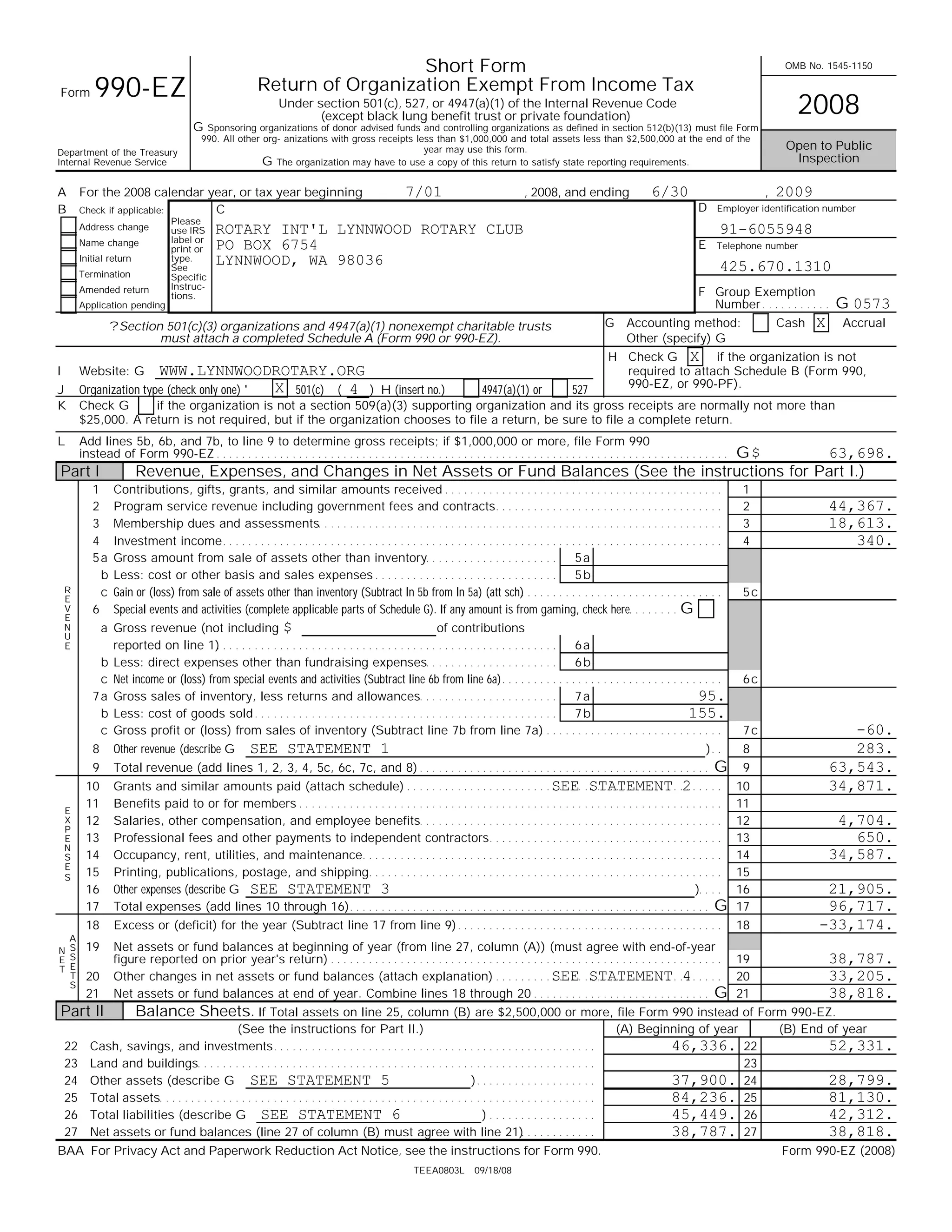

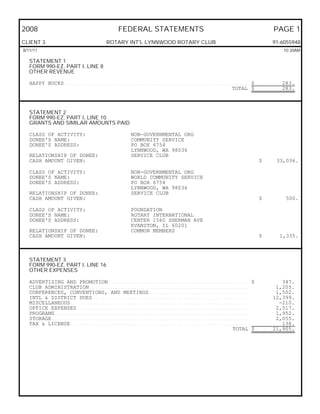

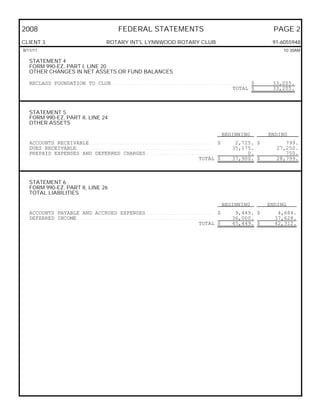

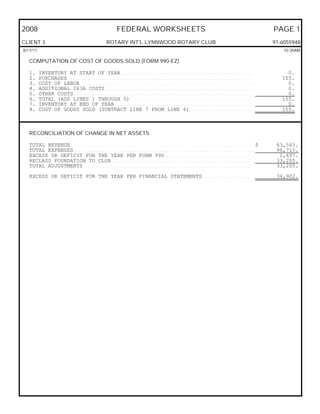

This document is an IRS Form 990-EZ for Rotary International Lynnwood Rotary Club for the 2008 tax year. It provides a summary of the organization's revenues, expenses, and changes in net assets. Revenues were $63,543, primarily from program service revenue, membership dues, and investments. Expenses were $96,717, including $34,871 in grants and $34,587 in occupancy costs. This resulted in a $33,174 deficit for the year. Net assets decreased from $38,787 to $38,818.