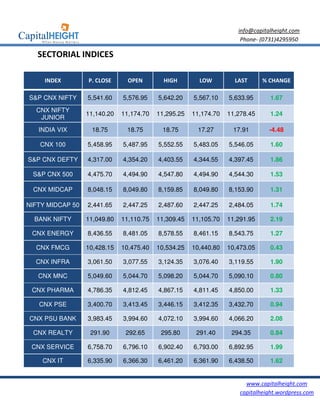

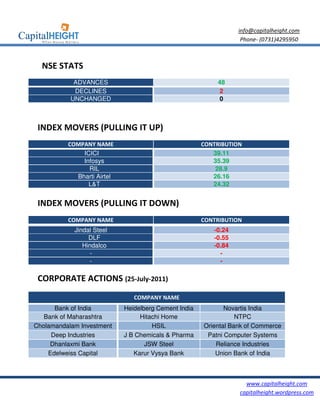

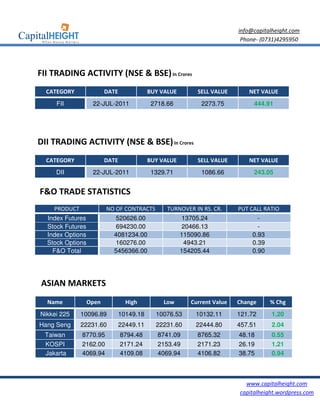

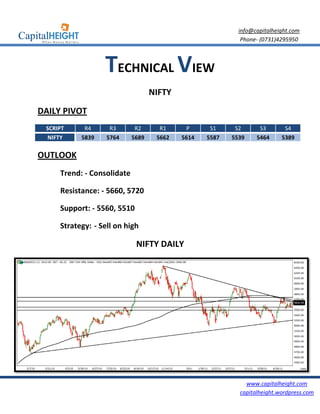

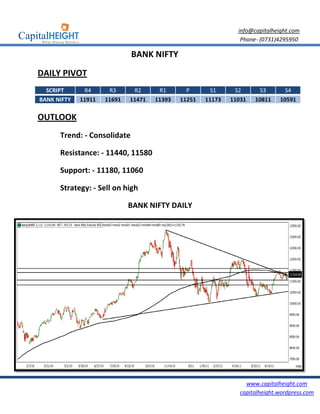

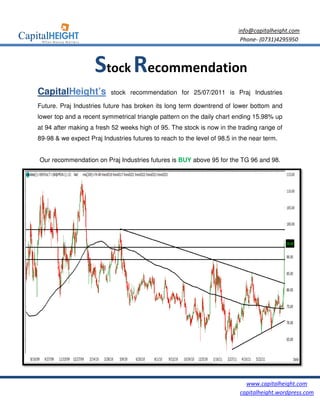

On July 25, 2011, Indian markets closed with significant gains, with the Nifty up 92 points and Sensex up 286 points, driven by positive global cues. European markets also performed well, leading to a robust trading session for Indian indices. The document includes market movers, sector performance, and specific stock recommendations, notably suggesting a buy for Praj Industries futures above 95.