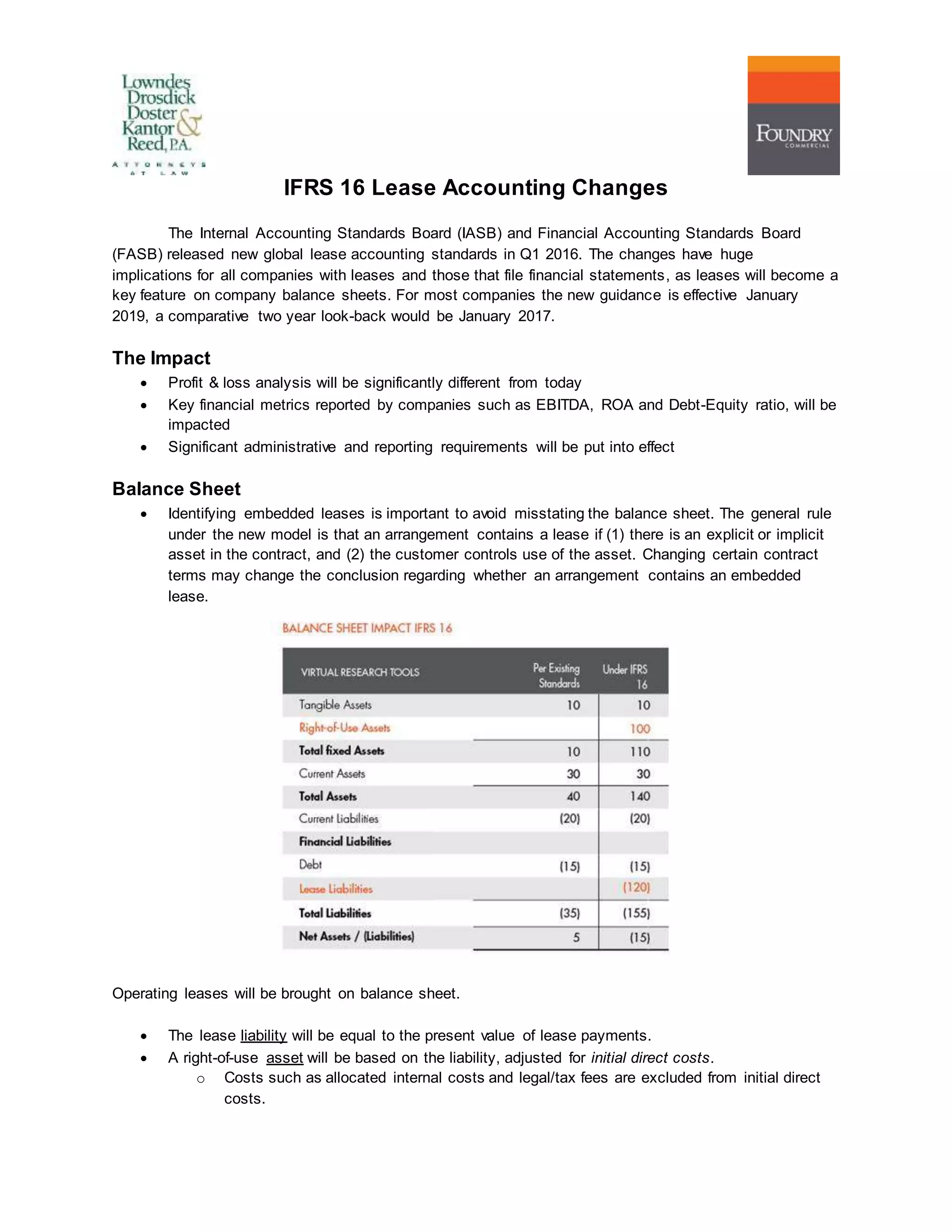

The International Accounting Standards Board (IASB) and Financial Accounting Standards Board (FASB) released new global lease accounting standards in 2016 that will significantly impact companies. The new guidance requires all leases to be reported on company balance sheets by recognizing new assets and liabilities for operating leases. It also expands what is considered part of the lease term and requires reassessment of lease accounting due to contract modifications. Preparing for the changes, which take effect in January 2019, may require upgrades to leasing software and systems and will involve analyzing thousands of leases.