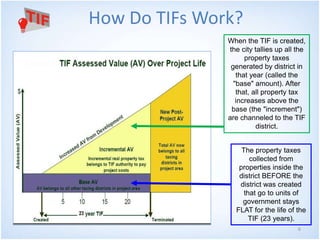

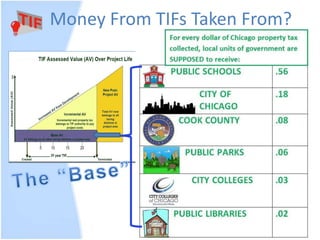

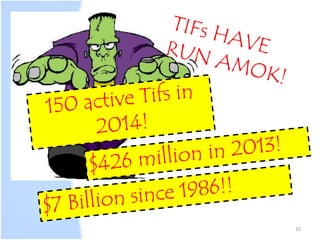

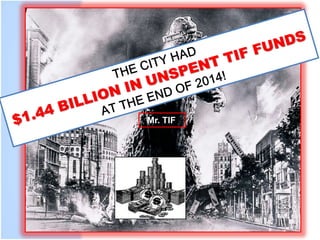

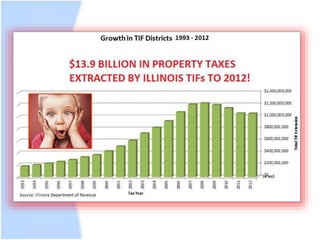

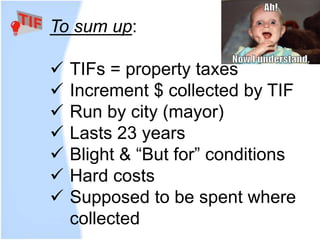

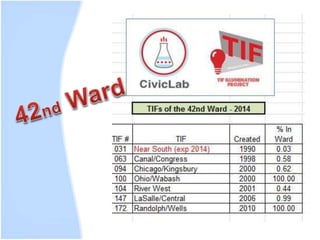

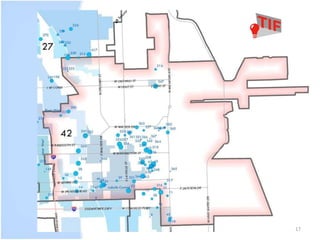

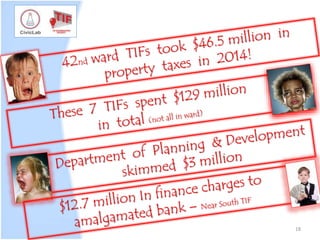

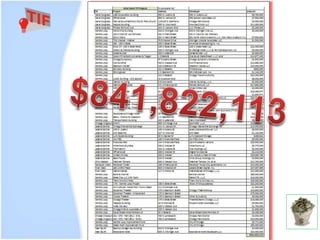

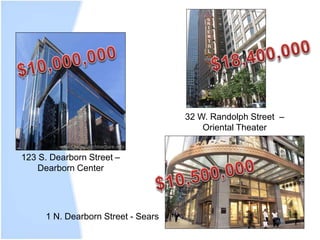

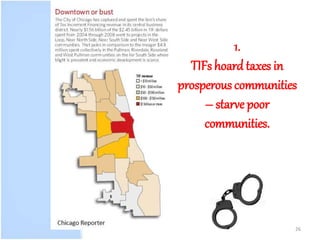

The document discusses Tax Increment Financing (TIF) as a means for municipalities to support business projects in blighted areas by capturing incremental property tax increases for a 23-year period. It raises critical policy questions about the appropriateness of public funding for private businesses, community development definitions, and how TIFs impact wealth distribution between prosperous and poor areas. The authors advocate for more cautious use of incentives, arguing that many incentives fail to deliver expected benefits.