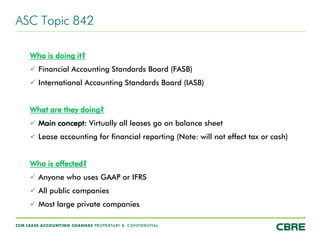

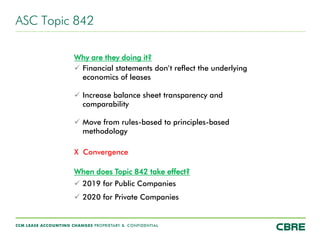

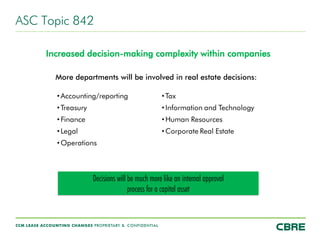

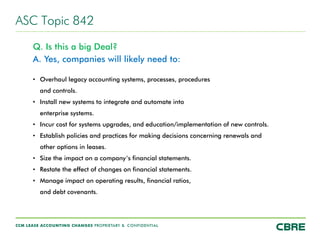

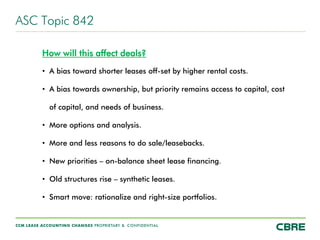

The Financial Accounting Standards Board and International Accounting Standards Board have issued new lease accounting standards that will require virtually all leases to be recognized on the balance sheet. This will affect any company that uses GAAP or IFRS financial reporting, and will take effect for public companies in 2019 and private companies in 2020. It represents a significant change from the current standards that will require companies to overhaul their accounting systems and processes to comply with the new principles-based methodology.