Embed presentation

Download to read offline

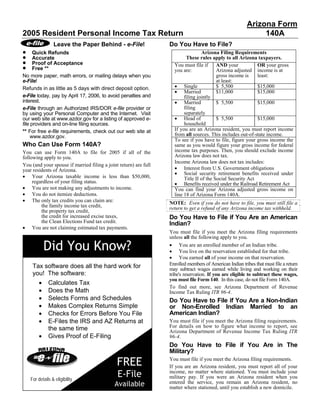

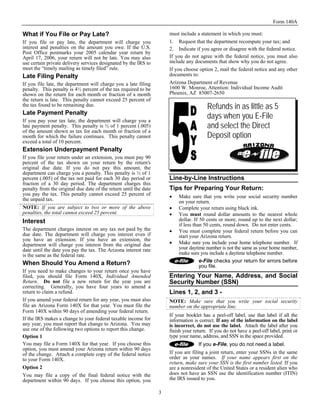

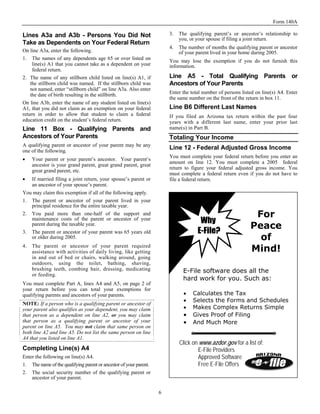

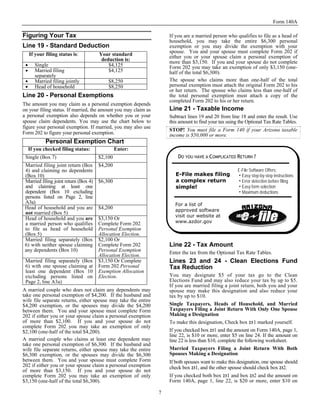

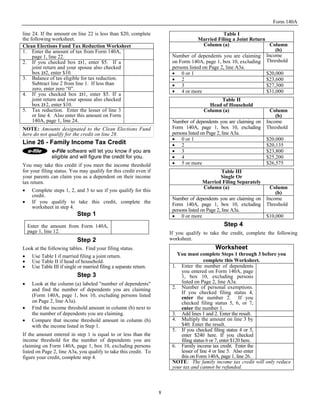

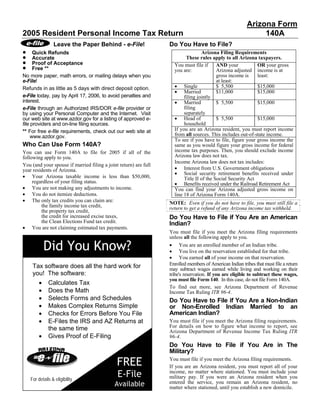

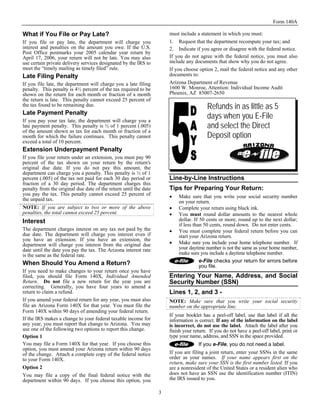

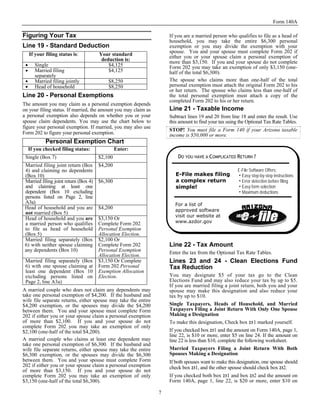

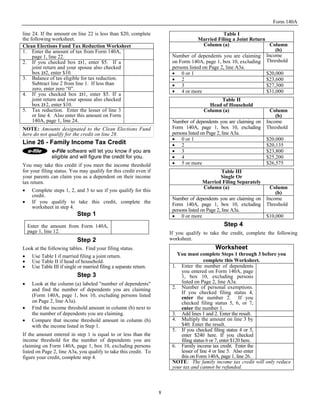

This document provides instructions for completing Arizona's Form 140A personal income tax return for 2005. It outlines who must file, basic filing requirements, definitions of residency, filing dates and penalties. Key points include: - You must file if your Arizona gross income or adjusted gross income is at least $15,000, regardless of your filing status. - Residents must report income from all sources, including out-of-state income. Nonresidents only report Arizona-sourced income. - The deadline for filing is April 17, 2006. Late filers may face penalties including late fees and interest charges. - Free electronic filing is available through the Arizona Department of Revenue website, offering quick