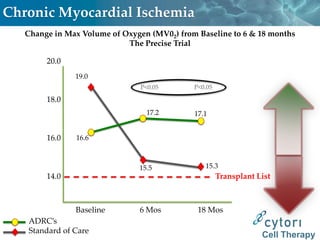

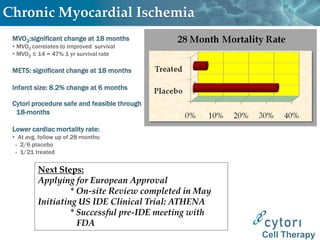

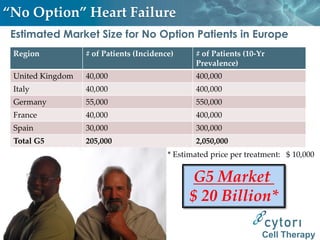

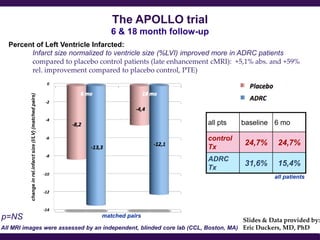

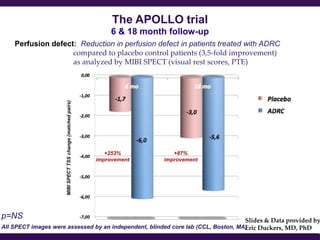

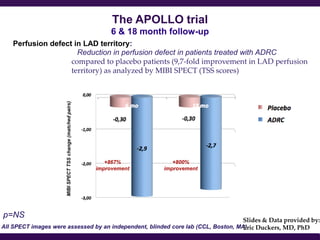

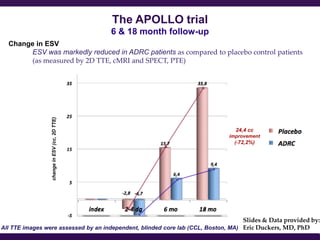

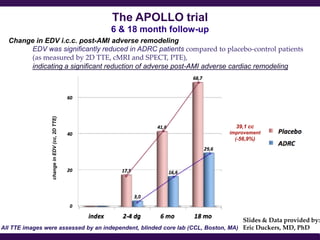

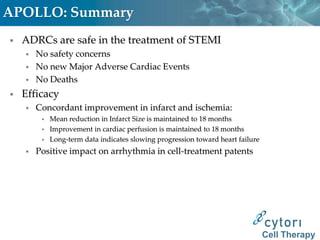

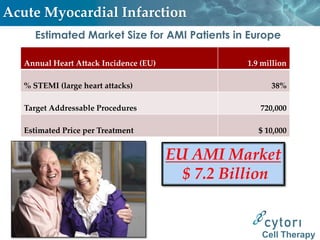

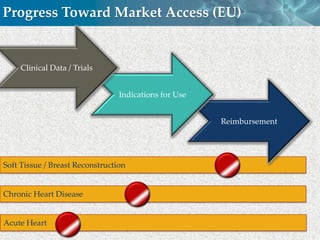

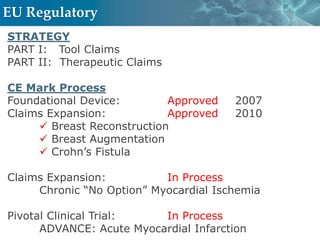

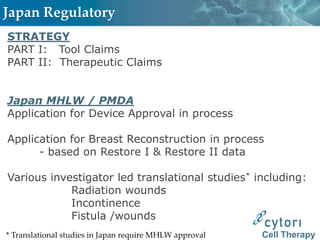

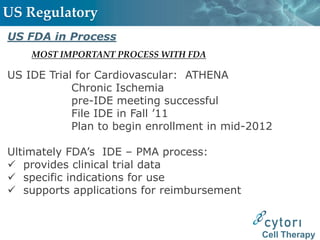

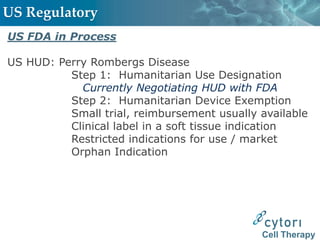

Cytori Cell Therapy aims to improve quality and length of life through innovative cell therapy. The company has treated over 4,000 patients for conditions like cardiovascular disease and soft tissue disorders. Recent clinical trials show promise for treating chronic myocardial ischemia and acute heart attack. For chronic heart failure, cell therapy may help improve heart condition, activity, and reduce mortality for "no option" patients, representing a large potential market.