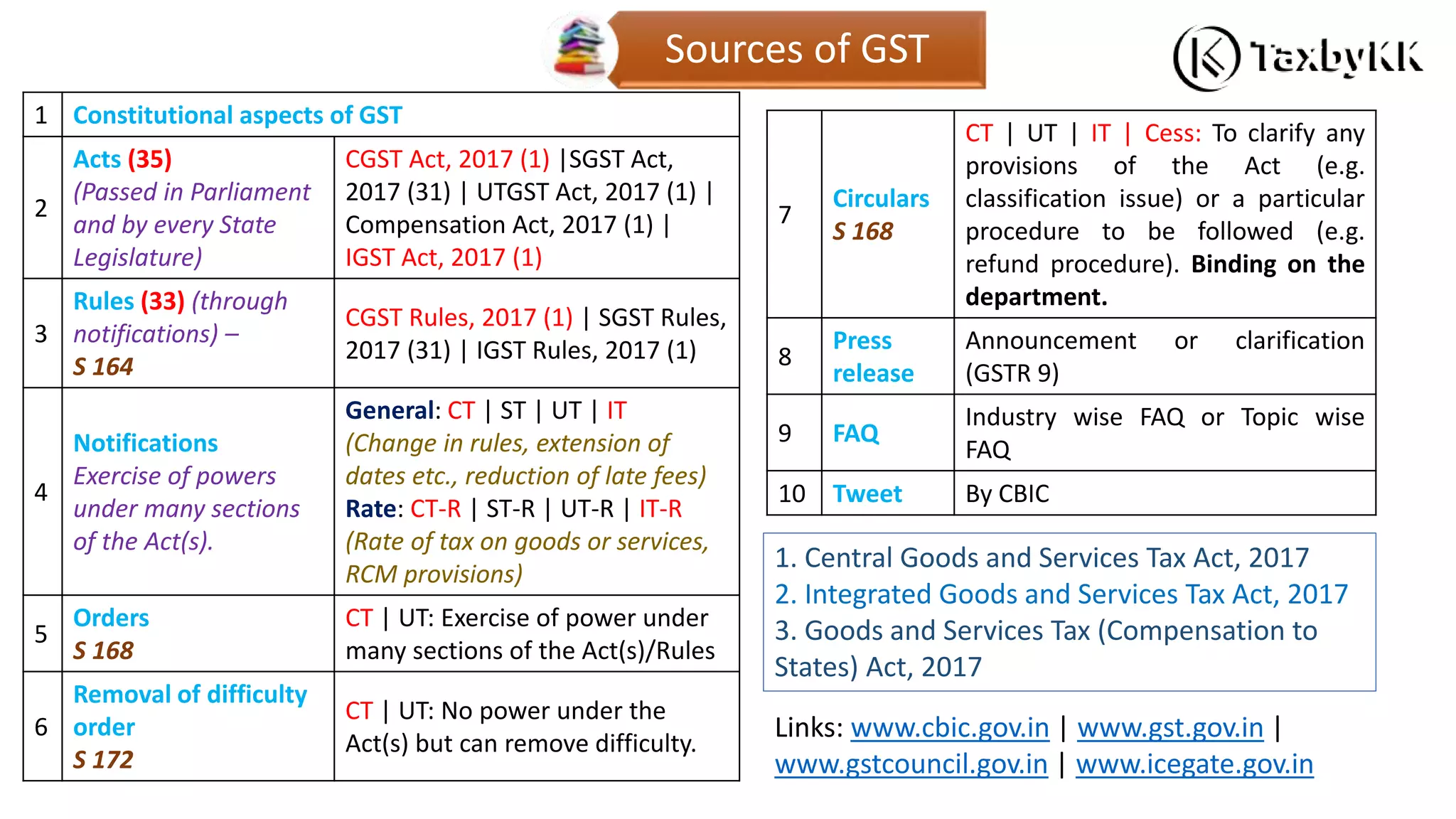

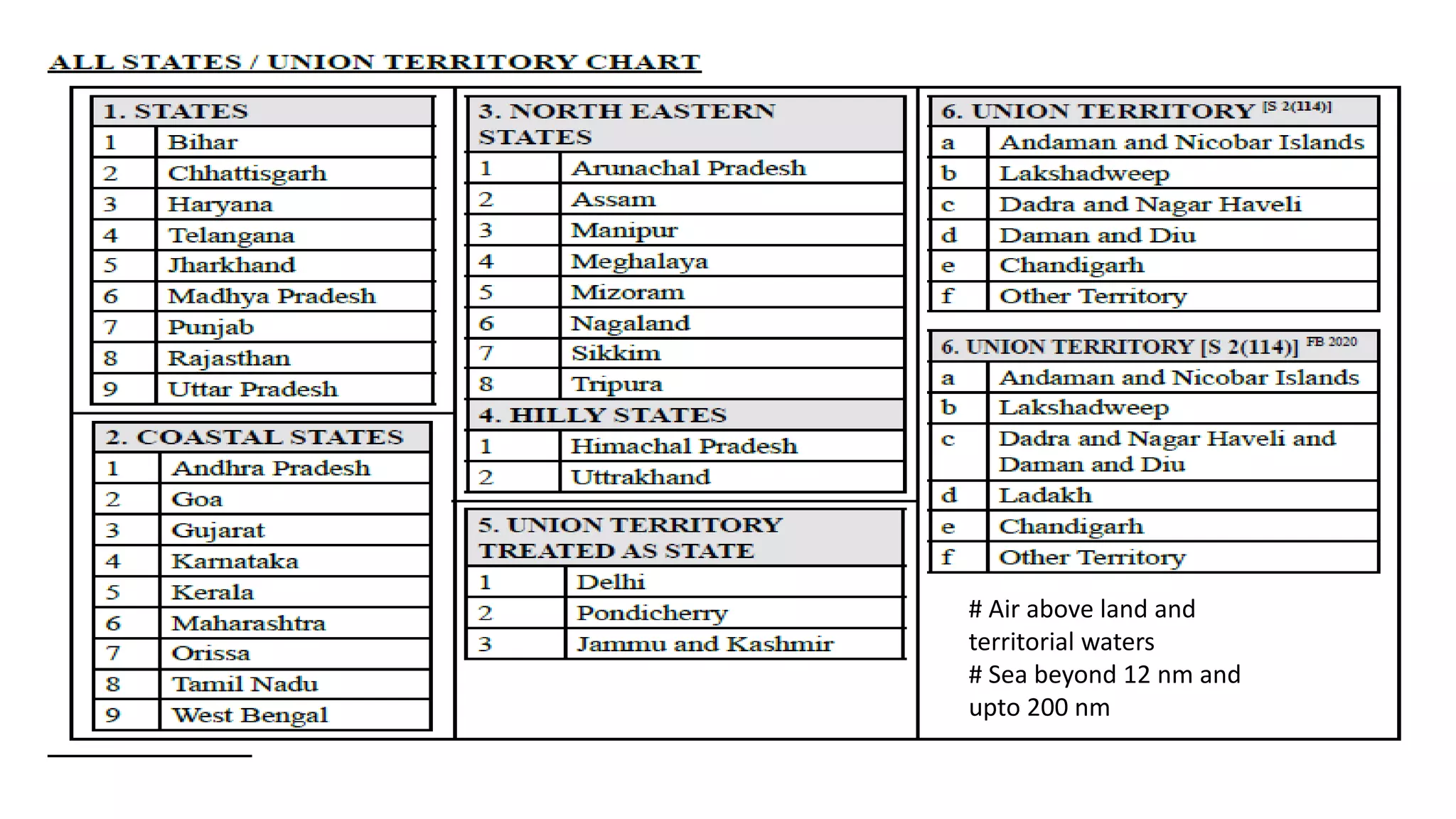

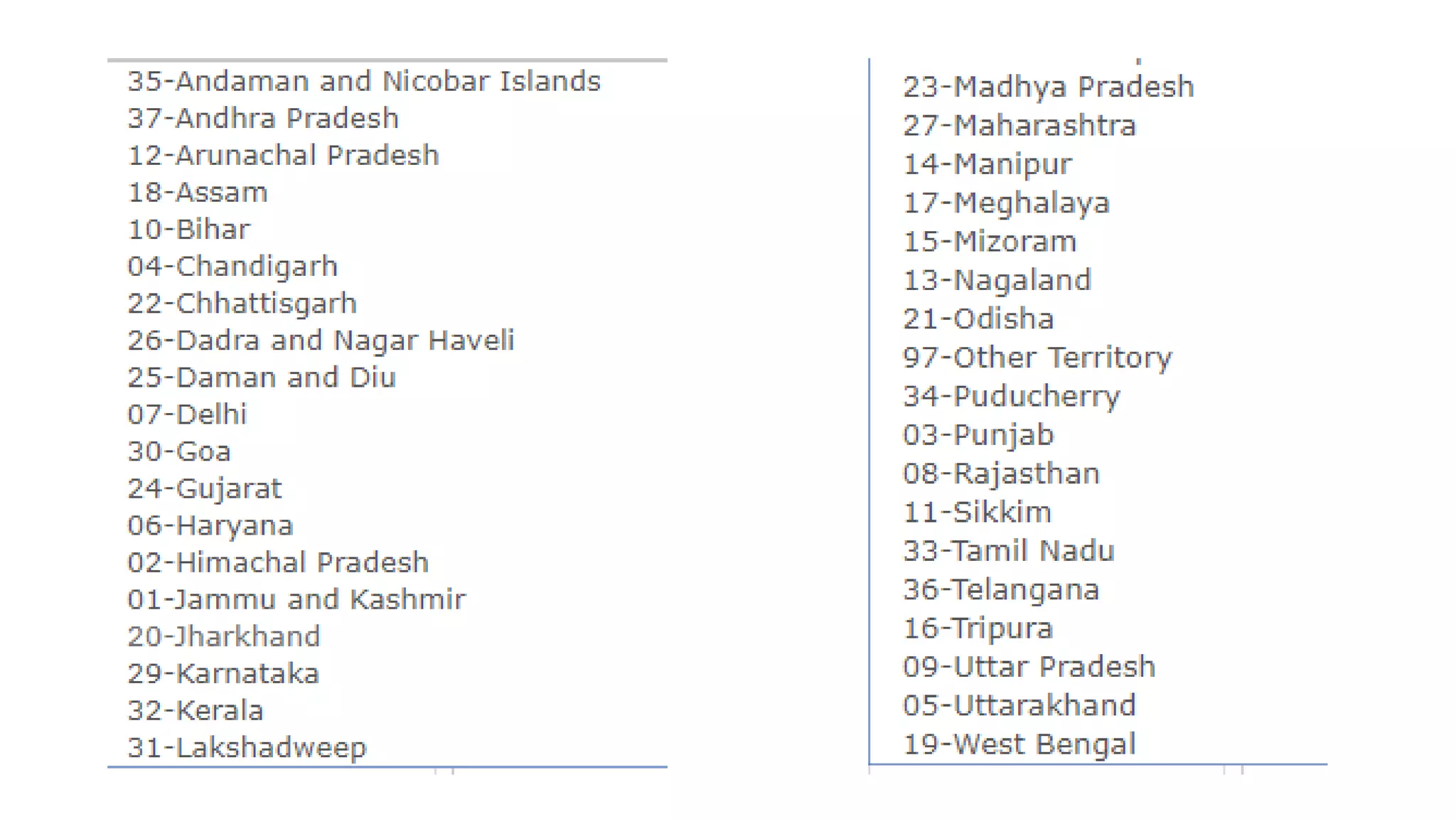

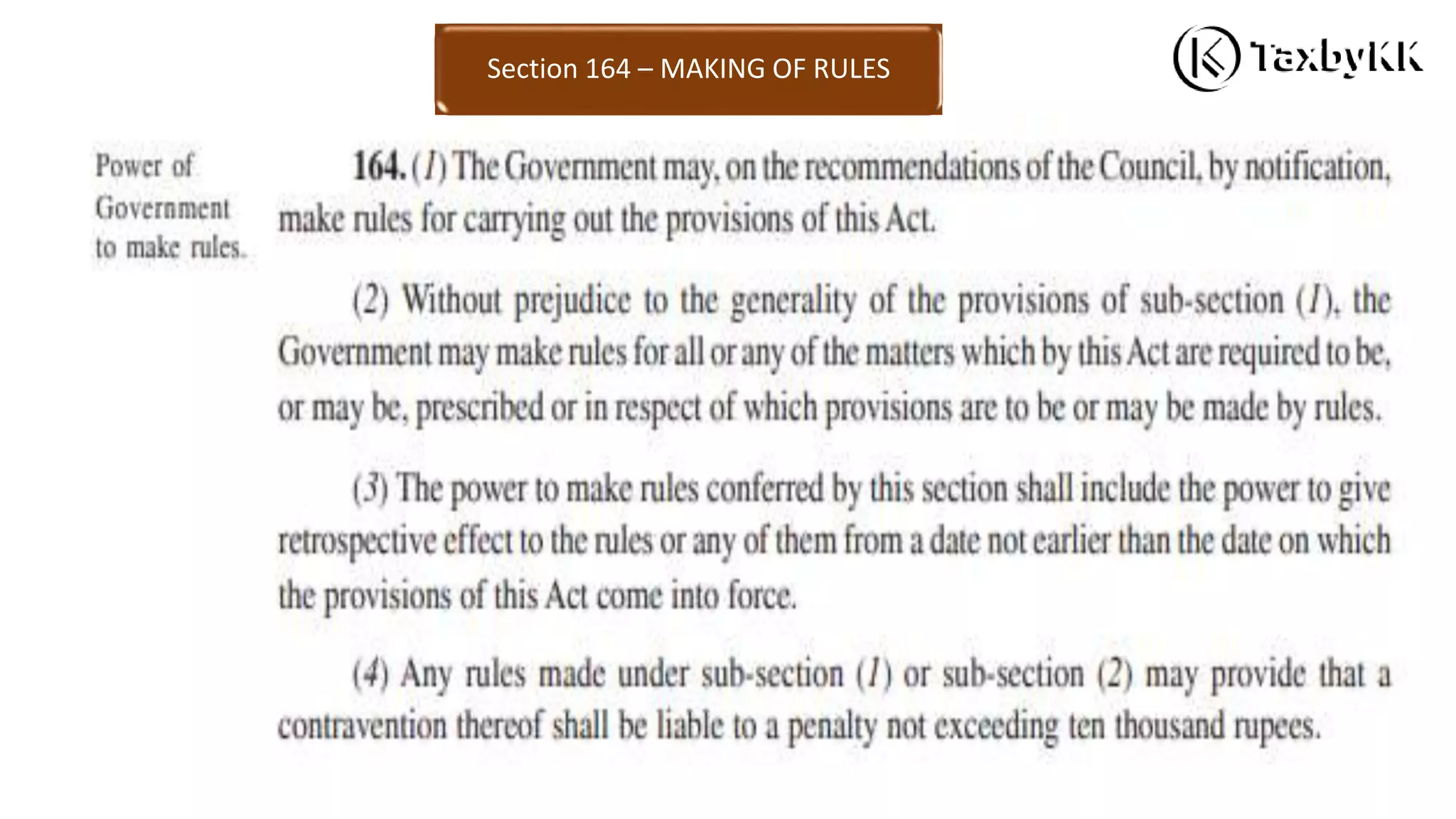

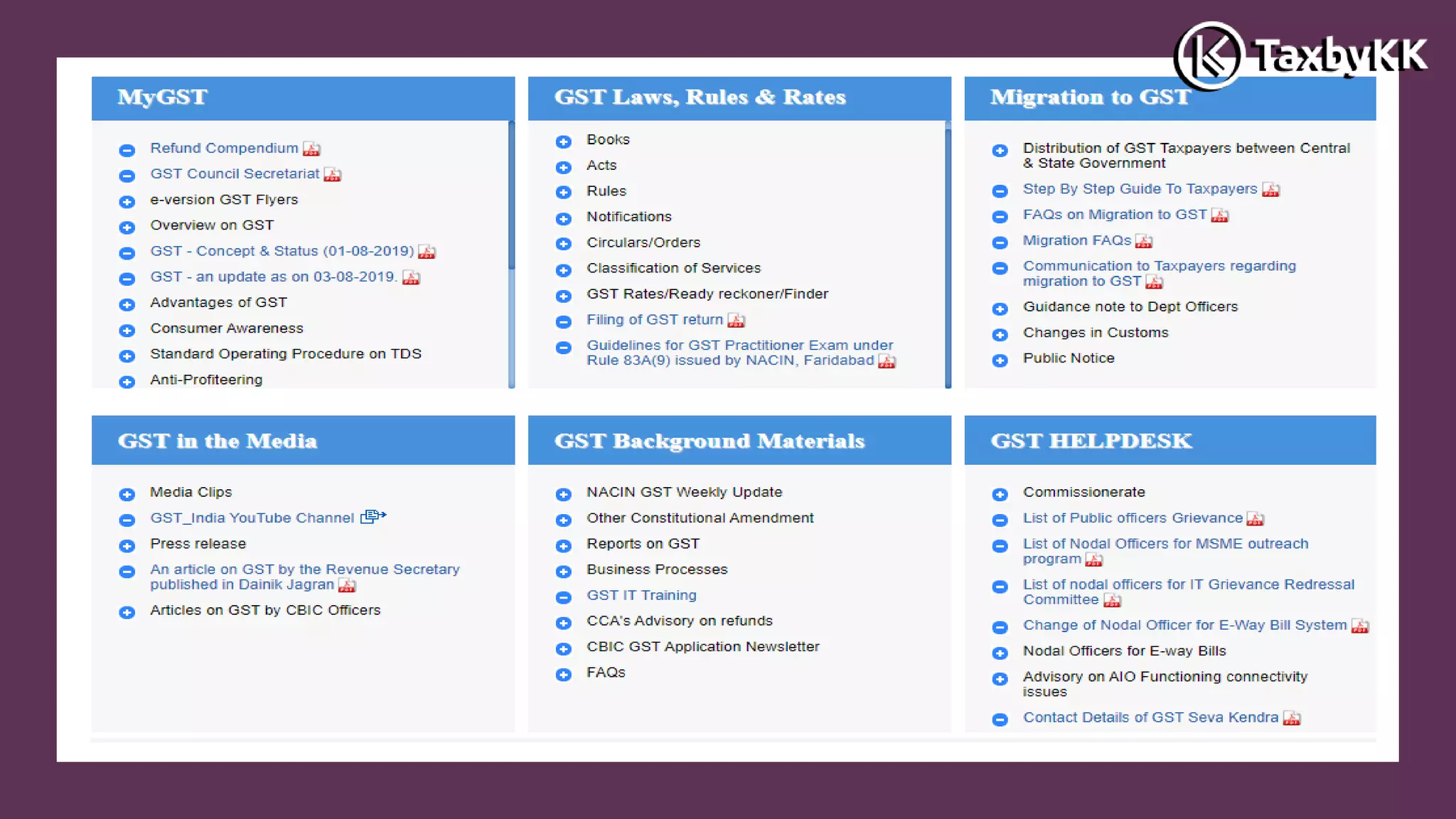

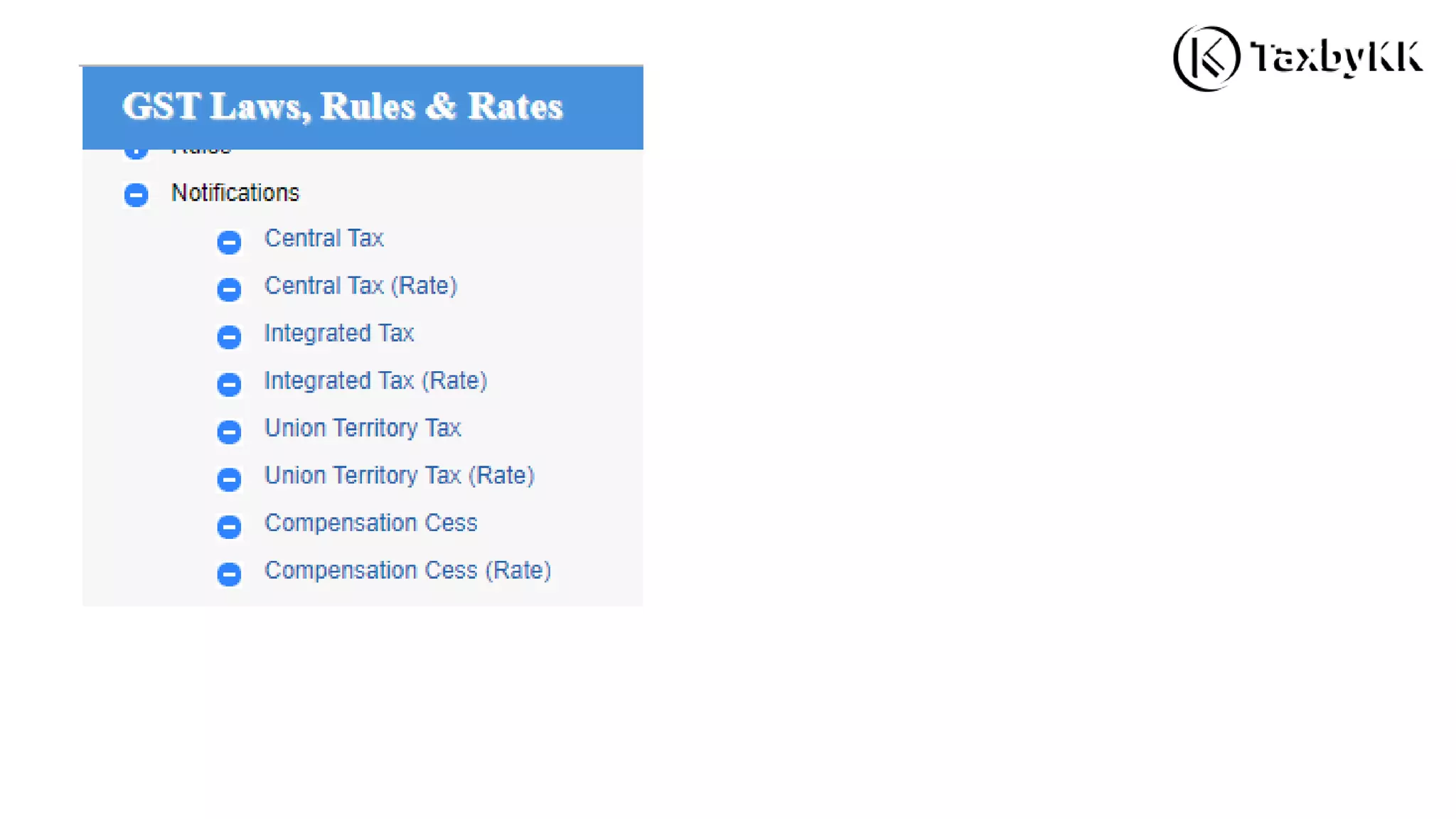

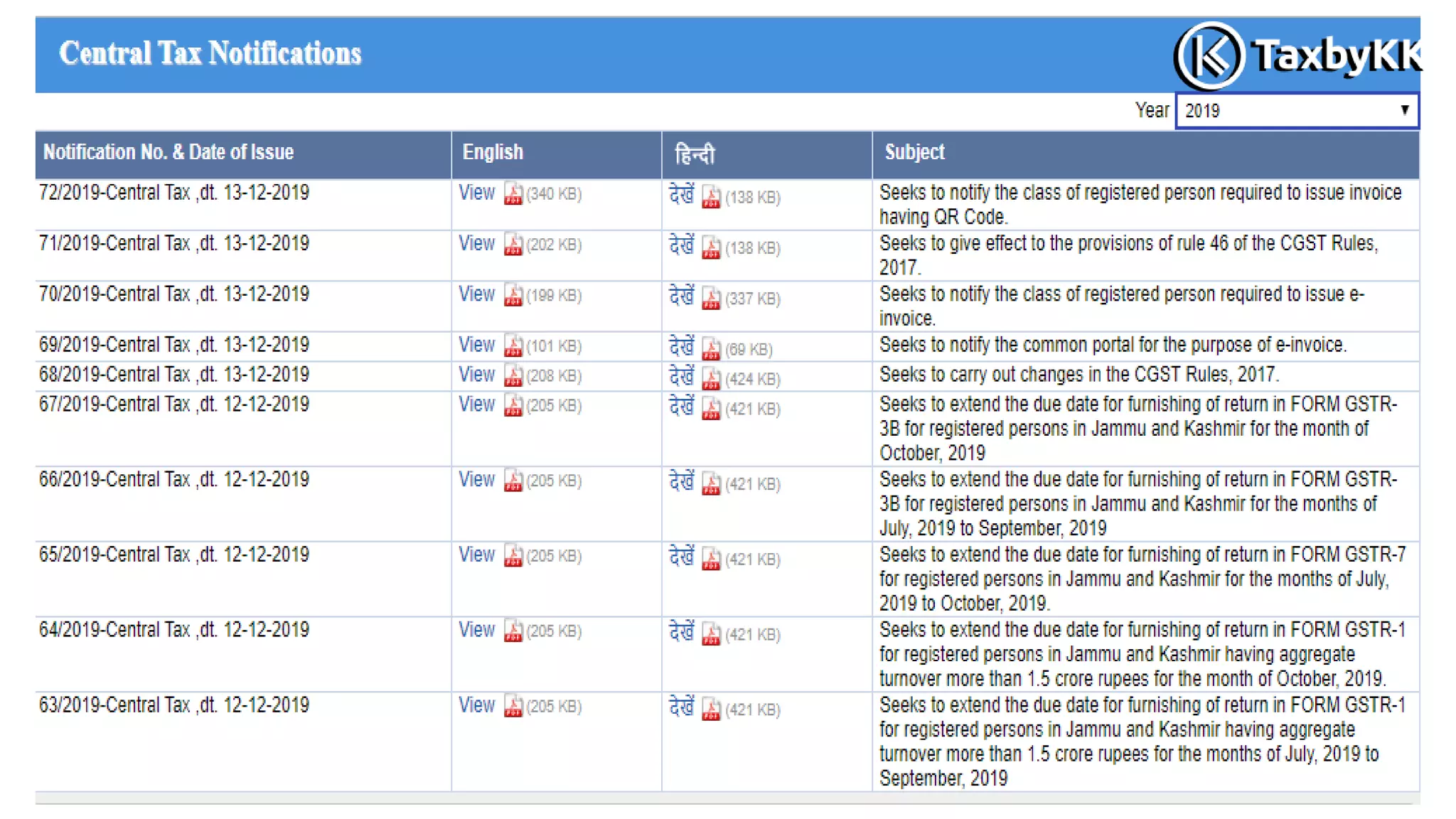

The document outlines the various sources and components of Goods and Services Tax (GST) law in India, highlighting acts, rules, notifications, and judicial decisions. Key authorities and documents related to GST include the CGST and IGST Acts, along with rules and circulars that guide implementation and interpretation. It details the binding nature of judicial decisions and clarifications issued by the government, emphasizing their relevance for both departments and applicants.