This document summarizes news from the December 11, 2009 issue of the Business Council of Mongolia NewsWire. Key highlights include:

- Mongolia is considering listing state-owned mineral assets on foreign stock exchanges like London and New York to raise cash from its natural resource wealth.

- The newly formed State Bank, which took over operations from the failed Zoos Bank, has appointed a new nine-member board of directors.

- The Mongolian government is discussing issuing a MNT 100 billion bond to support the new State Bank's operations and protect savings accounts.

- Ivanhoe Mines plans to spend USD 758 million in 2010 for construction of the Oyu Tolgoi copper/

![ECONOMIC INDICATORS

MSE WEEKLY REVIEW

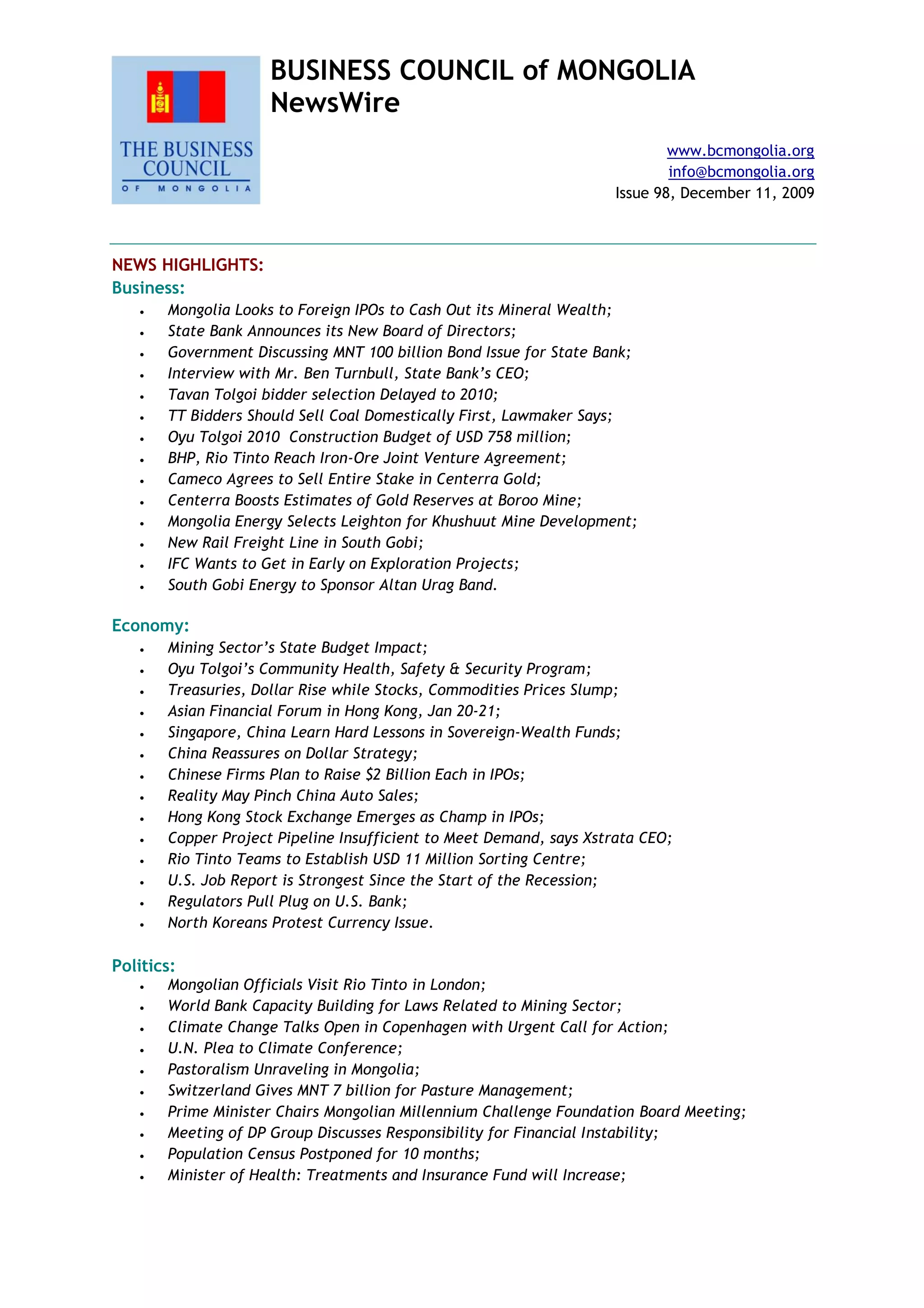

For the week ended December 4, 2009, trading activity on the Mongolian Stock Exchange (MSE)

totaled 17,818,000 shares with 33 companies traded. Total market value of transactions was MNT

1.9 billion. Total market capitalization of the 358 stock companies listed on the MSE was MNT 601.2

billion, and decreased by MNT 4 billion or 0.7% from the previous week.

The Top-20 Index decreased by 114.47 points or 1.8% compared to the previous week, closing at

6,094.96 points. The MSE Composite Index decreased by 19.61 points or 0.6% compared to the

previous week, closing at 3,060.48 points.

Most active stocks traded were: Khuh gan (17,716,000 shares), APU (51,800 shares), and Genco tur

buro (29,000 shares).

Major share price percentage gainers were: Mongol alt (15%), Jinst Uvs (14.4%), and APU (7.3%).

Major share price percentage losers were: UB buk (11.6%), Monnoos (7.7%), Darkhan nekhii (7.4%),

UID (7.4%), and NIC (7.3%).

INFLATION

Year 2006 6.0% [source: National Statistical Office of Mongolia (NSOM)]

Year 2007 *15.1% [source: NSOM]

Year 2008 *22.1% [source: NSOM]

November 30, 2009 *3.5% [source: NSOM]

*Year-over-year (y-o-y)

CENTRAL BANK POLICY LOAN RATE

December 31, 2008 9.75% [source: IMF]

March 11, 2009 14.00% [source: IMF]

May 12, 2009 12.75% [source: IMF]

June 12, 2009 11.50% [source: IMF]

September 30, 2009 10.00% [source: IMF]

CURRENCY RATES – December 10, 2009

Currency name Currency Rate

US dollars USD 1460.88

Euro EUR 2149.39

Japanese yen JPY 16.62

British pound GBP 2367.14

Hong Kong dollar HKD 188.48

Chinese yuan CNY 213.94

Russian ruble RUB 47.55

South Korean won KRW 1.26

Disclaimer: Except for reporting on BCM’s activities, all information in the BCM NewsWire is

selected from various news sources. Opinions are those of the respective news sources.](https://image.slidesharecdn.com/bcmnewswireissue98-160217020356/85/11-12-2009-NEWSWIRE-Issue-98-18-320.jpg)