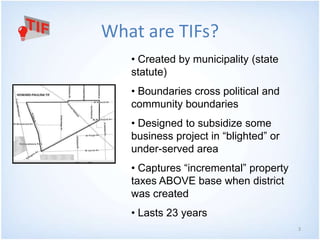

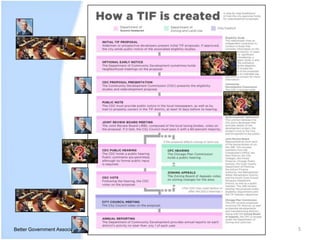

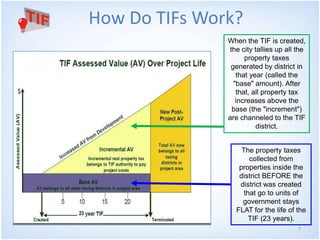

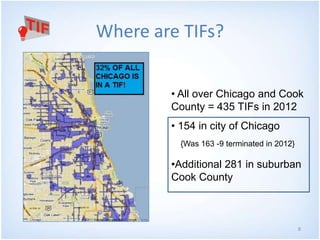

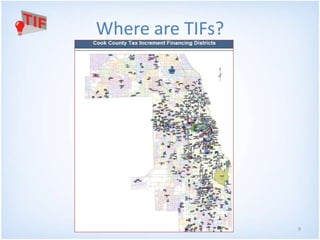

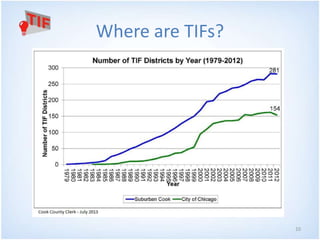

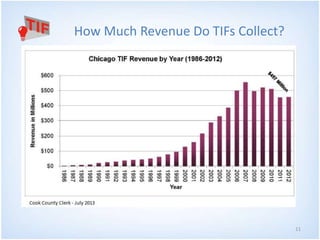

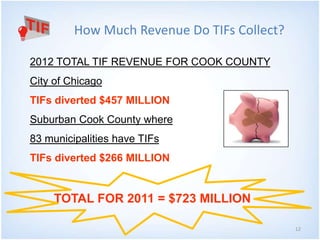

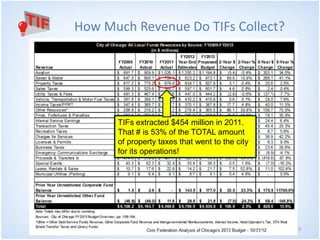

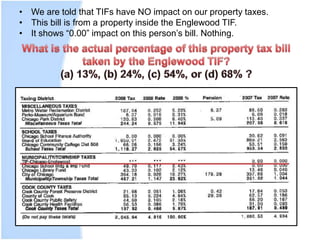

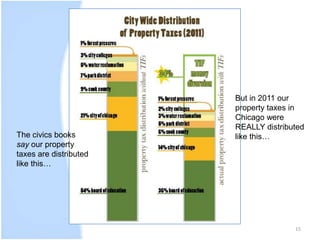

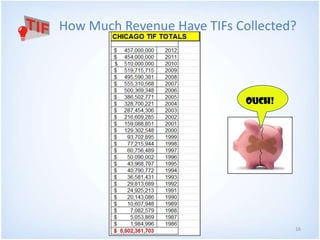

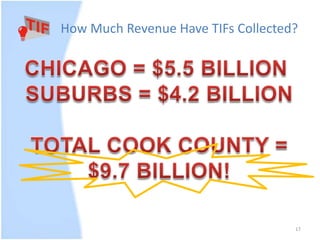

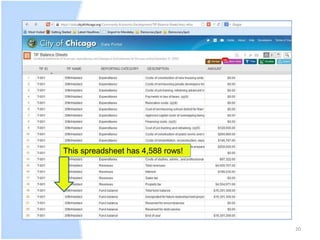

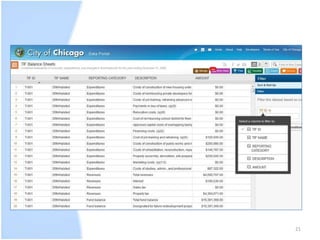

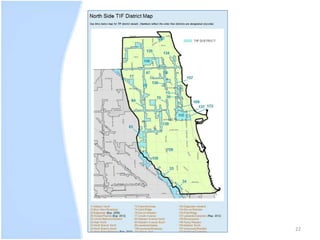

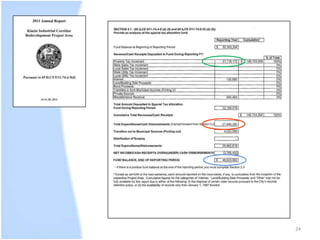

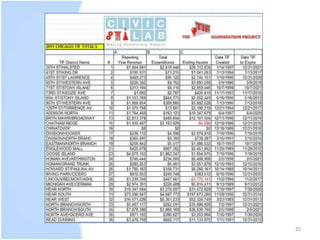

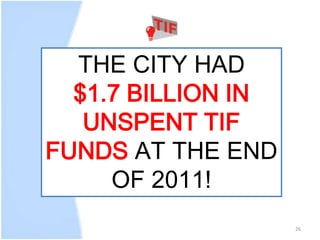

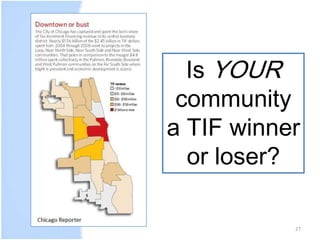

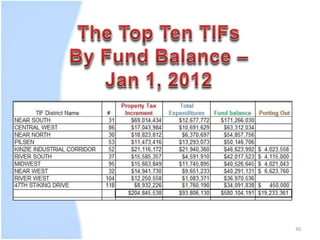

The document explains Tax Increment Financing (TIF) as a municipal tool created to support business projects in underserved areas by capturing increased property taxes over 23 years. In 2012, Cook County had 435 TIFs, collecting $723 million in revenue, with a significant portion claimed from the city of Chicago. The document also discusses the lack of impact on individual property tax bills despite substantial TIF revenue accumulation and highlights the existence of unspent TIF funds.