The document summarizes the latest news from the Business Council of Mongolia. It discusses that USD2.3 billion has been approved for construction of the Oyu Tolgoi project in 2011, which will be the peak year of construction. It also mentions that first ore delivery to the concentrator is targeted to be 6 months earlier than planned, in late 2012. Additionally, it provides details on the principal elements of the 2011 construction program and budget for Oyu Tolgoi totaling USD3.5 billion.

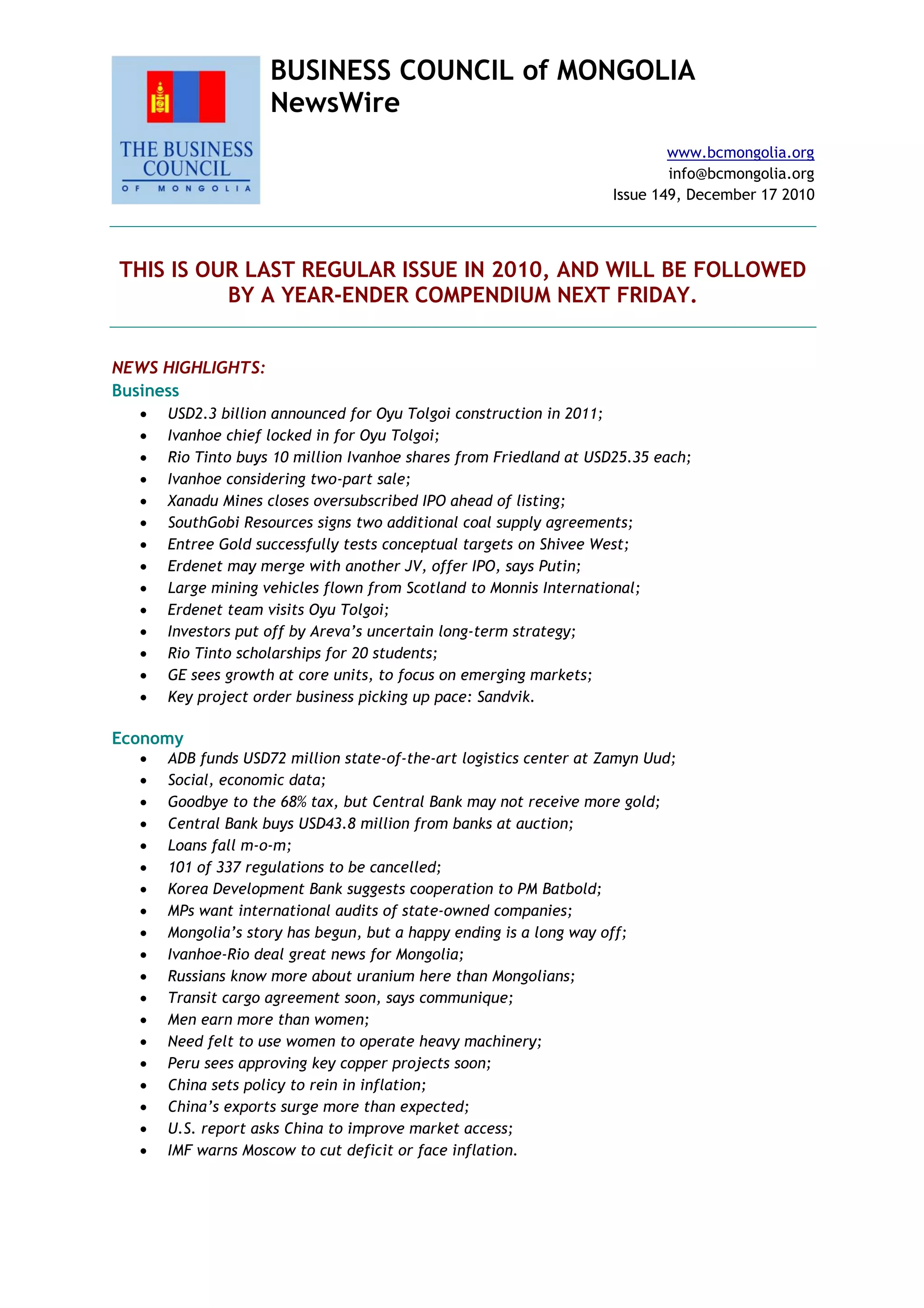

![INFLATION

Year 2006 6.0% [source: National Statistical Office of Mongolia (NSOM)]

Year 2007 *15.1% [source: NSOM]

Year 2008 *22.1% [source: NSOM]

Year 2009 *4.2% [source: NSOM]

November 30, 2010 *11.1% [source: NSOM]

*Year-over-year (y-o-y)

CENTRAL BANK POLICY LOAN RATE

December 31, 2008 9.75% [source: IMF]

March 11, 2009 14.00% [source: IMF]

May 12, 2009 12.75% [source: IMF]

June 12, 2009 11.50% [source: IMF]

September 30, 2009 10.00% [source: IMF]

May 12, 2010 11.00% [source: IMF]](https://image.slidesharecdn.com/bcmnewswireissue149-160216032545/85/17-12-2010-NEWSWIRE-Issue-149-21-320.jpg)