The debtor, Cordillera Golf Club, LLC, filed an application seeking approval to retain GA Keen Realty Advisors, LLC as its real estate advisor nunc pro tunc to the petition date. GA Keen Realty will assist the debtor by raising debt or equity capital to fund a reorganization plan, refinance properties, or sell properties. GA Keen Realty will receive transaction fees ranging from 2-6% of proceeds depending on the type of transaction closed. The application seeks to waive certain fee application requirements and employ GA Keen Realty under an incentive-based fee structure customary for its commercial real estate advisory services.

!["Declaration"), attached hereto as Exhibit A. In further support of the Application, the Debtor

respectfully states as follows:

JURISDICTION

1. The Court has jurisdiction over this matter pursuant to 28 U.S.C. §§ 157

and 1334 and the Amended Standing Order of Reference from the United States District Court

for the District of Delaware, dated as of February 29, 2012. This is a core proceeding pursuant

to 28 U.S.C. § 157(b)(2), and the Court may enter a final order consistent with Article III of the

United States Constitution. Venue is proper in this Court pursuant to 28 U.S.C. §§ 1408 and

1409. The statutory and legal predicates for the relief requested herein are sections 327(a) and

328(a) of the Bankruptcy Code and Bankruptcy Rules 2014 and 2016 and Local Rules 2014-1

and 2016-2.

GENERAL BACKGROUND

2. On June 26, 2012 (the "Petition Date"), the Debtor filed a voluntary

petition for relief under chapter 11 of the Bankruptcy Code. The Debtor has continued in

possession of its properties and has continued to operate and maintain its business as a debtor in

possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code.

3. On July 6, 2012, the Office of the United States Trustee for the District of

Delaware (the "U.S. Trustee") appointed an official committee of unsecured creditors (the

"Committee") [Docket No. 86]. No request has been made for the appointment of a trustee or

examiner in this case.

4. A description of the Debtor's business, the reasons for commencing this

chapter 11 case, and the relief sought from the Court to allow for a smooth transition into chapter

11 are set forth in the Declaration of DanielL. Fitchett, Jr. in support of Chapter 11 Petitions

01:12239656.9

4](https://image.slidesharecdn.com/10000001201-121112192752-phpapp01/85/10000001201-2-320.jpg)

![and First Day Relief[Docket No. 2] (the "First Day Declaration"), filed on the Petition Date and

incorporated by reference herein.2

RELIEF REQUESTED

5. The Debtor has determined, in its business judgment, that it has a need for

a qualified real estate professional to assess the highest and best use of real property that the

Debtor owns in fee (collectively, the "Owned Property") and to assist the Debtor with respect to

the matter set forth in ,-r 10 hereof. 3 The Debtor has also determined that, in its sound business

judgment, the retention and employment of GA Keen Realty, who has substantial experience in

handling real estate and consulting matters in the chapter 11 context, will provide substantial

benefit to the estate because GA Keen Realty is well suited to assist the Debtor and handle the

capital infusion need for its business. Accordingly, the Debtor seeks to employ and retain GA

Keen Realty on the terms and conditions set forth in the retention agreement dated June 13, 2012

(the "Retention Agreement"), a copy of which is attached hereto as Exhibit C.

BASIS FOR THE RELIEF REQUESTED

6. Bankruptcy Code section 327(a) provides, in relevant part, as follows:

[T]he trustee, with the court's approval, may employ one or more

attorneys, accountants, appraisers, auctioneers, or other

professional persons, that do not hold or represent an interest

adverse to the estate, and that are disinterested persons, to

represent or assist the trustee in carrying out the trustee's duties

under this title.

11 U.S.C. § 327(a).

7. Bankruptcy Code section 328(a) provides, in relevant part, as follows:

2Capitalized terms not otherwise defmed herein shall have the meaning attributed to them in the First Day

Declaration.

3 A comprehensive list of the Owned Property is attached as Exhibit A to the Retention Agreement.

01:12239656.9

5](https://image.slidesharecdn.com/10000001201-121112192752-phpapp01/85/10000001201-3-320.jpg)

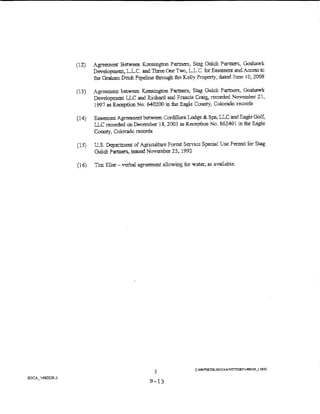

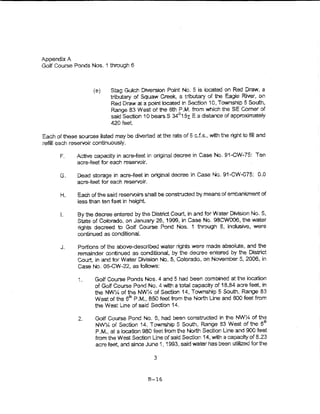

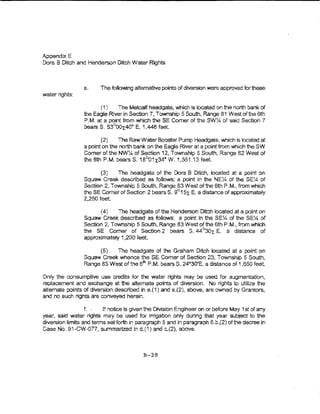

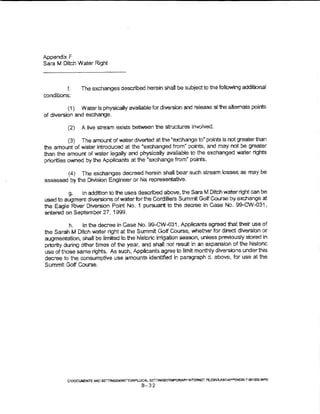

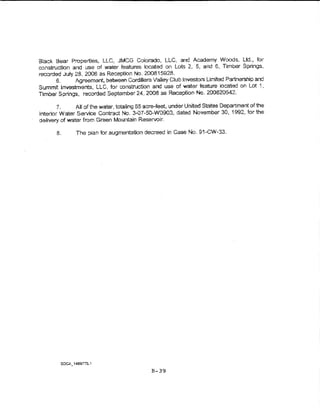

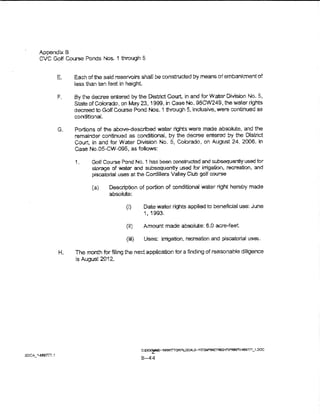

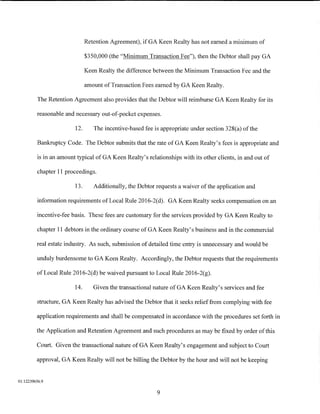

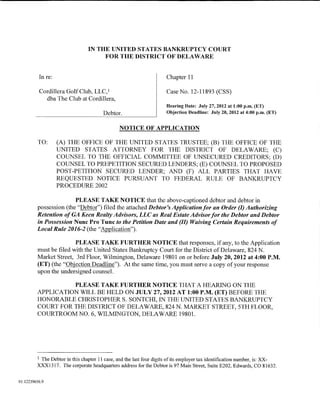

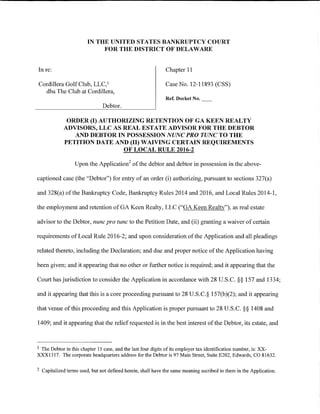

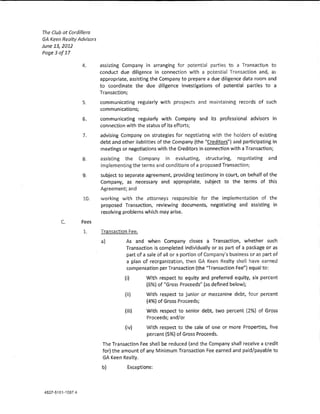

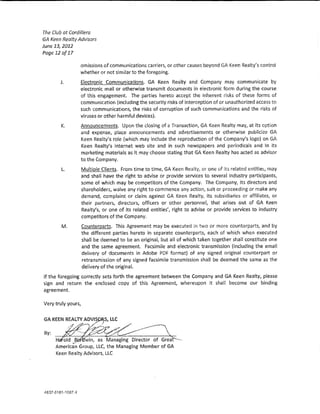

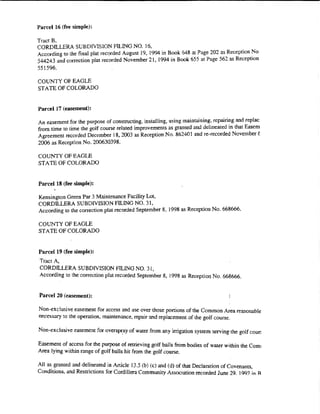

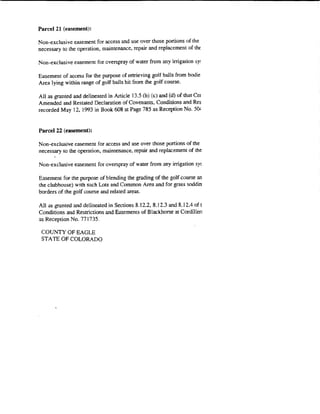

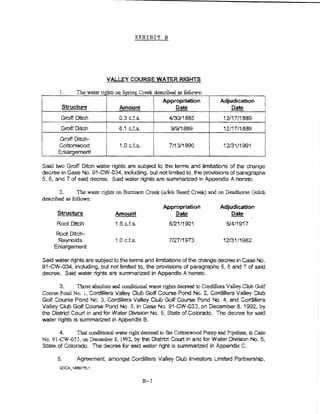

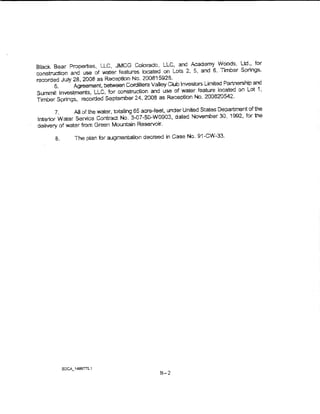

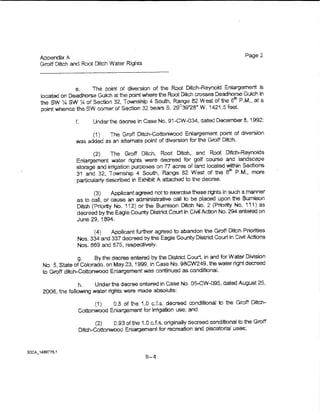

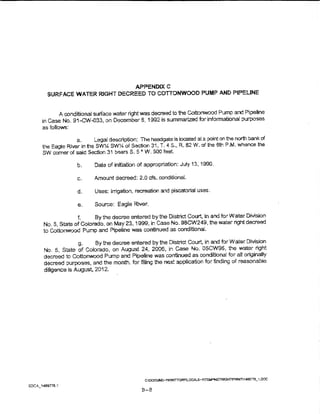

![StJMMIT COURSE, MOtJNTAIN COURSE AND SHORT COURSE WATER R1GHTS

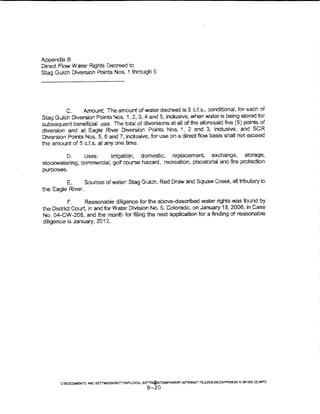

1. Those certain conditional storage water rights decreed in Case No. 91-CW-075 on

January 3, 1992, by the District Court in and for Water Division No. 5, State of Colorado, for the

Golf Course Ponds Nos.. i through 6, inclusive, which vvate:r :rights are sum.marized on Appeudix A

2. Those conditional water rights decreed to Stag Gulch Diversion Point No. l, Stag

GuichDiversion PoinfNo. 2, StagGulchDiversion Point No.3, StagGtllchDiversionPointNo. 4,

and Stag Gulch Diversion Point No.5, in Case No. 91-C,:{.(]76, on January 3, 1992, by the District

Court in and for Water Division No. 5, State of Colorado. Tne decree for said water rights is

summarized in Appendix B hereto.

3. The water right decreed to SCR Diversion Point No. 2, SCR Diversion Point No. 3,

SCR Diversion Point No.4, SCR Diversion Point No.5, and SCR Diversion Point No.6 (the

Graham Ditch headgate) in U!se No. 89-CW-218 on October 11, 1990, by the District Court in and

for Water Division No.5, State of Colorado. Tne water rights decreed to SCR Diversion Point

No.2., SCR Diversion Point No.3, SCR Diversion Point No.4, SCR Diversion Point No.5, and

SCR Diversion Point No.6 are more particularly described in Appendix C hereto.

4. Tne water rights on Squaw Creek descn"bed as follows:

Strnetu.re Antount

Appropriation

~

Adjudication

Date

i

'

'

I

Graham Ditch l 1.5 c.f.s. I 6/22!1904

l

2/27/1911 j

r

Graham Ditch 3.0 c.f.s. 6/i0/1914 J 4tl5/1920 i

Said water rights are subjret to the terms and limitations of the change decree in Case

No. 91-CW~077, including, hut not limited to, the provisions of paragraph 5; pa:ra.graph 6.b.(1),

paragraph 6.c.(3), anrl pa:ragrapb 17. S.aid water rights are SUmmarized on Appendix D hereto.

5. The water rights on Squaw Creek described as follows:

Appropriation i Adjndication

Structure A..mount Date I

I ~

l

Dora B Ditch 1.0 c.fs.. 11/1/1892 lj

6/29/1&94 l

Henderson Ditch 0.90 c..f.s. 2/27/1911 i 6/2&'1907

Sara M Ditch OAO cJ.s. 5/1/i 892 I

!

6/29/1894

B-9](https://image.slidesharecdn.com/10000001201-121112192752-phpapp01/85/10000001201-51-320.jpg)