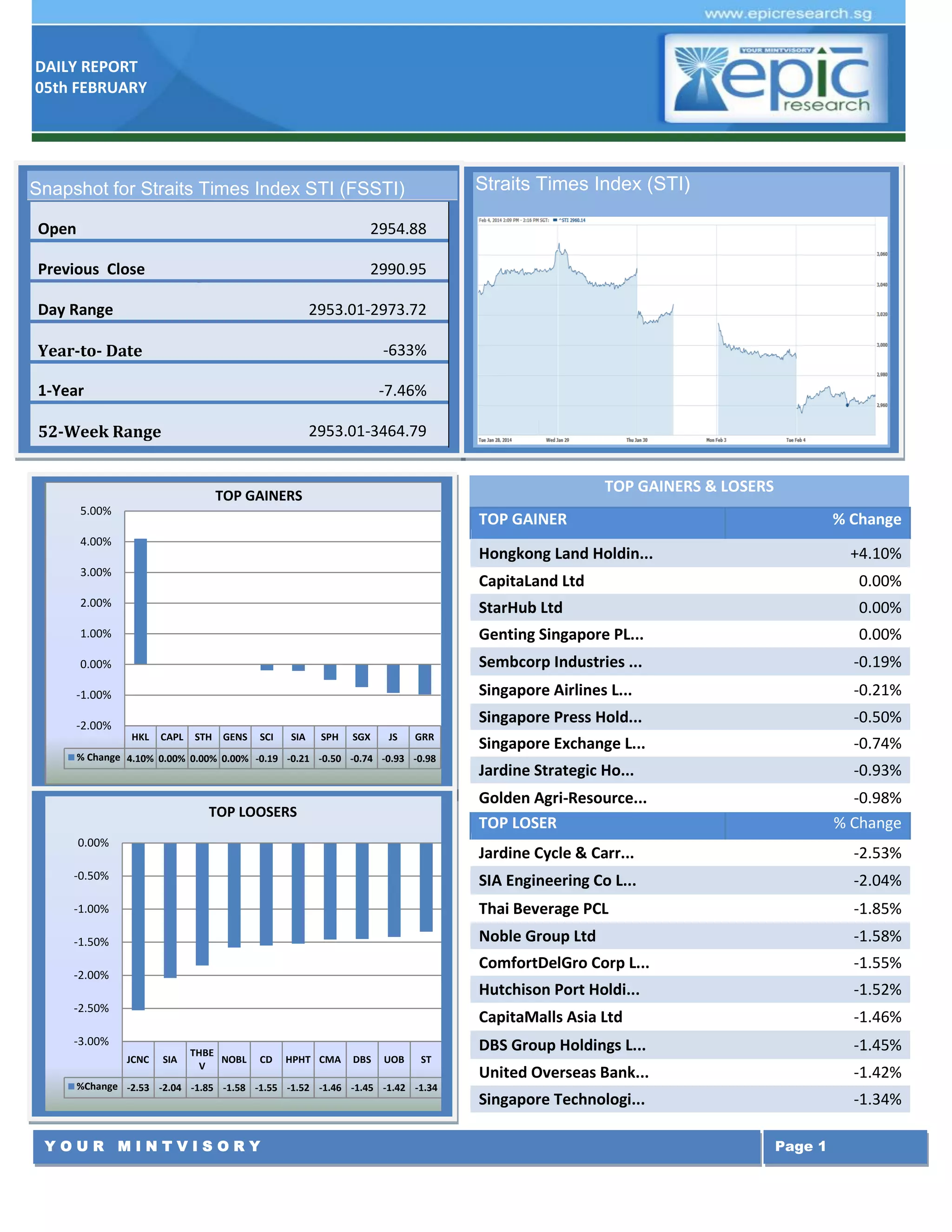

The daily report summarizes the performance of the Straits Times Index and notable top gainers and losers among Singapore stocks. It also provides updates on Singapore banks improving their global brand rankings, new City Direct bus services being launched, and recommends buying Hong Kong Land stock above S$6.12.