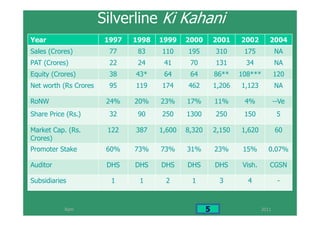

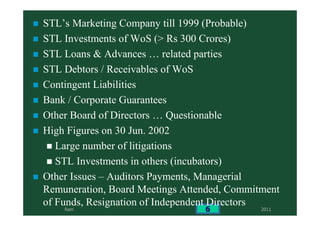

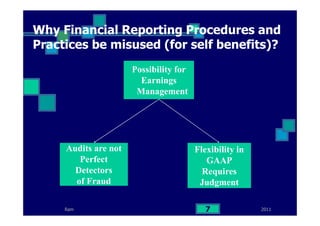

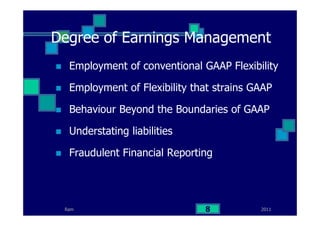

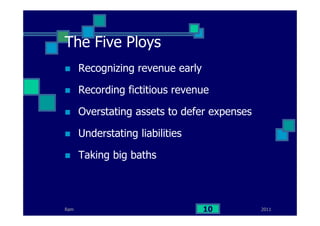

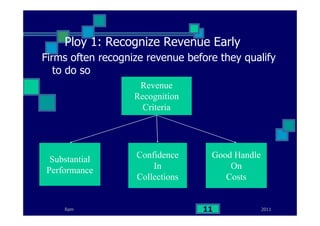

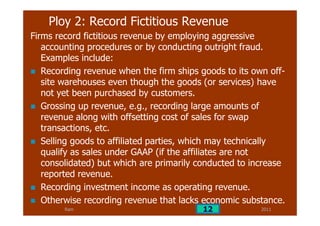

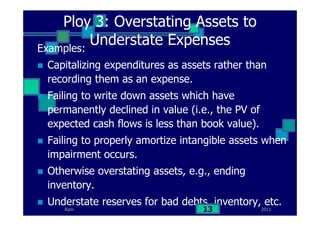

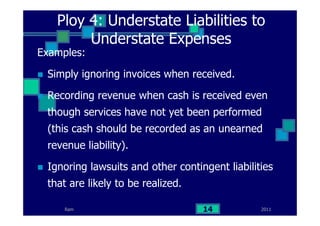

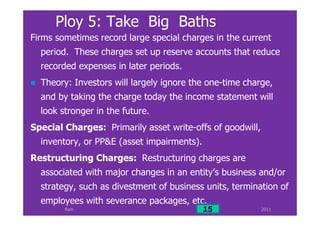

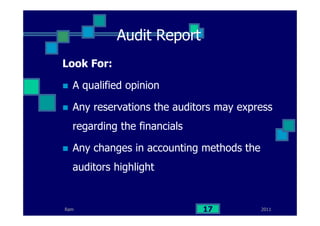

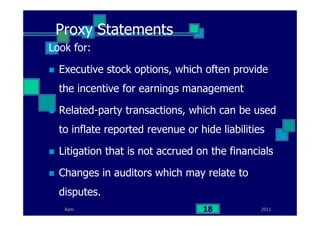

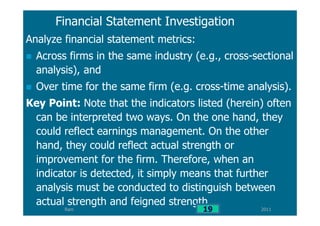

This document provides an overview of the failed IT company Silverline Technologies Limited. It discusses Silverline's growth from 1997 to 2002, with rising sales, profits, and share prices. However, from 2002 onwards Silverline began to struggle, with falling sales, profits, share prices, and market capitalization. The document examines possible reasons for Silverline's downfall, including external factors like recession, as well as systematic manipulation of accounting policies, such as overstating assets and understating liabilities. It also notes issues such as related party transactions, high figures reported on financial statements, and numerous legal cases facing Silverline. The document concludes by discussing the importance of corporate governance and transparency to avoid such business failures.