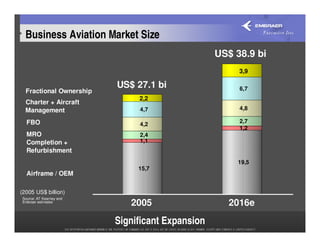

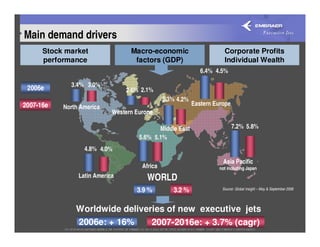

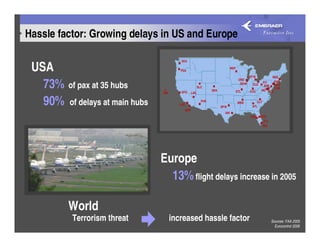

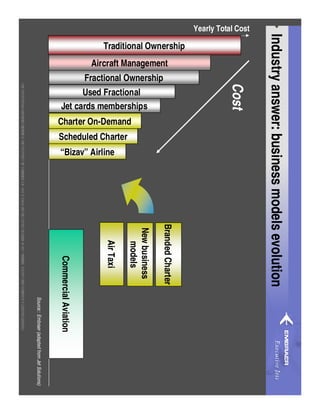

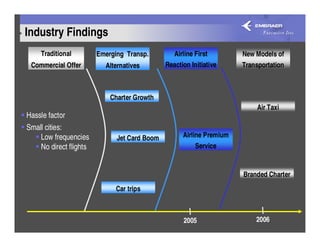

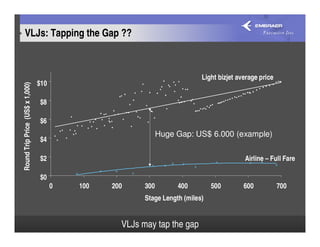

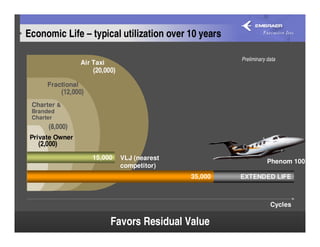

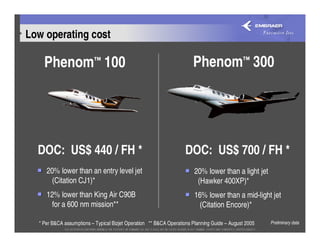

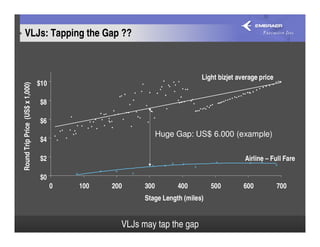

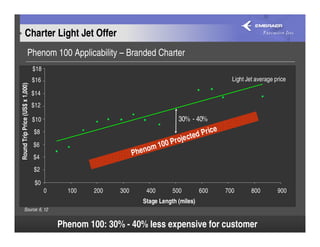

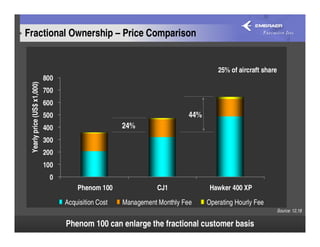

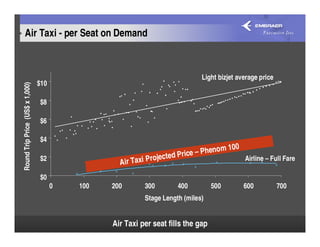

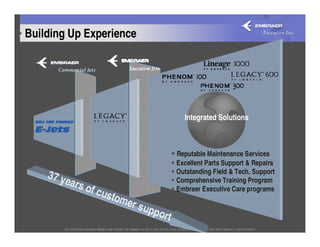

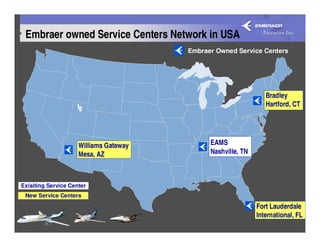

This document discusses UBS's presentation at the 2006 NBAA convention. It begins with a forward-looking statement disclaimer and provides market figures on the size and growth of the business aviation market. It notes drivers of demand growth and issues with increasing delays at major airports in the US and Europe. The document then discusses the evolution of business models in aviation to address rising costs and hassle factors, including fractional ownership, jet cards, air taxi, and branded charter options. It provides a forecast for executive jet deliveries from 2007-2016 and notes very light jets may help address the price gap between commercial and private aviation for small cities and short flights.