ∼ p(x) then 1

n

n

i=1 g(xi ) → E[g(X)] = X g(x)p(x)dx

Instead of maths – simulation: generate independent samples from

the joint posterior distribution

Milovan Krnjaji´c (NUIG) 31 / 60](https://image.slidesharecdn.com/2013-140724081706-phpapp02/75/2013-03-26-Bayesian-Methods-for-Modern-Statistical-Analysis-41-2048.jpg)

![Bayesian decision theory

Bayesian decision theory: rational and coherent decisions are made

based on maximization of the expected utility function.

Let A be a set of possible actions, U(a, θ) the utility function, action

a, where the unknown info is θ;

The optimal actions a∗ maximizes the expectation of U:

E(θ|y) [U(a, θ)]

This approach has been succesfully used in many areas, such as

business management, econometrics, engineering, health care,

medicine, etc.

Milovan Krnjaji´c (NUIG) 37 / 60](https://image.slidesharecdn.com/2013-140724081706-phpapp02/75/2013-03-26-Bayesian-Methods-for-Modern-Statistical-Analysis-47-2048.jpg)

![Modelling of Count Data

Example: Count data — Bayesian parametric Poisson based model vs.

Bayesian nonparametric (BNP) with a Dirichlet process prior.

Fixed-effects Poisson model, (for i = 1, . . . , n),

(yi |θ)

ind

∼ Poisson[exp(θ)]

(θ|µ, σ2

)

iid

∼ N(µ, σ2

)

(µ, σ2

) ∼ p(µ, σ2

).

(2)

This uses a Lognormal prior for λ = eθ

rather than conjugate Gamma choice;

the two families are similar, and the Lognormal generalizes more readily.

Data often exhibit heterogeneity resulting in (extra-Poisson variability),

variance-to-mean ratio, VTMR > 1

Milovan Krnjaji´c (NUIG) 43 / 60](https://image.slidesharecdn.com/2013-140724081706-phpapp02/75/2013-03-26-Bayesian-Methods-for-Modern-Statistical-Analysis-53-2048.jpg)

![Parametric Random-Effects Poisson (PREP) Model

Random-effects Poisson model (PREP):

(yi |θi )

ind

∼ Poisson[exp(θi )]

(θi |G)

iid

∼ G

G ≡ N(µ, σ2)

(µ, σ2) ∼ p(µ, σ2),

(3)

assuming a parametric CDF G (the Gaussian) for the latent variables

or random effects θi .

Distribution, G, in the population to which it’s appropriate to

generalize may be multimodal or skewed, which a single Gaussian

can’t capture; if so, this PREP model can fail to be valid.

Milovan Krnjaji´c (NUIG) 44 / 60](https://image.slidesharecdn.com/2013-140724081706-phpapp02/75/2013-03-26-Bayesian-Methods-for-Modern-Statistical-Analysis-54-2048.jpg)