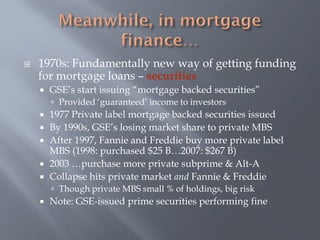

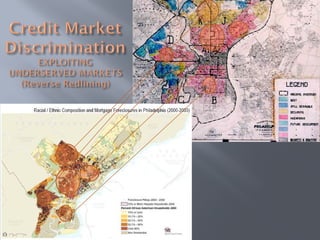

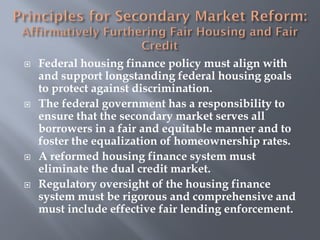

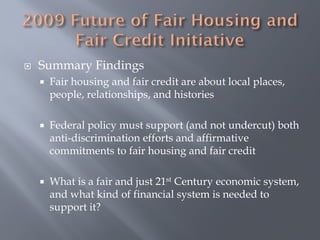

The document discusses the interconnected issues of fair housing and fair credit. It notes that unequal dual housing and credit markets developed together due to discriminatory policies like redlining. Moving forward, the document argues that reforming the financial system requires addressing its racial inequities and ensuring all communities have access to fair and affordable credit. Local context matters, so solutions require input from communities most affected by lending abuses and lack of access to financial services and homeownership opportunities.