The document is a newsletter from the Business Council of Mongolia that provides news highlights from Mongolia in business, economy, and politics. Some of the key business highlights include: Oyu Tolgoi is expected to begin copper and gold production in August 2012; SouthGobi Resources updated coal reserves at Ovoot Tolgoi; and Winsway Coking Coal plans to issue $500 million in senior notes to finance investments including in Mongolia. Economic highlights include a 30% increase in minimum wages and plans for Mongolian citizens to receive shares in Erdenes MGL. Political highlights discuss Mongolia considering nuclear power and investigations related to riots in July 2010.

![mining development, the block cave mining method. "This method requires construction of

significant underground infrastructure prior to ore production," according to Rio Tinto. "In

anticipation of this need, Rio Tinto Technology & Innovation has been engaged in a long running

development program to significantly improve both the safety and speed of constructing

underground infrastructure such as shafts and tunnels."

Mr. David Stewart, chief executive of Leighton Holdings, detailed the involvement the company has

in Mongolia, and its commitment to contribute to the local communities. "The bulk of the mine

workers are local people. We employ 680 local people and we have a long term view at the mine

site." He said the facilities in the country are conducive to successful mining operations and the

company strives to understand and participate in the cultural customs. "When I've been there, I've

been very impressed with the airport, phone service, and the camp site was extraordinary. There

are 35 ethnic groups and 45 religions, and they work in every province in the country.‖ Mr. Stewart

said the weather conditions in Mongolia often presented a challenge. "The environment is harsh,

and temperatures range from minus 40 to plus 40."

Mr. Ch. Khashchuluun, Chairman of the National Development and Innovation Committee in

Mongolia, said one of the benefits of Mongolian mining is the type of people who are available to

work there. "Mongolia has a very young population," he said, adding that with the movement of the

new growth areas, the nation is in need of infrastructure and investment in schools, hospitals and

other necessary services.

Mr. Sloane said a World Bank economist estimates the Mongolian Government will need to invest

around AUD4 billion in infrastructure over the next decade, which is set to cause headaches as the

budget of the Government is around the same size as the city of Brisbane. According to Mr.

Khashchuluun, 800 km of railway is planned for 2011, and 3,000 km more over the next four years.

Some 600 km of specialized highways and truck auto roads for mining is also in the planning, as well

as copper smelting, gold refining, coal processing and oil processing plants and facilities.

At Tavan Tolgoi, there is a plan to build an 11,000-km railway to Russia, despite it being only 300

km from China, so as not to be dependent on the Chinese. Mr. Sloane explained that the Mongolians

―are wary of both the Russians and the Chinese, but are hedging their bets, and would actually like

to turn some of its thermal coal into electricity after which it could export the power generated."

Mr. George Lhagvaa, managing director of Hunnu Coal, perfectly demonstrated the extent of the

mining boom in Mongolia at the forum, when he told of a conversation with his mother. "The other

day my 70-year-old mother wanted to discuss how mining affects Mongolia. That shows its impact

on the country's economy," he said. "Growth in Mongolia can be compared to growth in the Western

Australian mining regions."

Mr. Rod Commerford, Austrade's Senior Export Advisor, told the forum that Mongolia is at the

beginning of its mining boom, and ―the business opportunities for Australians are huge, because we

are generally viewed more favorably than Canadians and Americans for our direct approach to doing

business‖. Mr. Thornton added that Australian miners dominate the junior miner space.

Source: Australian Mining

ASIAN CITIES’ APPEAL TO WEALTHY INCREASING

Six of the 10 cities worldwide that most appeal to wealthy individuals as places to live and invest

will be located in Asia within a decade, according to research that highlights how the region is

rapidly closing the gap with the west. The 2011 Wealth Report, published on Wednesday by Citi

Private Bank, shows that Shanghai, Mumbai and Beijing are expected to shoot up the rankings by

2020, outpacing western rivals. Mumbai – expected to rise from 38th place this year to seventh by

2020 – stands out as one of the fastest movers. Shanghai is forecast to leapfrog Beijing to become

the third-highest ranked city in the world.

New York and London will fight off competition from rapidly growing markets to retain the first two

spots, according to the report, but other European cities – including Paris, Brussels, Berlin and

Frankfurt – are set to experience a decline in popularity.

The increasing appeal of Asian cities reflects the region‘s strong economic growth rates relative to

western markets, as well as high employment levels, lower taxes and ―liveability‖ – their good

education systems and infrastructure. ―When compared [with] other regions, Asia continues to be

an attractive location for global talent, as it offers good job opportunities as well as a relatively

easy environment for family relocation,‖ said Mr. Kwang-Meng Quek, global co-head of real estate

investment at Citi.

The yearly report looks at the attitudes of wealthy individuals based on a survey of 160 of Citi‘s

global wealth advisers. Their views represent about 5,000 investors in 36 countries who are each

worth more than USD100 million on average. Assessment criteria included the level of economic](https://image.slidesharecdn.com/bcmnewswireissue162-160215153601/85/08-04-2011-NEWSWIRE-Issue-162-10-320.jpg)

![Jiabao, the Chinese premier, told reporters last month. The government predicts that headline

inflation will continue to rise and peak around June or July. But official economists made the same

forecast at the start of last year and were proved wrong.

An overabundance of bank credit resulting from the government‘s post-crisis economic stimulus

package is the main cause of inflation, although officials also blamed ―external factors‖ such as

soaring oil prices.

Read more…

As well as raising rates, Beijing has also increased the proportion of deposits that banks must hold

in reserve with the central bank nine times since the start of last year in an attempt to limit the

amount they can lend. Large banks in China are now subject to required reserve ratios of at least

20 per cent.

Analysts remain divided on whether China‘s economy is slowing or if more concerted action is

needed to avoid overheating and runaway inflation. The Chinese economy grew 10.3 per cent last

year and Beijing has announced plans to bring the headline rate down while trying to encourage

more balanced and sustainable growth.

Source: The Financial Times

POLITICS

MONGOLIA SOUNDED ABOUT STORING NUCLEAR FUEL SPENT ELSEWHERE

The Obama administration has held informal talks with Mongolia about the possibility that the

Central Asian nation might host an international repository for its region's spent nuclear fuel, a

senior U.S. diplomat said last week. U.S. Energy Department officials and their counterparts in

Ulaanbaatar are in the early stages of discussion and there has been no determination yet about

whether to proceed with the idea, according to Mr. Richard Stratford, who directs the State

Department's Nuclear Energy, Safety and Security Office.

Speaking at the biennial Carnegie International Nuclear Policy Conference, Mr. Stratford said a

spent-fuel depot in the region could be of particular value to Taiwan and South Korea, which use

nuclear power but have few options when it comes to disposing of atomic waste. "If Mongolia were

to do that, I think that would be a very positive step forward in terms of internationalizing spent-

fuel storage," he said during a panel discussion on nuclear cooperation agreements. "My Taiwan and

South Korean colleagues have a really difficult time with spent fuel. And if there really was an

international storage depot, which I have always supported, then that would help to solve their

problem."

The United States provides fresh uranium rods to selected trade partners in Asia, including South

Korea and Taiwan. For Mongolia to accept and store U.S.-origin spent fuel from these or other

nations would require Washington to first negotiate a nuclear trade agreement with Ulaanbaatar.

Although Energy Department officials have reportedly engaged in informal talks with Mongolian

representatives for several months, Mr. Stratford has not yet had any contact with Ulaanbaatar on

the matter, he said. It is not yet certain whether formal negotiations on a nuclear trade pact will

move forward.

Read more…

Energy Department officials traveled to Mongolia last fall for meetings on the matter, according to

Mr. Mark Hibbs, a senior associate with the Nuclear Policy Program at the Carnegie Endowment for

International Peace. He chaired the discussion on nuclear cooperation. "It was a fruitful discussion,"

Mr. Hibbs said. "They went into some details [but] it was very exploratory."

In most nations, the idea of accepting foreign spent fuel has seemed an anathema. Russian officials

have discussed building an international repository on their territory, but the idea appears to have

faded due to domestic opposition. Nuclear expert Jeffrey Lewis said he wonders if the situation

would be any different in Mongolia. "I think these guys are fooling themselves [if they] believe we

will put a spent-fuel depot in Mongolia. I don't think Mongolia is going to accept being a regional

spent-fuel repository," he said.

Mr. Hibbs said that as "a country that's surrounded by two big powers" -- Russia and China --

Mongolia is "trying to carve a niche out for itself economically in the region". Broadening its

involvement in the nuclear energy sector might serve as just such an economic lever, he said. It

could seek to step up mining of its natural uranium deposits and potentially expand into a wider

array of services, such as providing foreign nations with fresh fuel and then taking back the atomic

waste at a later date, according to regional experts. This type of move would come at a time when

neither Russia nor China has acted on similar concepts for what is termed "leasing" of nuclear](https://image.slidesharecdn.com/bcmnewswireissue162-160215153601/85/08-04-2011-NEWSWIRE-Issue-162-13-320.jpg)

![material.

There could also be interest among officials in and outside the Mongolian government in developing

nuclear power to meet that nation's own growing energy needs, according to some sources.

Ulaanbaatar recently signed a memorandum of understanding with Seoul to cooperate on peaceful

nuclear technologies and expertise. Mr. Lewis, who directs the East Asia Nonproliferation Program

at the Monterey Institute of International Studies, said it was difficult to believe that Mongolia

would find it profitable to enter a field that has been dominated for decades by established nuclear

energy powers such as Russia and France.

"I don't understand why Mongolia wants to be involved in the fuel-cycle business to begin with," he

said. "If I were running Mongolia, I could think of a bunch of other things to spend that kind of

industrial investment on before it came down to fuel-cycle services." Nor would it likely prove

politically palatable for Mongolia to become a final destination for its neighbors' atomic waste, he

argued. "Without some compelling evidence -- like a statement by the government of Mongolia that

they're willing to be the region's nuclear waste dump -- I don't see why anybody thinks they would

do this," Mr. Lewis said.

If Mongolia ultimately does see merit in offering nuclear fuel services, inking a nuclear trade

agreement with the United States would be a shot in the arm, Mr. Hibbs said. "Having the blessing

of the US would be very valuable for them," he said. "Mongolia is emerging as a very Western-

friendly country. ... [Getting] the agreement would basically underscore that the US supports the

development of nuclear energy activities in Mongolia."

Mr. Hibbs said it is highly unlikely that Mongolia is exploring its atomic energy options with an eye

toward eventually developing a nuclear weapon. ―I think it's inconceivable that Mongolia would be

interested in nuclear weapons in the environment that they're in," he said. "It realizes that by being

a member of good standing in the [1970 Nuclear Nonproliferation Treaty], it's better served than

getting involved in a hair-brained arms race with either the Russians or the Chinese."

Mr. Lewis had a slightly different take on the matter. "I don't think Mongolia has any interest in

developing a bomb right now," he said. "But if Mongolia wants to move from uranium mining into

the fuel cycle, that could contribute to an unwelcome spread of sensitive facilities."

Source: Global Security Newswire

NEA OFFICIALS DENY REPORTS ON TALKS ABOUT NUCLEAR FUEL STORAGE

Officials of the Nuclear Energy Authority of Mongolia have denied reports that the U.S.

administration has held any talks with Mongolia about setting up an international storage facility for

the region's spent nuclear fuel. They categorically denied that any agreement has been concluded

with any foreign government, company or individual on the matter.

They have asserted that Mongolia is a signatory to the international nuclear non-proliferation treaty

and is committed to using nuclear energy only for peaceful purposes. Besides, it has a law

prohibiting import or transit through Mongolia to a third country of any form of harmful waste. The

Ministry of Foreign Affairs and Trade will ask U.S. officials about the reports.

Source: News.mn

MONGOLIA WILL CHECK WORLD SENTIMENT BEFORE GOING FOR NUCLEAR POWER PLANT

Mongolia will take its cue from the global reaction to Japan‘s nuclear disaster before continuing

with plans to build atomic power plants, according to the deputy chairman of state-owned nuclear

company Monatom. ―It will depend on how the world community reacts‖ to the accident at the

Fukushima Dai-Ichi nuclear station that occurred last month, Mr. T. Gombo said in an interview in

Singapore. ―We don‘t think it‘s a big problem for the industry as a whole. It may be a little setback

in the timeframe.‖

Mongolia, which has at least 1 percent of the world‘s uranium resources, was planning to start

operating its first nuclear power plant by 2020 and build a nuclear fuel center, Mr. Gombo said.

Russia‘s Rosatom Corp. last year set up a venture with Monatom to mine uranium, used to make

nuclear fuel. Rosatom agreed also to help Mongolia develop its nuclear industry strategy.

Japan‘s situation is unlikely to dampen interest in Mongolian uranium deposits or stop the nation

from working with Japanese nuclear companies, Mr. Gombo said. ―Currently there is not much

foreign investment in the uranium sector, but we expect there would be huge investments because

the superpowers -- U.S, Russia and China -- are all interested and competing with one another,‖ Mr.

Gombo said. Mongolia would favor developing its nuclear industry together with the U.S., France

and Japan, as opposed to its two neighbors Russia and China to ―balance‖ its interests, he said.

Source: Bloomberg](https://image.slidesharecdn.com/bcmnewswireissue162-160215153601/85/08-04-2011-NEWSWIRE-Issue-162-14-320.jpg)

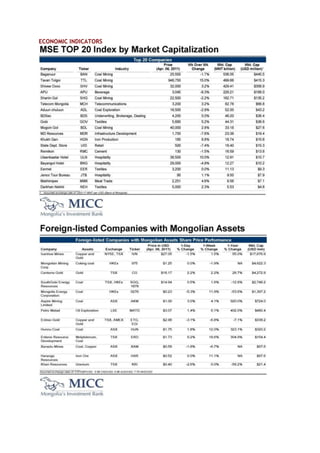

![INFLATION

Year 2006 6.0% [source: National Statistical Office of Mongolia (NSOM)]

Year 2007 *15.1% [source: NSOM]

Year 2008 *22.1% [source: NSOM]

Year 2009 *4.2% [source: NSOM]

February 28, 2011 *11.0% [source: NSOM]

*Year-over-year (y-o-y)

CENTRAL BANK POLICY LOAN RATE

December 31, 2008 9.75% [source: IMF]

March 11, 2009 14.00% [source: IMF]

May 12, 2009 12.75% [source: IMF]

June 12, 2009 11.50% [source: IMF]

September 30, 2009 10.00% [source: IMF]

May 12, 2010 11.00% [source: IMF]

CURRENCY RATES - April 7, 2011

Currency Name Currency Rate

US dollar USD 1,208.55

Euro EUR 1,726.66

Japanese yen JPY 14.18

British pound GBP 1,973.26

Hong Kong dollar HKD 155.47

Chinese Yuan CNY 184.68

Russian Ruble RUB 42.77

South Korean won KRW 1.11

Disclaimer: Except for reporting on BCM‘s activities, all information in the BCM NewsWire is

selected from various news sources. Opinions are those of the respective news sources.](https://image.slidesharecdn.com/bcmnewswireissue162-160215153601/85/08-04-2011-NEWSWIRE-Issue-162-21-320.jpg)