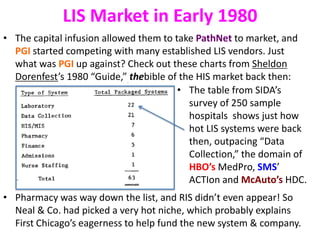

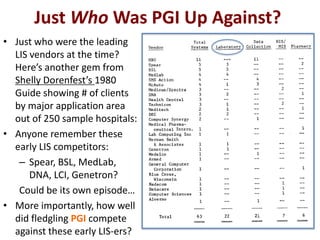

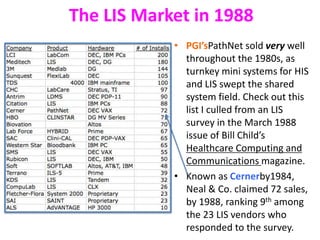

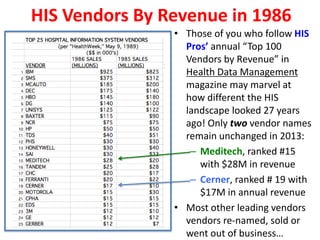

This document summarizes the early history of Cerner, formerly known as PGI. It discusses how PGI entered the healthcare IT market in the early 1980s by developing a laboratory information system (LIS) called PathNet. PGI was able to win its first contract with St. John Medical Center in Tulsa by automating their entire lab operations with PathNet. PathNet was then implemented at three other pilot sites. This success allowed PGI to raise venture capital and begin competing with established LIS vendors at the time like Spear, BSL, and MedLab. By 1988, PGI, now known as Cerner, had grown to 72 LIS sales, ranking them 9th among LIS vendors.