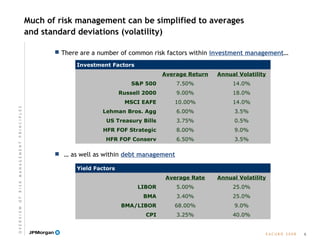

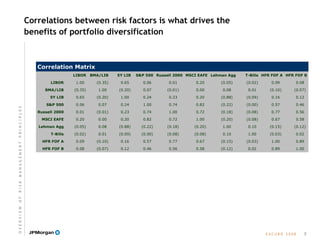

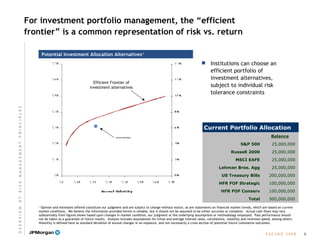

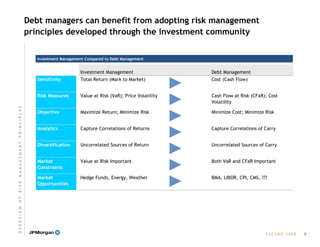

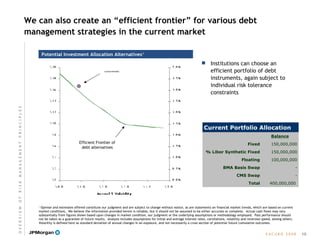

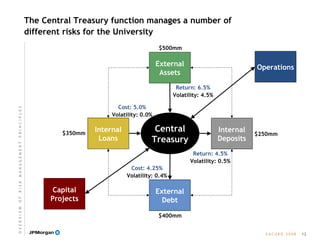

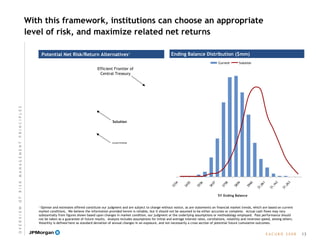

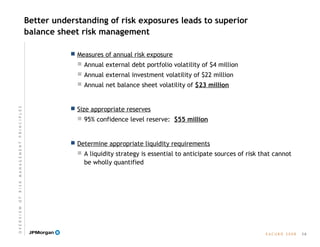

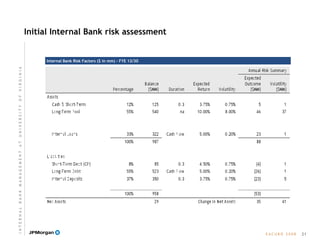

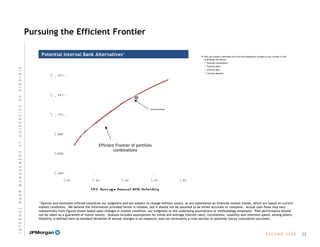

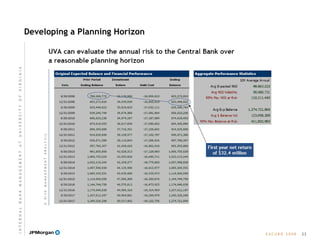

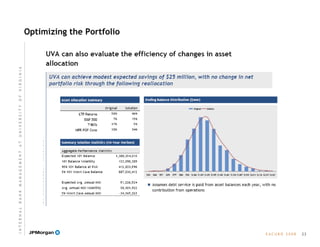

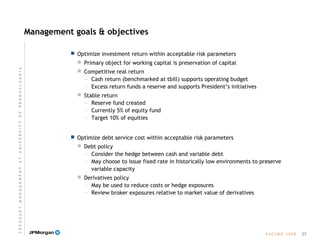

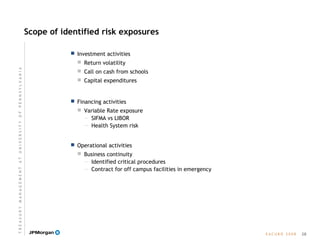

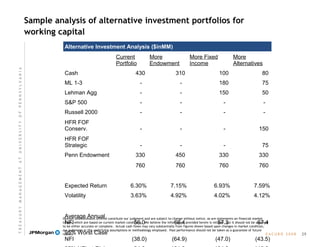

This document discusses balance sheet risk management for universities. It provides an overview of common risks such as financing, investment, operational and construction risks that institutions face. It emphasizes quantifying exposures through measures like expected outcomes, volatility and correlations. The goal is to manage risk versus return, accept appropriate risk levels and maximize financial performance while planning for downside scenarios. Simple tools from investment management like analyzing averages, standard deviations and correlations can help simplify risk management. Constructing efficient frontiers can also help institutions optimize portfolios of investments or debt strategies based on their individual risk tolerances.