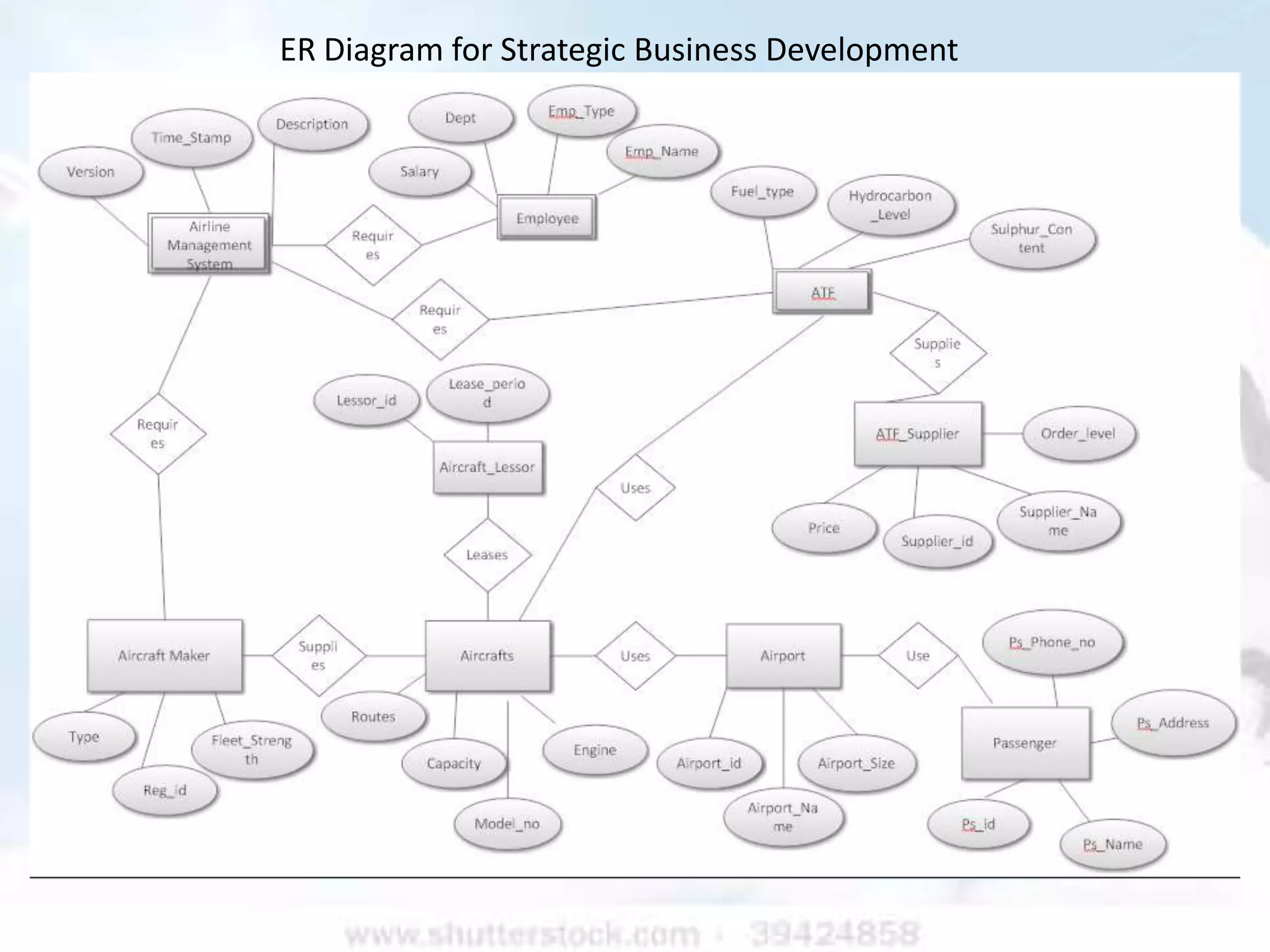

The document provides information on an airline company's current operations, objectives, business model, challenges and strategic management. Currently, the airline operates low-cost domestic flights in South India with 5 aircraft. It aims to expand pan-India in phases, adding routes and aircraft. The business model focuses on low costs, affordable prices and operating only Boeing 737 aircraft on lease. Key challenges include competition, capital requirements, and retaining employees.