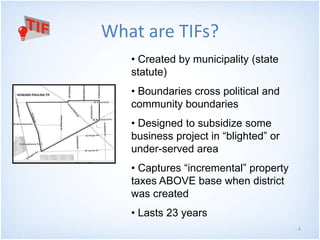

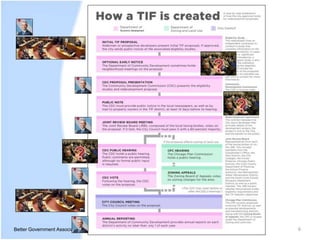

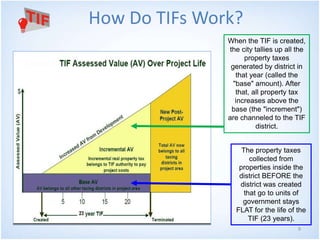

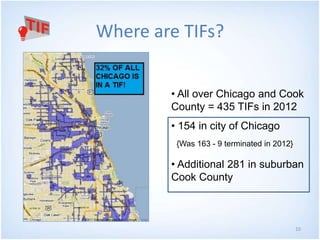

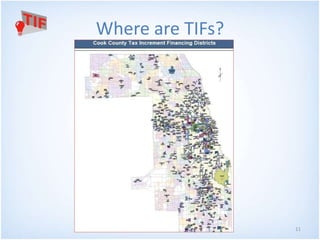

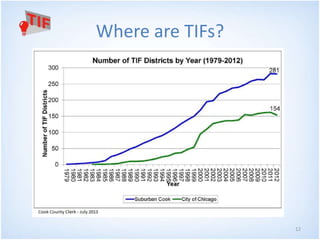

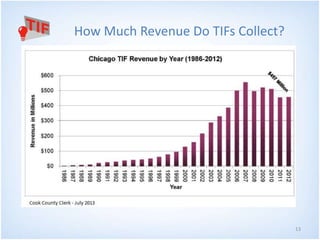

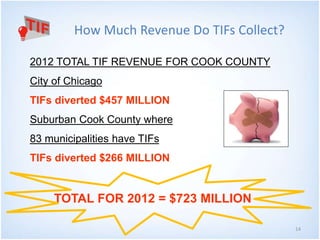

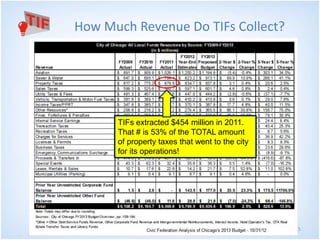

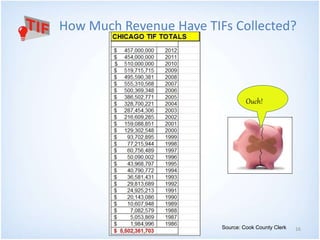

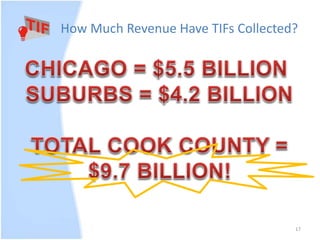

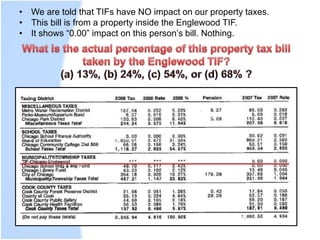

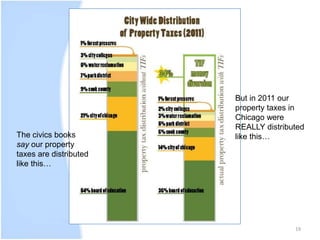

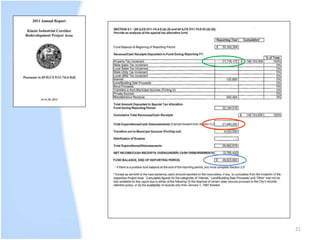

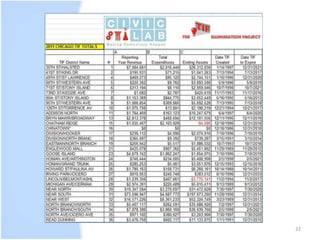

The document provides an overview of Tax Increment Financing (TIF), explaining that it is created by municipalities to support business projects in under-served areas by capturing increased property taxes. As of 2012, there were 435 TIF districts in Cook County, generating significant revenue, including $723 million for the year. It also discusses the impact of TIFs on property tax bills and highlights the large unspent TIF funds at the end of 2011 and 2012.