Embed presentation

Download as PDF, PPTX

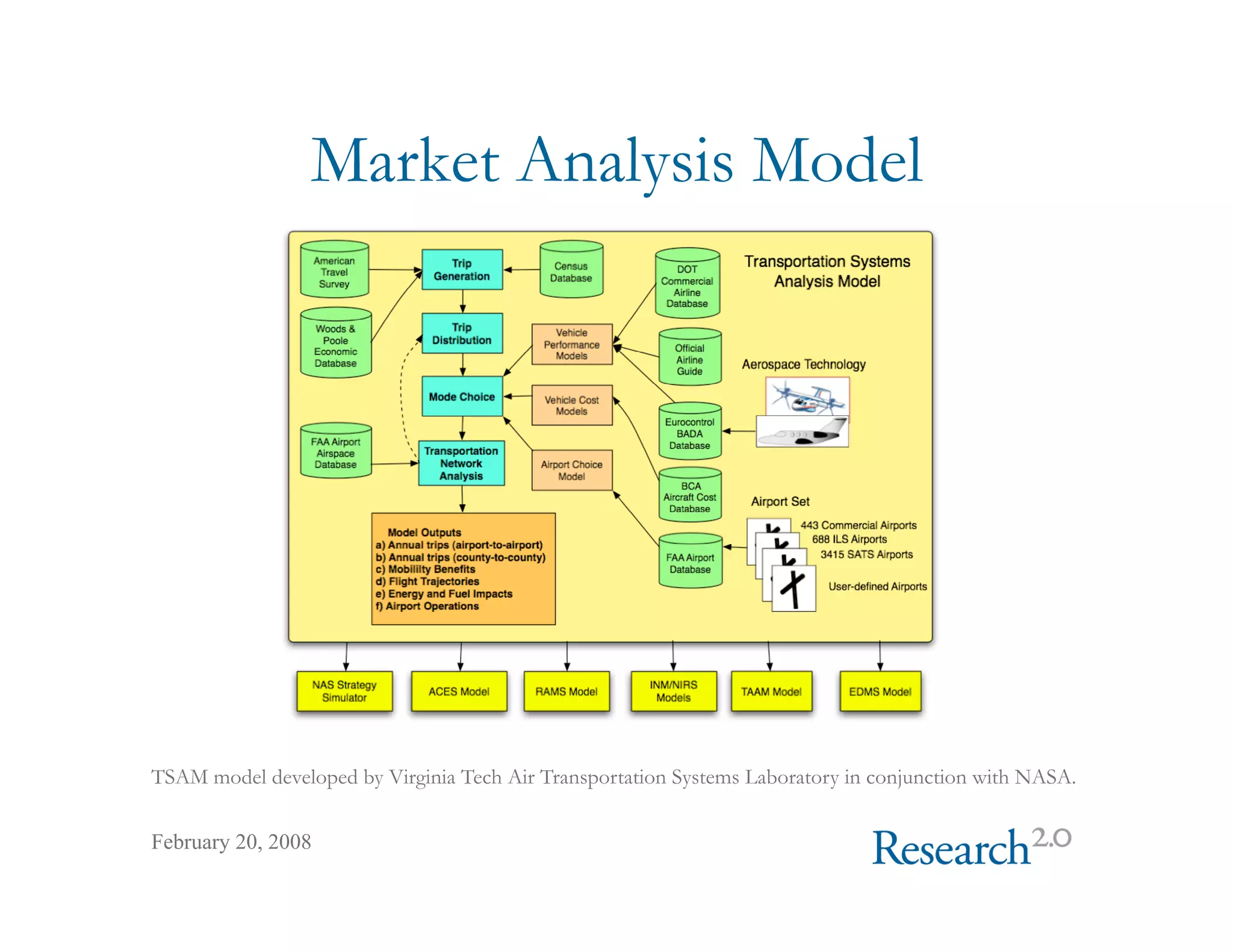

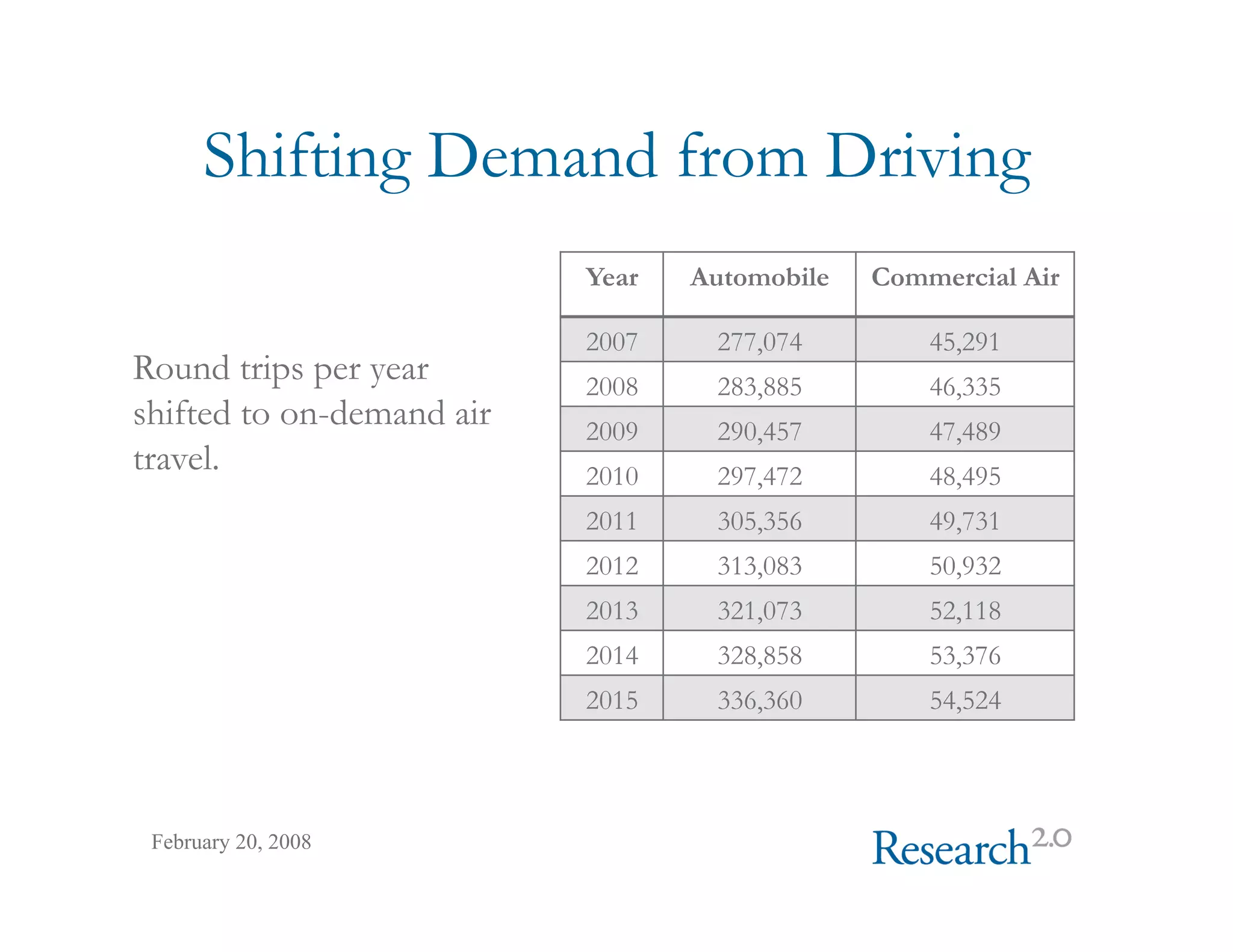

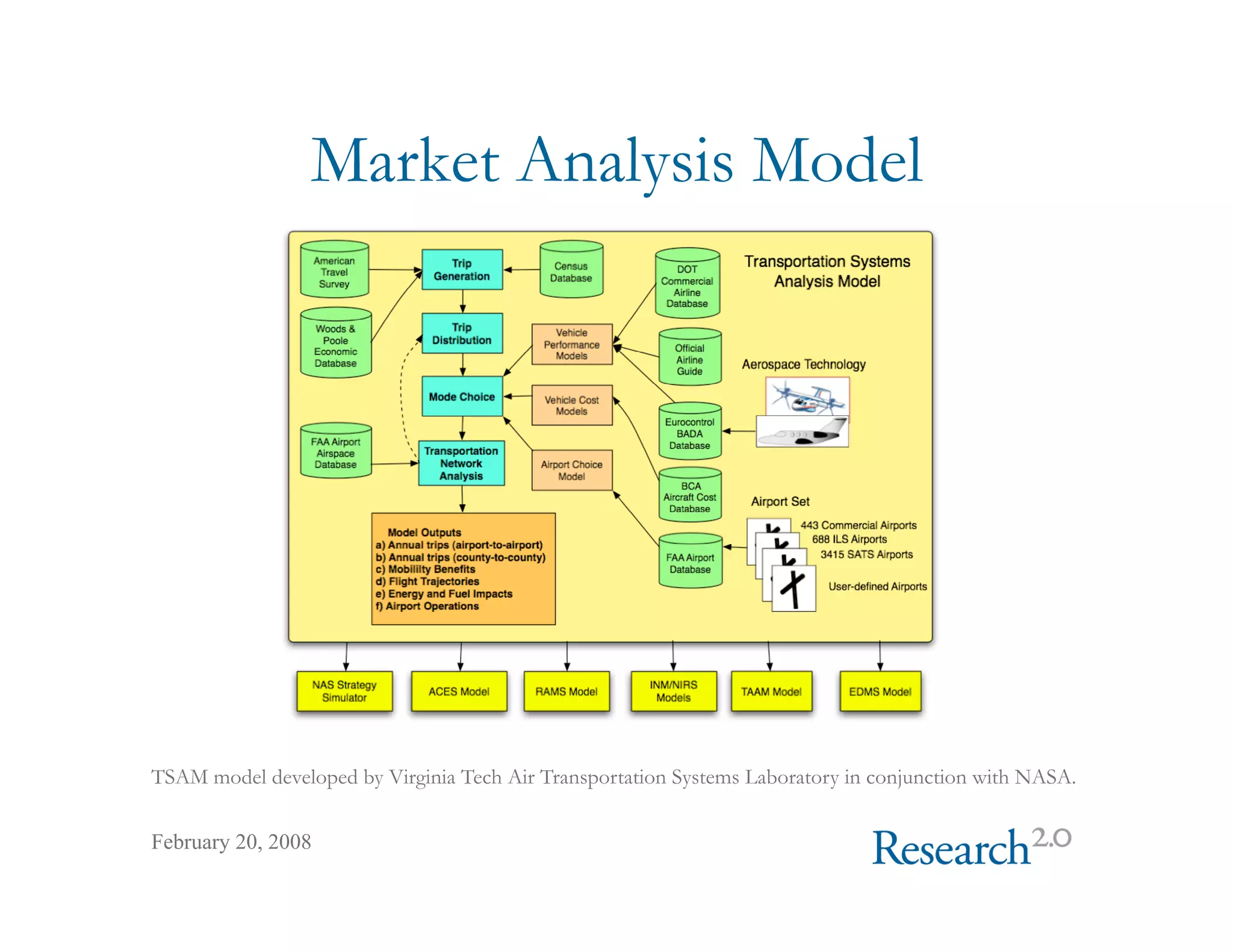

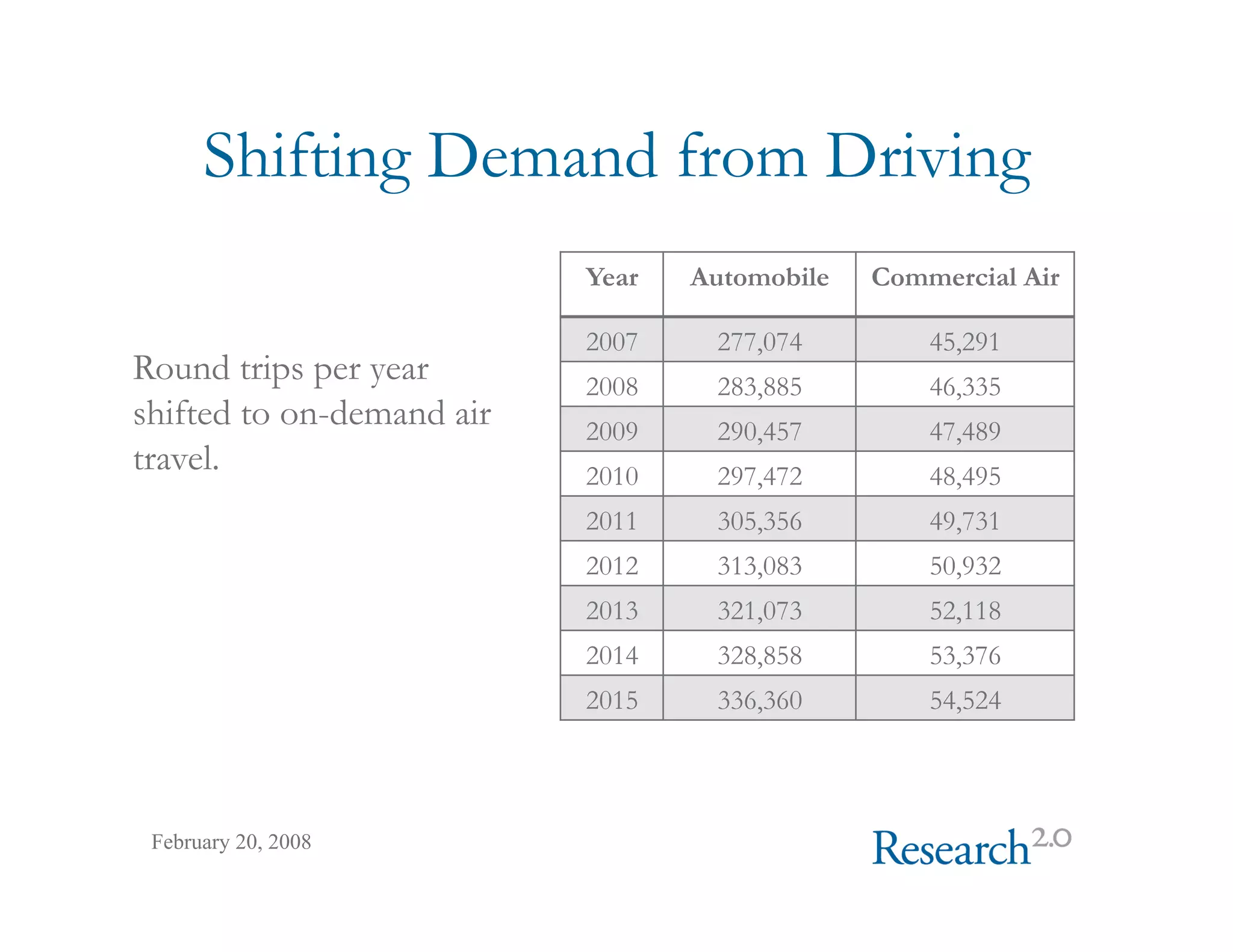

The document discusses the emergence of very light jets (VLJs) in the on-demand air travel market, which aims to bridge the gap between commercial airlines and private jet ownership. It highlights significant demand in the Northeastern U.S., the economic advantages of VLJs, and the success of existing operators. The document also outlines market growth forecasts and various challenges facing the VLJ industry, including production, certification, and financing issues.